- Date:

- 17 Apr 2023

Responsible body’s declaration

In accordance with the Financial Management Act 1994, I am pleased to present the Portable Long Service Benefits Authority’s Annual Report for the year ended 30 June 2022.

Julius Roe

Chair, Governing Board

Note on accessibility

We've provided as much of this annual report in HTML as practicable. Complex financial tables are provided in position in Word documents.

For accessibility assistance understanding this report, contact us via email(opens in a new window).

Overview

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

The Portable Long Service Benefits Authority (the Authority) is an independent statutory body established to administer the Long Service Benefits Portability Act 2018 (the Act). The Act, together with the Long Service Benefits Portability Regulations 2020 (the Regulations), provides a scheme for the portability of long service benefits to eligible workers in the community services, contract cleaning and security industries.

The Portable Long Service Benefits Scheme (the Scheme) enables eligible workers to accrue long service benefits based on the length of time employed in their respective industry, rather than the length of time employed by one employer.

The Authority maintains registers of covered employers and workers and is responsible for the collection of levies and overseeing the payment of benefits.

The Authority also has regulatory and enforcement powers exercisable by the Registrar and/or Authorised Officers.

These include:

- monitoring powers to ensure compliance with provisions of the legislations as well as ensuring the accuracy of the information provided to the Authority

- the power to compel information during investigations and enquiries

- investigative powers, which can be used to gather materials that relate to the contravention of an offence

- commencing civil proceedings to recover unpaid levies and/or pursuing criminal proceedings against those who fail to comply with their obligations under the Scheme or who breach the Act.

Coercive powers, including monitoring and investigative powers are used by the Authority to ensure compliance with provisions of legislation.

Enforcement powers are typically only used by the Authority where coercive powers have been used and the Registrar is satisfied that the use of such enforcement powers is appropriate.

Vision

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

Purpose

Administering an effective Portable Long Service Benefits Scheme through prudent, sustainable investment and supporting all stakeholders – including employers and workers alike – as well as educating and enforcing every stakeholder’s role and interest in the Scheme.

Values

The Authority has adopted the Victorian Public Sector values, which underpin the behaviours that the government and community rightly expect of it. Acting consistently with these values strengthens the Authority’s capacity to operate effectively and achieve our objectives. These values are:

- Responsiveness - We are approachable and provide timely, useful and accurate information.

- Integrity - We have unbiased and honest interactions.

- Impartiality - We are firm and consistent in our application of the law.

- Accountability - We fulfil our objectives in a clear, transparent and responsible manner.

- Respect - We respect our stakeholders, each other and ourselves.

- Leadership - We seek to have a positive influence and to empower others.

- Human rights - We administer the law and deliver decisions and support everyone’s human rights.

Chair and Chief Executive Officer / Registrar’s Report

On behalf of the Governing Board, we are pleased to present the Annual Report of the Portable Long Service Authority for the financial year ended 30 June 2022.

The Authority, which manages the Schemes for the community services, contract cleaning and security sectors, has matured and grown into an established, successful entity in the short space of just 3 years.

A major highlight of the past year has been the registration of the 200,000th worker with the Authority, who describes himself as a “hard-working Shepparton-based community services worker”. This registration of the Authority’s 200,000th worker was acknowledged in an address to Victoria’s Parliament by the Minister for Industrial Relations, Tim Pallas MP. In recognising the achievement of the Authority, the Minister added that “portable long service leave is a victory for fairness in industries where people have often moved between jobs because they’ve had little choice”.

We are pleased to observe that the acceptance and embrace of the Scheme by employers has been more far-reaching than just simple long service leave entitlements. Staff shortages brought on by the COVID-19 pandemic has seen employers develop a greater appreciation of their workforce. Employers now perceive the Scheme as an incentive to attract, acquire and retain valued staff members.

As custodians of almost $230 million in worker entitlements as at 30 June 2022, we also understand our responsibilities to safeguard and monitor worker entitlement investments as well as to make prudent investment decisions. We do this by working closely with the Victorian Government’s Investment Manager, Victorian Funds Management Corporation, as well as the Scheme’s actuary to ensure that returns are maximised especially against the current volatile investment market background.

The impact of the COVID-19 pandemic for a second year has also once again tested the resilience of the staff working at the Authority.

The dedication and adaptability of the Authority’s staff in dealing with rapidly changing work environments during unprecedented, challenging times remains exemplary. The Authority’s head office in Bendigo continues to thrive with staff adapting well to the end of lockdowns and transition back to the office environment. Our staff have embraced the team camaraderie of being together and the intrinsic value of engaging face-to-face with each other. Bendigo remains home to the majority of the Authority’s staff and as an organisation, we are proud to have established ourselves as a valued member of the local community.

Our efforts in the coming year will include an enhanced focus on compliance, education, and enforcement, particularly for employers who are yet to register with the Authority. We aim to help these employers understand the value of affording their workers portable long service benefits. Additionally, we aim to extend and concentrate efforts on the registration of contract cleaning and National Disability Insurance Scheme employers.

This year we also announced the departure of two Governing Board members: Linda White who resigned on 5 April 2022, and Kate Marshall whose term concluded on 7 April 2022. We acknowledge their valuable contribution and commitment to the Authority during their three-year tenure.

Lastly, we as a collective team are excited for the future of the Authority as we build our people, systems and processes towards receiving the first eligible worker claim for their portable long service leave benefits.

Julius Roe

Chair, Governing Board

Joseph Yeung

Chief Executive Officer / Registrar

Role and functions

The Authority has several key roles and functions including:

Registry

- Registration of employers

- Registration of workers

- Accuracy of registers of covered employers and workers

- Administration of claims and benefits.

Funds

- Collection of funds

- Investment of funds

- Management of funds.

Education and enforcement

- Consultation with employers and workers

- Working with industries affected by decisions made under the Act

- Resolving disputes as to the timing of taking a period of leave (applicable to workers in contract cleaning and security industries)

- Enforcement of legislation and associated powers.

Statement of Expectations

The Authority continues to deliver on the Minister for Industrial Relations’ Statement of Expectations dated 7 July 2020 (as published on the Authority’s website) and as set out in the Registrar’s response to the Minister dated 3 August 2020.

The Authority’s Statement of Expectations is aligned to the Victorian Government’s commitment to reduce the administrative burden of regulation as well as promote greater efficiency and effectiveness in the administration and enforcement of regulation.

This report contains further information on our progress towards meeting the key priorities in the Statement of Expectations.

Year in Review

| Registered Workers: 228,767 | Community services: 150,137 (119,288 last year) Contract cleaning: 54,033 (39,368 last year) Security: 24,597 (19,304 last year) |

| Registered Employers: 2,875 |

Community services: |

| Worker Breakdown |

Community Services: (2,347 workers other/not provided) Contract cleaning: Security: |

| Engagement | Outbound calls: 11,922 Emails received: 14,257 Website visits: 205,000 Email newsletter subscribers: 3,911 |

| Calls Received |

From employers: 5,053 (97% of all calls answered within 3 minutes) |

| Submitted Quarterly Returns | 13,332 |

| Scheme Assets | $234.2m |

| Social Media | Facebook engagement up 106% LinkedIn followers up 40.25% |

Worker profile – Linda Saari

For many people, travel is a life-changing experience and that was certainly the case for Linda Saari.

