Overview and administrative arrangements

This section presents an overview of DPC’s financial results, detailing its operational and budgetary objectives. It includes an analysis of DPC’s operating results and financial position, highlighting significant factors that affect DPC’s financial information.

The results and information have been prepared on the same basis as DPC’s financial statements, which are available in Section 4 of this report.

As part of the Administrative Arrangements Order No. S 540 of Tuesday 10 October 2023, on 1 February 2024 the following outputs were transferred to other departments. These changes are also reflected in Note 4.2: Changes in departmental outputs, in the financial statements:

- The ‘Multicultural affairs policy and programs’ output is included for the period 1 February 2024 until 30 June 2024. From 1 July 2023 to 31 January 2024 this output is reported by DFFH.

- The ‘Industrial relations’ output is included from 1 July 2023 to 31 January 2024. From 1 February to 30 June 2024, this output is reported by DTF.

In addition, the Precincts and Land Coordinator General functions transferred to DTP.

Further details of the transfer of functions impacting DPC can be found in Note 8.6: Restructuring of administrative arrangements, in the financial statements.

Financial performance — operating statement

DPC recorded a net loss result from operations of $0.5 million in 2023–24. The result is primarily due to the timing of trust funds operations, where higher expenditure was incurred during 2023–24 compared to the revenue recognised.

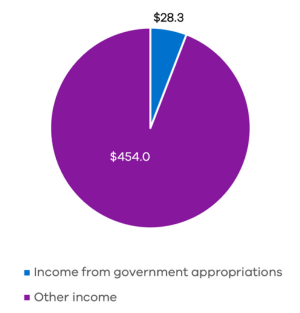

The sources of income available to DPC during 2023–24 are demonstrated in the chart below. DPC’s main source of income in 2023–24 was from government appropriations, which accounted for 94 per cent of income. The balance was derived from resources received free of charge, government grants, and services

Compared with 2022–23, the decrease in DPC’s income in 2023–24 is primarily due to the transfer of major functions, including digital transformation and corporate services, to DGS following machinery of government changes effective 1 January 2023. In 2022–23, DPC’s income was higher because these functions were still with DPC for the period from 1 July to 31 December 2022.

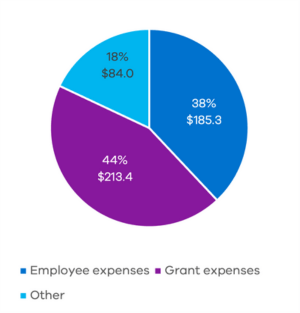

The chart below shows the distribution of DPC’s expenses in delivering the department’s services.

DPC’s total expenses decreased in 2023–24 by $247.8 million compared with 2022–23. This was mainly due to six months of operating costs included in 2022–23 financials for the functions that transferred to DGS on 1 January 2023, along with higher election costs for the 2022 State Election.

Financial position — balance sheet

DPC’s assets and liabilities have increased in 2023–24 due to the recognition and timing of payments associated with the transfer in of the Multicultural Affairs functions from DFFH.

Cash flows

DPC had a net cash inflow from operating activities of $4.0 million in 2023–24. This is a $13.1 million decrease compared with 2022–23. This decrease is mainly due to an overall decrease in level of operational activity due to the transfer of major functions following the machinery of government changes, including the impact on working capital movements.

Subsequent events

Refer to the section on subsequent events at Note 8.10 in DPC’s financial statements.

Capital projects / asset investment programs

During 2023–24, DPC did not have any capital projects, reaching practical or financial completion,

that met the disclosure threshold of $10 million or greater.

Asset Management Accountability Framework maturity assessment

This section provides a summary of DPC’s assessment of its maturity level against the Asset Management Accountability Framework (AMAF) requirements.

The AMAF is a non-prescriptive, devolved accountability model of asset management that includes 41 mandatory requirements. These requirements can be found on the DTF website.

The key requirements that DPC must follow to implement effective asset management systems are Leadership and Accountability, Planning, Acquisition, Operation, and Disposal. DPC has met the target maturity rating of ‘Competence’, indicating that our systems and processes are fully in place, consistently applied and systematically meet the 41 mandatory AMAF requirements. This includes having a continuous improvement process to expand system performance above the AMAF minimum requirements.

Updated