When the adventurous twenty-something left her native England for a back-packing holiday around Australia, she never thought that distant continent would become her permanent home. Whilst in Sydney, Linda met her future husband. The couple moved to Bendigo, her husband’s hometown, where they are raising two children.

Linda was a stay-at-home parent before deciding to look for part-time work. Through a friend at a local university campus, she found a job cleaning the residential student dormitories which house Australian and overseas students.

It has been 9 years since Linda began work at the Bendigo campus. Initially, she only worked during school hours. However, with the children growing up it is now a full-time role working 9 to 5, Monday-to-Friday.

Various companies have held the cleaning contract at the university, which is usually for a 3-year period. Linda has worked for 3 different companies in that time.

When a different company wins the tender, Linda endures an unsettling three-month work trial period before being presented with a contract.

“The job always feels secure until the next contract comes along, then it’s a waiting game as you don’t know if you will be offered your old position,” said Linda.

In addition to the insecurity of the job, contract cleaners such as Linda were excluded from long service leave benefits.

However, that changed for Linda and thousands of Victorian workers from July 2019 following legislation which created the Portable Long Service Benefits Scheme.

Linda is grateful for the existence of the Scheme and the benefits to workers such as herself and would like more workers who may be registered with the Authority to stay up to date with their registration.

“Their employers have done the right thing in registering their staff, but the workers may not be aware of their employer’s good intentions,” Linda added.

Linda’s comments echo the Authority’s focus on educating employers about their legal obligations to register with the Authority, along with ensuring they communicate to staff about their involvement in the Scheme.

What will Linda do with her portable long service benefit after 7 years in the contract cleaning industry?

“I can’t wait to travel back to England to see my family and friends.”

Celebrating 200,000 registered workers

The Authority achieved a significant milestone with the registration of 200,000 workers during the past financial year.

The registration accomplishment was highlighted by a media conference in Victoria’s parliamentary gardens featuring the Minister for Industrial Relations, the Hon Tim Pallas, supported by Authority Chief Executive Officer Joseph Yeung. Registered employers and workers were also in attendance.

The media conference on 10 February 2022 attracted national television and state-wide radio coverage.

“It is a major achievement that so many Victorians can look forward to the benefits of long service in the future, something which they had been denied in the past,” Mr Pallas told the gathered media.

At the time the Authority achieved 200,000 registered workers, approximately 136,000 workers were from the community services industry, 45,000 workers from the contract cleaning industry and 19,000 workers from the security industry.

Employer registrations have also steadily risen with positive indications that employers consider the Scheme is of benefit in attracting and retaining valued staff.

When the Scheme was launched in July 2019, it was not anticipated that the Authority would hit the 200,000 milestone in such a brief time frame.

Meet Ethan Rowley – 200,000th registered worker

Ethan Rowley never thought he would be in the spotlight.

The Shepparton resident is happy and content in his job at WDEA Works which he commenced in September last year.

WDEA Works, which is a not-for-profit organisation that helps people with a disability find employment, registered Ethan with the Authority soon after he began working there.

That registration proved to be a milestone event as Ethan became the 200,000th worker to be signed up with the Authority.

Authority Chief Executive Officer, Joseph Yeung, congratulated Ethan on his unexpected achievement adding that he and the other 199,999 registered workers can also look forward to portable long service benefits which were never available to them before the scheme began in 2019.

Ethan is a member of the Student Leaver Employment Support (SLES) section of the organisation where he works with young people with various disabilities who are currently in their last year of school or have recently left school.

“I help them develop individual skills in one-onone sessions, social skills in group sessions and visits to various industries within the community that they are interested in working,” said Ethan.

Before commencing at WDEA Works, Ethan worked nightshift for 13 years at a supermarket stocking shelves. He enjoyed the camaraderie of the team, which is something he feels his current job with WDEA Works also offers.

“Also, the young people I am helping are all so amazing. Every day it’s something new and an exciting challenge,” he added.

WDEA Works Chief Executive Officer, Tom Scarborough said, “we’re always looking for ways to attract, retain and reward our employees. We couldn’t do the important work we do without having great people in our organisation.”

“Thinking outside of our organisation and to the wider industry in which we operate, the Portable Long Service Benefits Scheme provides incentives for valued workers to remain within the industry,” added Mr Scarborough.

Asked what he planned to do with the portable long service leave benefits, Ethan said, “I haven’t even begun to think what might happen six years from now. I hope I’m still doing the good work this company lets me do and seeing the people I’ve worked with continue to grow.”

“Or maybe a holiday, who knows?”

A job well done Ethan.

Business units

The Corporate Governance and Secretariat business unit is responsible for establishing good governance, ensuring comprehensive risk management practices as well as facilitating the efficient and effective running of the Governing Board and Audit and Risk Committee.

The Customer Service and Operations business unit is the largest business unit within the Authority and delivers our core registry and enforcement functions by engaging with employers and workers to support them to fulfil their obligations and understand their rights.

The Financial Services business unit underpins our operations, and the Head of Finance has specific responsibilities under the Financial Management Act 1994. Performance monitoring, responsible budgeting, and a robust investment strategy ensures that the entitlements of registered workers are managed prudently and helps to ensure the sustainability of the Scheme.

The Facilities, Information and Technology business unit underpins our core operations and manages key vendors which support our network infrastructure and telephony systems. Having the best systems in place enable us to be efficient and effective in delivering on our functions.

The People and Culture business unit supports the growth and development of our people and culture. Our people are our greatest asset. Without our people, we have no capability to fulfil our statutory obligations under the Act.

The Communications and Engagement business unit leads communications, identification of, and engagement with key stakeholders. The business unit also leads internal and external education activities to ensure that employers understand and can meet their obligations while workers are aware of their rights.

The Legal business unit provides practical legal advice that advances the Authority’s objectives whilst being consistent with the law and regulatory environment. The unit provides both in-house commercial legal advice as well as advice on the Authority’s regulatory operations.

Employer profile – Deaf Chef Ross

There are some people in this world who are an inspiration to others. One of those people is Ross Onley-Zerkel.

Ross is the passionate creator and driven individual behind Deaf Chef Ross, which is an online and social phenomenon producing cooking programs in Auslan (Australian Sign Language) to encourage deaf people to cook and eat healthy food.

The journey for Ross towards setting up his company was through a difficult personal experience. Ross was stricken with psoriasis, a debilitating skin condition with severe flare-ups. After years of medical advice and various medications, Ross was advised that the disease is incurable.

The impact of his skin condition led Ross to endure low self-esteem and periods of depression.

His search for a self-cure led him to investigate if there was any correlation between his diet and the skin ailment. He also studied medicinal foods which led to the discovery that raw apple cider vinegar was beneficial for him.

After months of careful diet maintenance, his psoriasis and his self-esteem improved dramatically.

Combining his passion for cooking and a desire to inspire other deaf people to appreciate food, Deaf Chef Ross was born.

The major component of the fledgling business is a series of online programs including Learn to cook, Healthy cooking, Talk about food and Plan your meals. There are also workshops for groups or organisations who want to have a cooking class, cooking demonstration or simply talk about healthy eating.

Deaf Chef Ross is a registered employer with the Authority.

“I think it is a brilliant idea. Looking back in my younger years working at various organisations, I would have loved to have this opportunity. Now we have it, it will benefit many of us especially my staff knowing that there is money available for when they take long service leave,” said Ross.

“Being portable, it is much easier for employers to contribute money from different places if the employee has more than one job,” he added.

Ross remains committed to his deaf clients and ensuring his own staff are well looked after.

Objectives

The Authority’s primary objectives are to:

- Fulfil our legislative obligations by effectively administering the Long Service Benefits Portability Act 2018.

- Implement effective, responsible budget and investment strategies which grow levy funds and deliver long-term sustainability.

- Be clear, consistent, transparent and responsive in our stakeholder communications to encourage registration and levy payments and ensure that eligible workers and employers are aware of their rights and obligations.

- Maintain a healthy and safe workplace with a culture that encourages engaged, resilient and solution-focussed staff.

- Maintain an innovative secure, resilient and integrated information technology environment that supports effective operations now and into the future.

- Protect the long-term interests of the Authority through effective regulation using governance, strategic risk management and clear policies and procedures.

A people-powered cleaning business

Bendigo Professional Cleaning Service began operating in November 2015 after Jessica Johnson identified an opening in the Bendigo region for a company to provide high quality cleaning.

The company has grown into a successful business providing a broad range of domestic and commercial cleaning services, even including solar panel cleaning and pest control.

One of the most specialised services the company provides is crime scene cleaning.

There are two sides to crime scene cleaning. The first is the difficult and emotionally draining forensic cleaning after a death, with the welfare of staff being closely monitored in these situations.

“You can be filled with emotions when cleaning a deceased estate. As you are cleaning their home you gather small insights into their lives, looking at framed photos and other personal touches. It’s sad knowing they are no longer around,” Jessica said.

The other side to crime scene cleaning is illegal drug laboratory decontamination.

As Jessica explains, “drug laboratories can be found anywhere, in hotels, restaurants, garages, storage units, caravans, in homes and rental properties. Whatever area has been used for the clandestine lab, the entire scene requires a thorough decontamination due to the toxic chemicals involved in the drug making process.”

As company owner and managing director, Jessica has found the most difficult component of creating and maintaining a successful business is finding the right people to employ and keeping them.

“Our employees are the backbone of our business. We pay them above the award rate because we believe that each one of them is worth it and we do this to keep them with us,” said Jessica.

On their website, Bendigo Professional Cleaning Service highlight one of the benefits of working for their business is that they pay staff contributions into the Portable Long Service Benefits Scheme.

“I think the Portable Long Service Benefits Scheme is a great idea and it gives employees more financial security for the work they do,” she added.

Bendigo Professional Cleaning Services ticks the boxes when it comes to being a model corporate citizen in what can be a tough business.

Our performance

The Authority's financial and output performance for the 2021-22 financial year.

Business Unit Reports

Governance, Risk and Secretariat

The Governance, Risk and Secretariat business unit has a multitude of core functions including the effective running of the Governing Board and Audit and Risk Committee, providing sound governance advice as well as overall coordination of risk management across the Authority to support and ensure prudent and strategic decision making.

The business unit supports the Registrar to develop and maintain a mature risk culture that embeds risk management into the daily decision making of the Authority’s staff. The establishment of risk champions has further embedded a positive culture around risk management across staff of the Authority. Focussed and dedicated quarterly risk management meetings also continues to embed risk mitigation into the culture of the Authority.

The business unit is also responsible for maintaining a constructive corporate planning process and performance management framework, as well as scrutinising compliance and internal controls to ensure that the Authority meets its legislative obligations.

During the financial year, the business unit had responsibility for the coordination of the Authority’s three-year internal audit program to ensure that there is an adequate level of assurance and management of key areas of the Authority’s enterprise risks. The unit also progressed the Internal Control Framework which creates a foundation to review, analyse and evaluate the effectiveness of the Authority’s internal controls framework on a regular basis.

Other activities of the financial year led by the business unit included the Authority’s COVID-19 response, the review and update of the Authority’s Business Continuity Policy and the implementation of the Authority’s Business Continuity Plan, Crisis Escalation Matrix and Crisis Management Plan to provide a stronger and more robust foundation for the Authority to effectively manage future business disruptions.

Looking forward, the business unit will be focussed on refining the Authority’s internal messaging and looking to further embed sound governance and risk management principles across the Authority’s decision-making processes. There will be more work on educating business units through the intricacies of consistent project management and alignment of business unit cohesion in corporate strategy and planning in a post-COVID-19 working environment.

Financial Services

The Financial Services business unit has continued along the path set in the previous year of improving output by transitioning and refining business systems and processes.

The transition from using outsourced service providers to managing payroll and accounts internally has continued to provide both service and financial efficiencies to the Authority.

Following the significant work done in the previous two years in developing appropriate policies and procedures to ensure good financial governance, the Financial Services business unit has now embedded those policies and procedures into standard operating practices. These practices have resulted in significant operating efficiencies.

During the current year, 973 employer reimbursements totalling $1.5 million were processed, bringing the total amount reimbursed to employers to $2.2 million since the commencement of the Scheme.

The Authority now has $196.7 million in cash and investments. Those funds will provide for the future portable long service benefits of more than 228,000 registered workers.

The Authority continues to invest employer contributions with the Victorian Funds Management Corporation (VFMC). There have been challenges for our managed investments in the past year which can be attributed to several factors including the COVID-19 pandemic, rising inflation and the general downturn in global equity markets. The Authority will continue to work with VFMC to monitor the fund’s strategic asset allocation in order to manage portfolio risk.

The actuarial valuation process for the accrued portable long service benefit liabilities has been enhanced through an additional year of live data used to validate key assumptions underlying the valuation model.

The Financial Services business unit will continue to work closely with the Facilities, Information and Technology business unit to develop streamlined processes for submitting quarterly returns and employer reimbursements. As the business matures and the number of registered workers increases, greater reliance will be placed on core business systems to ensure the efficient operations of the Authority.

Customer Service and Operations

The Customer Service and Operations business unit is responsible for three teams: Customer Service and Education, Compliance and Enforcement, and Research and Education.

Customer Service and Education

The Customer Service and Education team has continued to deliver its core responsibilities of assessing employer applications for registration, being the key point of contact for employer and worker enquiries received by telephone and email, and processing employer quarterly returns.

A focus area in the 2021-22 financial year, we have enhanced our processes to assist employers complete their quarterly returns in a timely and accurate manner, as well as improved processing times while we continued our quality assurance program to educate employers to ensure that worker benefits are being recorded correctly.

Our frontline staff have been resilient and responsive to change and the impacts of the COVID-19 pandemic while continuing to work with employers and workers to help them understand matters of coverage under the Scheme.

Our processes and business systems have been further refined to support the delivery of our services and continue to be reviewed to ensure we provide employers and workers with quality service and support.

Compliance and Enforcement

The Compliance and Enforcement team continues to work closely with employers to ensure they fulfil their obligations and financial commitments to the Scheme. We commenced significant work to strengthen our investigation capacity and develop a more wholistic system for compliance and enforcement. This includes the recruitment of a Compliance and Enforcement Manager, critical decision-making processes, and escalation processes to activate enforcement activities. This aligns with an increased effort ensuring timely and consistent communication about the Scheme’s coverage through multiple channels.

The Authority undertook projects targeting contract cleaning and community services which uncovered additional unregistered employers.

The Compliance and Enforcement team has also been exploring different ways to monitor employer compliance under the legislation. This includes adopting new technologies and plans to trial dedicated compliance software to assist with investigations and simplify processes and procedures.

The team has also dedicated significant research effort into gaining deeper insights into the complexity of the relationships between employers and workers within the business structures that operate within the sectors that we regulate. With this information, we have been able to uncover more unregistered employers.

Research and Education

The Research and Education team identifies employers in the covered industries who are likely to be eligible for the Scheme, and develops, tests, and evaluates the engagement processes required for converting this information into registrations.

We believe that there are a number of employers in particular areas still not registered, and that some employers are not paying for all eligible workers.

The team has therefore developed a detailed program of work centred around eight key strategies to identify eligible employers that remain unregistered within the covered sectors, to be implemented in the coming year. These eight strategies are aligned to the Authority’s risk appetite and allow for a systematic and methodical regulator approach to the identification and focus of the Authority’s efforts in targeting under-registration in selected subsectors.

Facilities, Information and Technology

The Facilities, Information and Technology business unit ensures the Authority operates to its full potential by providing enhanced information and technology support.

Our resolve was once again tested as the organisation continued to maintain operations whilst managing the impact of the COVID 19 pandemic on the Authority.

The challenge created by the continued increase in the number of employers and workers registered with the Authority involved the implementation of new technologies for more efficient and effective systems.

We made major improvements to our core business platform, and those developments included increased functionality to assist employers with the handling of bulk employer quarterly returns as well as data analytics to review the quality of data submissions.

There were also upgrades to the worker and employer portals to enable better communication offering a better customer experience.

Cost reductions were achieved by replacing the phone system with voice calling via Microsoft Teams. Meanwhile, within the organisation, there was a continued focus on security and cyber awareness in staff training sessions and the introduction of a standardised Information Security Framework was also implemented.

We appointed an Information Management and Project Support Officer, focussing on records management and compliance areas. A full review of our current records management systems and practices is underway with a view to further improving our record keeping procedures in the new financial year.

On another front, the business unit provided technical support as the Authority successfully adapted to the hybrid workplace environment, which involved the crossover of staff working from home and returning to an office environment.

In relation to workplace facilities, the business unit made sure the Authority’s Bendigo and Melbourne offices remained fit for purpose and provided staff with a COVID-19 safe environment.

The business unit has also been involved in the planning process for the new GovHub building in central Bendigo: a $90 million project that will accommodate about 1,000 City of Greater Bendigo and Victorian Government workers including staff of the Authority. The building is expected to be completed in early 2023. The Authority has been working with key stakeholders to ensure the needs of the organisation are accommodated and continue assessing our facility needs now and into the future in line with our workforce profile.

People and Culture

The People and Culture business unit continued its commitment to supporting our staff through a second challenging year of the COVID-19 pandemic.

The mental health and well-being of our people continued to remain at the forefront of the Registrar and the team.

We were creative and highly agile in developing initiatives to boost staff morale and productivity, ensuring everyone retained social connectivity and felt supported as they adjust to a hybrid working environment.

To foster this social connectivity, many best practice initiatives were introduced, while webinars focussing on exercise and ergonomics in the home office were available to staff. The team also coordinated the communication of regular up-to-date official health and safety advice to staff along with re-entry support webinars to enable a seamless transition upon return to the physical office premises. Engagement from staff was enabled through a People and Culture led Return to Office planning committee where the team developed guidelines for attending our offices in Bendigo and Melbourne’s CBD with relevant and valued input from staff.

We also made physical modifications to the office workplace and changed access levels in response to government and WorkSafe advice to minimise the risk of exposure and spread of COVID-19 at the height of transmission during the pandemic.

At the forefront of priorities, we have been working with the Registrar on the Authority’s Cultural Transformation journey and People Matter Survey Action Planning Framework. We established a Cultural Champions working group who are gentle architects of change, seeking out new ideas and opportunities to make the Authority a happy, inclusive and productive workplace.

In response to the People Matter Results 2022, we are empowering staff to shape a culture they want to work in and are meeting with staff via Listen and Learn focus groups to ensure every staff member has a voice. People and Culture aim to continue to use empowerment strategies to support the Authority’s culture transformation journey and encompass a phased approach to create a values-driven organisation.

Communications and Engagement

The Communications and Engagement business unit leads the organisation’s internal and external communication initiatives.

The team was focussed on several major organisational achievements during the financial year. The highlight was the 200,000th worker campaign. This involved developing relationships with the employer and worker who marked the 200,000th worker registered with the Authority and working closely with the Minister’s office in developing media releases and organising the ministerial media event at state parliament.

The outcome was national television and statewide radio coverage. Internal communications kept staff up to date with proceedings, along with the production of a commemorative booklet.

Elsewhere, the business unit produced creative content for the monthly email newsletter, which has a steady readership. Additionally, acknowledging the changing external environment and the way employers and workers consume information, focus shifted to the Authority’s digital channels in terms of operating as a modern regulator. This work has led to strong growth in social media content and audience engagement, especially through the Authority’s twitter account. Our website content was consistently improved through the year. Additional employer information was published on the number of workers they registered in their previous quarterly return, to encourage employers to register all eligible workers.

The Authority has also developed a suite of content in other languages to support the Authority’s culturally and linguistically diverse audiences.

The business unit also led the coordination of the Authority’s participation in trade exhibitions and other external events to strengthen the understanding of the Authority’s work in covered sectors. The Authority also participated in and spoke at various events during the financial year.

The challenge ahead is to leverage these significant achievements and develop messaging and raise awareness to employers and workers on the broad coverage of the Scheme through our research and education activities. This will reduce the reliance of the Authority on the use of compliance and enforcement powers.

Legal

The Legal business unit continued to provide high-level practical and strategic legal advice to all areas of the Authority, including the Chief Executive Officer / Registrar, Governing Board and business units.

The guidance covers a wide range of disciplines, including administrative and criminal law, privacy and data protection, freedom of information, along with general corporate and commercial law.

Our efforts during the year were enhanced by the recruitment of senior legal personnel to the business unit, technological solutions to support workflow and streamline processes and professional development opportunities for legal team members.

We also appointed a dedicated Privacy Officer and enhanced the Authority’s privacy framework.

The key word for the Legal business unit during the year was ‘collaboration’, working closely with our internal stakeholders to support them in achieving the objectives of their business units and the Authority.

This was evident in our support to the Customer Service and Education team in a variety of projects and initiatives regarding coverage of employers and workers in the Scheme, particularly in relation to amendments to the Regulations.

We also worked closely with the Compliance and Enforcement team to progress investigations in relation to possible contraventions under the Act.

The challenge ahead for the Legal business unit is to compliment the Authority’s growing maturity by continuing to provide high quality and practical legal advice to empower business units to achieve their objectives in a legally compliant manner.

Delivering on our objectives

The Authority’s Corporate Plan 2020-23 sets out the Authority’s short and medium-term priorities along with its key measures for success.

Below is an overview of the Authority’s activities in meeting these objectives.

Fulfil our legislative obligations by effectively administering the Long Service Benefits Portability Act 2018.

Key highlights

Customer Service and Education

- Improved and streamlined processes to improve efficiencies and create a robust and transparent operating environment.

- The Authority’s Worker Customer Relationship Manager (WCRM) system continues to be refined with the vendor, as the Customer Service and Education team identify and carry out improvements.

- Ongoing review of data accuracy of quarterly returns to ensure worker entitlements are being recorded correctly, with the team undertaking quality assurance and education to assist employers better understand their obligations and importance of accurate data reporting.

- Continued education activity to support employers to fulfil their quarterly return obligations.

Compliance and Enforcement

- Issued 147 enforcement notices to compel documents and information, of which 43% of employers complied.

- Engaged 135 potential employers who had been identified to register with the Scheme, of which 35% of employers complied.

- Issued 19 letters of demand for overdue levy invoices, of which 57% of employers complied before a lodgement for default was listed.

- Engaged 145 employers via telephone and email, who were not meeting their obligations, of which 64% complied with their obligations.

- Received 54 worker disclosures of possible failure of employer to meet obligations, of which 29% have been resolved.

- Engaged with 801 employers where obligations were in dispute, of which 61% complied before the dispute escalated.

Research and Education

- Identified unregistered employers using multiple data sources.

- Commenced implementation of eight strategies to increase employer registration.

- Produced internal training resources to strengthen the Authority’s relationship with external stakeholders.

- Provided tailored education sessions to employers and stakeholders.

Numbers

- 228,767 workers registered:

- 150,137 in community services

- 54,033 in contract cleaning

- 24,597 in security.

- 2,875 employers registered:

- 1,753 in community services

- 648 in contract cleaning

- 474 in security.

- 13,332 employer quarterly returns submitted (incorporating the retrospective returns outside of this financial year due to late registration with the Scheme).

- 19,923 calls were made and received during the financial year.

Of the 18 successful service of affidavits to employers failing to meet their obligations, 80% of employers either complied or engaged with the Authority to put a plan in place.

Implement effective responsible budget and investment strategies which grow levy funds and deliver long-term sustainability.

Key highlights

- Investment strategy reviewed.

- Final year of three year rolling internal audit review of compliance with the Standing Directions of the Assistant Treasurer which did not identify any material compliance deficiencies.

- Total Authority expenditure remained prudent for the year.

- Implemented a process for monitoring investment returns since inception.

- Business unit budget monitoring implemented.

- Cost savings achieved through centralisation of procurement and human resource activities.

Numbers

- $105.4 million invoiced, $4.9 million outstanding at 30 June 2022 of which $0.7 million is more than 30 days overdue.

- $169.6 million invested with VFMC in the Balanced Fund.

- $196.7 million in cash and investments.

- $1.5 million reimbursed to employers for workers who have taken long service leave.

Be clear, consistent, transparent and responsive in our stakeholder communications which encourages registration, levy payments and ensures that workers and employers are aware of their rights and obligations.

Key highlights

- Achieved state-wide coverage of our 200,000 worker celebrations raising awareness of the Authority and Scheme.

- Social media channels continued to grow with increased engagement and awareness, and we broadened our presence by establishing our twitter account.

- Continued circulating our email newsletter, increasing subscribers, improving our content through feedback from our reader survey and updating the design to increase engagement and click through rates which remain above the industry average.

- Enhanced our internal communications via PLSA Pulse – the Authority intranet – including updating content to support initiatives such as Strategic Alignment, COVID-19 updates, Return to Office and, the Social Committee while ensuring staff were trained and contributed updates to their business unit content.

- Evolved the Authority brand by introducing new style elements, increasing our image library, updating templates, producing a suite of Authority branded Teams backgrounds and internal email banners, and developing internal project-specific design concepts for staff to clearly identify project material.

- Conducted a website review, amending and updating our content in response to feedback and ensuring it remains relevant, informative and accessible.

- Translated material into 8 languages to support our culturally and linguistically diverse employers and workers.

- Undertook design projects including the updating of the worker annual statement to ensure the design and information was useful and informative.

- Provided the Customer Service and Education team with support for their quarterly return information sessions delivered to employers consistently through the year.

- Continued planning and preparing for the trade exhibitions across the three industry sectors and the Authority’s third birthday communications to internal and external audiences.

Numbers

- 205,000 visits to the Authority’s website, an increase of 2.9% on the previous year.

- Audience was 59.5% female and 40.5% male.

- The most visited page is the home page followed by the ‘worker information’ page.

- The average open rate for the email newsletter is a healthy 51.3% and click through rate of 10.1%.

- Email newsletter contacts have increased by almost 15%.

- Both Facebook and LinkedIn follower numbers have increased.

- Business development was the highest visiting demographic, followed by Information and Communication Technology (ICT) and then human resources.

Maintain a healthy and safe workplace with a culture that encourages engaged, resilient and solution-focussed staff.

Key highlights

- Organisational-wide training opportunities provided by the Authority included Re-Entry Office Support Training, Successful Computing (Microsoft Word), Vicarious Trauma Training, and Thriving Through Workplace Change.

- Supported and endorsed staff to undertake external secondment opportunities to extend the depth and breadth of their VPS exposure.

- Prioritised internal staff to undertake higher duty arrangements to act up in a senior or team leader roles to support development and leadership capabilities.

- Celebrated and recognised International Day Against Homophobia, Biphobia, Intersex Discrimination and Transphobia (IDAHOBIT), International Women’s Day and NAIDOC week.

- Embarked on a phase of research and analysis, drawing out themes and uncovering areas of focus following People Matter Results. Held an organisational wide focus group session and 1:1 staff empathy mapping session as a basis to build a cultural climate action plan.

- Created the Authority’s Cultural Transformation journey and People Matter Survey Action Planning Framework.

- Created a Cultural Champions group to support as a key driver to influence the desired culture and ultimately embed a sustainable positive organisational culture.

- Created the Social Committee to facilitate and lead in organising activities/events to foster greater social cohesion and connectivity.

- Established the Return to Office (RTO) Planning Committee to aid the Authority’s transition back to our primary workplaces following Victoria reaching the 90 per cent vaccination milestone, Phase D of Victoria’s Roadmap.

- Created a hybrid working model to recapture the benefits of spending face-to-face time with colleagues whilst committing to what has worked well during the remote working period.

- Organised a ‘Welcome back’ pack issued to staff upon their return to the office and created a calendar of events to boost employee morale for staff through the initial transition return to office period.

- Enabled staff to submit individual flexible requests for consideration to the Executive leadership group and supported staff to work collaboratively with their manager to use flexible arrangements on an as needed basis.

- Partnered with our Employer Assistance Provider to deliver “Thriving through Change” workshops to support staff with personal coping mechanisms to self-motivate, be more adaptable and resilient to change and deliver re-entry and anxiety support seminars to help staff transition to a hybrid working model.

- Launched the Performance Development program using the Authority’s performance development framework along with support sessions providing staff enhanced understanding of performance development and feedback strategies.

Numbers

- 12 merit-based fixed term higher duties assignments with 1 internal promotion

- 6 external secondments

- 2 accredited Mental Health First Aiders

- 21 roles were advertised

- 50 staff employed as of 30 June 2022, an increase of 6.38% from last financial year.

Implement an innovative, secure, resilient and integrated information technology environment that supports effective operations now and in the future.

Key highlights

- Implemented Microsoft Teams Calling improving the telephony system’s resilience to a high level as well as the accessibility for all staff, removing legacy equipment and achieving cost savings.

- Developed Power Business Intelligence Reporting to assist with workforce planning and operational reporting.

- Continued enhancement of Worker Customer Relationship Management system to improve employer experience as well as process efficiency for back-office staff.

- Maintained effective and efficient contact centre operations, while working remotely, during the extended lockdowns in Victoria supported by technology enhancements.

- Supported the implementation of superior Human Resource management modules in core information technology systems.

- Conducted a review and updating of document and records management policy and procedures.

- Improved our cyber resilience and implemented Domain-based Message Authentication Reporting and Conformance (DMARC) to protect the Authority’s email from ‘spoofing’: this allows people to validate the trustworthiness of the ‘from’ address which users see in their email clients. By adopting DMARC only someone from the government (or someone we authorise) will be able to send emails using our plsa.vic.gov.au domain.

- Completed the Protective Data Security Plan.

Numbers

- 103 WCRM Support tickets created (59 issues, 44 enhancements and tasks)

- 4 major releases WCRM implemented during the year and 6 minor / Hotfix releases

- 51 incidents lodged and closed with Cenitex

- 1 major project managed with Cenitex

- 117 Internal ICT Support interactions.

Protect the long-term interests of the Authority through effective regulation using procedure governance, strategic risk management and clear policies and procedures.

Key highlights

- Developed a suite of business continuity procedures and plans.

- Implemented Risk Champions across the Authority, with the group meeting quarterly.

- Governance Framework in place.

- Developed key corporate policies.

- Implemented project risk registers to improve the quality of risk reporting, streamline the monitoring and amendment of project risk.

- Implemented an Occupational Health, Safety and Wellbeing (OHSW) specific risk register.

- Risk Framework, including a risk policy, procedures and appetite in place and aligned with the Victorian Government Risk Management Framework (VGRMF) (and ISO 31000: 2018 standard).

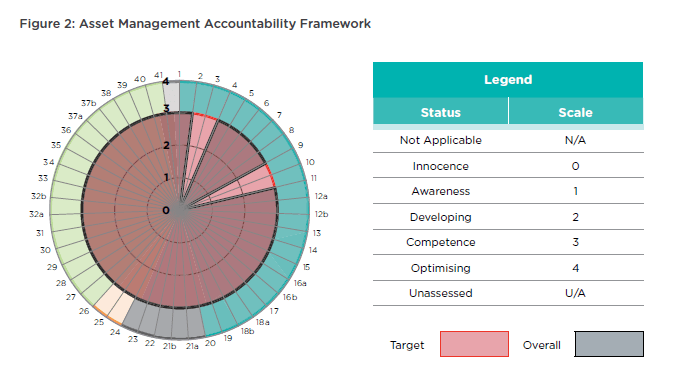

- 91.1% overall score on the risk maturity selfassessment, which places the Authority well above the average benchmark of 78.2% (from 217 submissions).

- Integrity Framework consistent with Victorian Public Service practices in place.

- Implemented voluntary risk training to all Authority staff members.

- Developed Project Management tools, including Project Plan template, PM template - Dashboard Monitor and Traffic Light Report and Terms of Reference template.

- Made available a staff online risk assessment system, as well as governance, integrity, strategy and policy material via the Authority’s intranet.

- Implemented an enterprise level Issues Register.

- Established a new three-year risk aligned strategic internal audit program providing assurance over key areas of the Authority’s enterprise risks.

- Completed eight internal audits and concluded 13 internal audit recommendations.

- Conducted six internal audits.

Numbers

- 91.1% on the Risk maturity self-assessment

- 4 Quarterly Risk Management meetings held

- 1 Quarterly Risk Champions meeting held

- 2 Management Strategy meetings held

- 5 Governing Board meetings held

- 5 Audit and Risk Committee meetings held

- 147 processes currently in use across the Authority:

- 111 updates approved

- 53 new processes.

Financial performance

Five-year financial summary

The Authority commenced operations on 18 March 2019, therefore only three full years of comparative information is available.

Table 1: Authority four-year financial summary

| Summary | 2021-22 ($'000) | 2020-21 ($'000) | 2019-20 ($'000) | 2018-19 ($'000) |

| Total income from transactions | 98,166 | 101,833 | 61,883 | 1,820 |

| Total expenses from transactions | 101,023 | 95,643 | 53,146 | 301 |

| Net result for the period | (2,857) | 6,190 | 8,737 | 1,519 |

| Net cash flow from operating activities | 95,420 | 75,929 | 40,387 | - |

| Total assets | 244,106 | 154,187 | 59,204 | 2,351 |

| Total liabilities | 230,517 | 137,741 | 48,948 | 832 |

| Net assets | 13,589 | 16,446 | 10,256 | 1,519 |

Current-year financial performance

The 2021-22 financial year is the Authority’s third full year having only commenced on 18 March 2019.

The Authority administers three schemes which provide portability of long service leave benefits for registered workers in the community services, contract cleaning and security industries in Victoria.

The Authority levies registered employers for workers in the covered industries in accordance with the Long Service Benefits Portability Act 2018 and the Portable Long Service Regulations 2020 and makes payments for benefits taken.

In the 2021-22 financial year, the Authority reported a net loss for the year of $2.8 million compared to $6.2 million surplus in 2020-21. The current year result was significantly impacted by a loss of $22.6 million on the fair value of investments, driven by the general downturn in global equity markets.

Levy contributions from employers and contractors based on levy rates set by the Governing Board was the largest source of income from transactions. Levy contributions increased by $18.5 million in the current year as a result of the increase in registered workers. There are 228,767 (177,960 2020-21) registered workers with 2,875 (2,540 2020-21) registered employers.

The Authority continued investing with the VFMC Balanced Fund and transferred a total of $83.6 million additional investments during the year, increasing the total investments to $169.6 million.

A final payment of $0.2 million in Government grants was received during the year to continue the assistance with the establishment of the Authority.

The portable long service benefit expense for 2021-22 was $93.1 million ($88.7 million 2020-21).

Administration costs totalled $7.7 million with $5.5 million relating to employee benefits expense and $2.2 million for information technology costs, office expenses, professional services, promotion costs and internal and external audit fees.

Financial position balance sheet

The Authority ended the financial year with net assets of $13.6 million and a solvency ratio of 105.9%.

Cash at bank totalled $27.2 million, which included scheme funds collected and not transferred to VFMC investments and administration charge received to fund the Authority but not spent.

The Authority increased the investment funds with VFMC to $169.6 million and accrued $7.9 million of investment income due in July 2022.

The Authority’s actuary valued the long service leave benefits for the Scheme’s 228,767 registered workers as at 30 June 2022. This amounted to $229.4 million and is supported by $234.2 million in Scheme assets.

Operating cash flows

Net cash flow from operating activities was positive for the year totalling $95.4 million, which included $104.0 million of receipts from employers for their worker levy contributions and $0.2 million from Government to continue the establishment of the Authority.

The Authority transferred $83.6 million to VFMC Balanced Fund and received $6.1 million of proceeds from these investments during the year.

Investment performance

The Governing Board has approved an investment strategy based on an analysis of desired investment returns against investment risk appetite.

The investment objectives of the Authority at 30 June 2022 are:

- Return: To achieve an average return objective of at least CPI + 3.0% p.a. with greater than 60% probability over a rolling 10-year period; and

- Risk: To limit the likelihood of a negative annual return to no more than one year in every five years and when negative returns occur, for this not to exceed a 10% loss of capital on average.

Current-year investment performance

Under the Act, the Authority is permitted to invest Scheme assets for the benefit of the schemes.

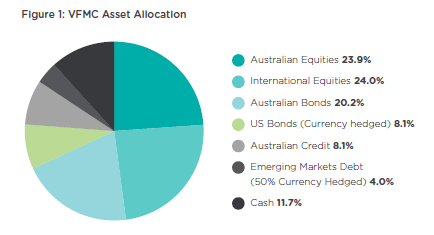

The Authority has appointed VFMC as its investment manager and VFMC has determined the following balanced asset allocation of investments for the Authority’s portfolio:

For the 12 months from 1 July 2021 – 30 June 2022, the Authority recorded unrealised investment losses of $22.6 million against total scheme funds of $169.6 million as at 30 June 2022. The Authority received $8.7 million of investment income during the year.

Outlook

The Authority is continually working with its investment manager to adjust portfolio positioning in response to market movements and changes to economic conditions and policy outlook of governments, which may affect key investment asset classes.

Governance and organisational structure

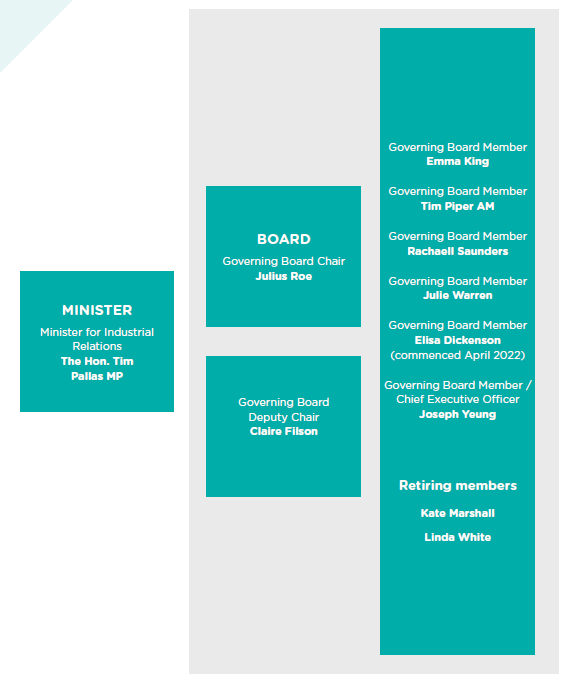

The Governing Board of the Authority.

The Authority is responsible to a Governing Board appointed by the Victorian Minister for Industrial Relations. The Governing Board comprises a mix of expert skills, qualifications and experience, including individuals from organisations who represent employers and workers for the three covered industries.

The directors of the Governing Board perform their duties consistent with the standards set in the Code of Conduct for Directors of Victorian Public Entities and the duties and values contained in the Public Administration Act 2004.

In accordance with the Long Service Benefits Portability Act 2018, the Governing Board:

- sets the levy to be paid by employers and contract workers

- is responsible for the governance, strategic planning and risk management of the Authority

- advises the Minister on agreements for corresponding schemes across Australia

- may perform functions and exercise the powers of the Authority that it deems appropriate.

Governing Board

Julius Roe, Chair

Julius Roe’s career spans 40 years in industrial relations, including as Fair Work Commissioner from 2010 to 2017. He is currently a member of the Police Registration and Services Board and, since 2017, Julius has been working as a consultant, handling mediation in a diverse range of workplace disputes in the public and private sectors. Julius has been a leader in vocational education and training policy, including various boards at both state and national level. He was National President of the Australian Manufacturing Workers Union from 2000–2010.

Claire Filson, Deputy Chair

Claire Filson has worked extensively in the financial services sector, with more than 20 years’ boardroom experience in superannuation and infrastructure businesses.

Before taking a break to travel in 2010, she was a Director on the Board of Emergency Services and State Superannuation, a 150,000-member public sector superannuation fund managing $15 billion.

Claire has a mix of skills spanning law, governance and risk management and is currently a director of Greater Western Water and Redundancy Payment Central Fund Limited, and the Deputy Chair of the Port of Hastings Development Corporation and the Indigenous Land & Sea Corporation.

Emma King

Emma King is currently CEO and Company Secretary of the Victorian Council of Social Service. Emma is a strong voice on social justice, has a Masters in Industrial and Employee Relations and has worked as a policy adviser, teacher and in a range of industrial and training roles.

Emma is also a member of the Victorian Skills Authority and the Chair of the Farnham Street Neighbourhood House Learning Centre.

Tim Piper AM

Tim Piper is the Head of the Australian Industry Group’s Victorian branch, advocating for more than 12,000 businesses in Victoria and over 60,000 across Australia. He has had significant engagement with government at all levels. He chairs the Industry Capability Network, is deputy Chair of the Rail Industry Advisory Council and sits on a number of Ministerial Committees and government bodies. He is also on the Board and a Director at GS1 and Co-Invest.

A lawyer in private practice in Australia and the UK, Tim was previously Executive Director of the Australian Retailers Association in Victoria. Tim was appointed a Member of the Order of Australia (AM) in the Queen’s Birthday 2020 Honours List for significant service to industry and manufacturing, to skills training, and to multicultural youth.

Rachaell Saunders

Rachaell Saunders is founder and CEO of National Protective Services, a leading national security organisation that specialises in both protective services and electronic security. Having founded the organisation in 1988 Rachaell has an extensive career within the security industry.

Rachaell has various qualifications in marketing, international business, risk management, security and business. As CEO of National Protective Services, she sets the strategic direction for the business with focus on operations, finance, human resources, sales and marketing.

Rachaell has been on the board of the Australian Security Industry Association Limited (ASIAL) the peak body for security employers for several years and is currently Vice President.

Julie Warren

In addition to her work with the Authority, Julie Warren is also on the Board of Victorian WorkCover Authority (WorkSafe Victoria) and the Migrant Workers Centre Inc.

She has worked for more than 20 years with the National Union of Workers and was president of the union’s Victoria branch for 13 years. In that role, she has been part of a number of valuable changes in strategic direction. Previously Julie Warren was the Senior Vice President of the Victorian Trades Hall Council and has considerable understanding of the issues and concerns that are relevant to contract industries.

Elisa Dickenson

Elisa Dickenson is Senior Industrial Officer of the Health and Community Services Union (Health Services Union, Vic No. 2 Branch) and has been at the union since 2015. She leads the industrial team at the union and represents members working in disability and mental health.

She holds a Bachelor of Arts / Laws degree and has extensive legal and advocacy experience. Prior to working at the union, she was a Senior Criminal Solicitor at the Victorian Aboriginal Legal Service and regularly appeared in the Magistrates’ Court across Victoria.

Joseph Yeung

Joseph Yeung is an experienced government senior executive and was previously the Chief Financial Officer at the Department of Premier and Cabinet from 2017 to 2019.

Before working in State Government, Joseph was an Assistant Secretary in the Civil Justice and Legal Services Division at the Commonwealth Attorney-General’s Department in Canberra. A chartered accountant and lawyer, Joseph also holds an MBA (Executive).

As Registrar, Joseph is a non-voting member of the Governing Board.

As Chief Executive Officer, Joseph is responsible for the day-to-day management of the Authority and its operations.

Retiring members

Kate Marshall

Kate Marshall is the Assistant State Secretary of the Health and Community Services Union (HSU, Vic No. 2 Branch), having joined in 2015. She is currently the National Junior Vice President of the Health Services Union.

Before that, Kate was a legal officer with the Construction, Forestry, Mining and Energy Union in Victoria and Tasmania, heading the legal department to run matters before the Fair Work Commission, the Federal Court and the Federal Circuit Court. Kate was an associate in the Federal Court in Queensland and completed her articles at Maurice Blackburn Lawyers.

Kate Marshall did not seek reappointment for a second term and retired from the Governing Board on 7 April 2022. Elisa Dickenson commenced on 8 April 2022.

Linda White

Linda White is an experienced industrial relations and legal professional with extensive board director experience.

Ms White sat on a number of boards including the Melbourne Cricket Ground Trust, Greater Western Water and Statewide Super and was Chair of the Chifley Research Centre.

She was previously an executive member of the Australian Council of Trade Unions and Assistant National Secretary of the Australian Services Union where she was responsible for the union’s strategy in the community sector.

Linda resigned from the Governing Board on 5 April 2022. Following the financial year end, Lisa Darmanin was subsequently appointed on 1 September 2022.

The following table indicates Director attendance at Governing Board meetings for the Authority.

Table 2: Director attendance at Governing Board meetings

| Director | Eligible to attend | Attended |

| Julius Roe | 5 | 5 |

| Claire Filson | 5 | 5 |

| Emma King | 5 | 5 |

| Tim Piper AM | 5 | 5 |

| Rachell Saunders | 5 | 5 |

| Julie Warren | 5 | 4 |

| Kate Marshall | 3 | 3 |

| Elise Dickenson | 2 | 2 |

| Linda White | 3 | 3 |

| Joeseph Yeung | 5 | 5 |

Audit and Risk Committee

The Audit and Risk Committee is established by the Governing Board and in accordance with the Standing Directions for the Minister for Finance (2018) under the Financial Management Act 1994 (the Standing Directions).

It provides independent assurance and advice to the Governing Board and Chief Executive Officer / Registrar on the effectiveness of the Authority’s financial management systems and controls, performance and stability, compliance with laws and regulations and risk management.

The Audit and Risk Committee comprises four members. The Committee is governed by a charter detailing its role and responsibilities consistent with the Standing Directions and best practice corporate governance principles.

Audit and Risk Committee members

The Audit and Risk Committee consists of the following members:

- Claire Filson

- Rachaell Saunders

- Julie Warren

- Peter Wyatt (independent member)

Peter Wyatt

Independent Member - Audit and Risk Committee

The Audit and Risk Committee’s independent member, Peter Wyatt, is the Chief Financial Officer of Treasury Corporation Victoria (TCV) and has responsibility for TCV’s finance, reporting and settlements functions.

Prior to joining TCV in 2006, Peter was the Chief Financial Officer of the State Superannuation Fund, having formerly held senior management roles in life insurance and financial services organisations.

Peter has a Bachelor of Business and a Graduate Diploma of Applied Finance, is a Certified Practicing Accountant, and a member of the Australian Institute of Company Directors (GAICD).

The following table indicates committee member attendance at Governing Board meetings for the Authority

Table 3: Attendance at Audit and Risk Committee meetings

| Member | Eligible to attend | Attended |

| Claire Filson | 5 | 5 |

| Rachaell Saunders | 5 | 5 |

| Julie Warren | 5 | 5 |

| Peter Wyatt | 5 | 5 |

Conflicts of interest

The Authority has a Conflict of Interest Policy for the Governing Board and for employees. These policies set out obligations in relation to managing conflicts of interest.

The policies ensure that there is a clear, transparent and accountable process in place to manage actual and perceived conflicts of interest which facilitates the Authority’s compliance with section 81 of the Public Administration Act 2004 and section 45 of the Long Service Benefits Portability Act 2018 in relation to pecuniary interests.

Occupational health and safety

The Authority is committed to providing and maintaining a healthy and safe working environment for staff and visitors in accordance with the Occupational Health and Safety Act 2004 and associated regulations.

OH&S Committee

The Authority’s OH&S Committee meets bimonthly to discuss the health, safety and wellbeing of staff and visitors in the workplace. The Committee consists of management, employees and health and safety representatives from both our Bendigo and Melbourne offices.

Workforce data

Employment and conduct principles

The Authority is committed to applying merit and equity principles when appointing staff.

The selection processes ensure that applicants are assessed and evaluated fairly and equitably on the basis of the key selection criteria and other accountabilities, without discrimination. Employees have been correctly classified in workforce data collections.

Public sector values and employment principles

The Authority maintains policies and practices that are consistent with the Victorian Public Sector Commission’s employment standards and provide for fair treatment, career opportunities and the early resolution of workplace issues. The Authority has advised its employees on how to avoid conflicts of interest, how to respond to offers of gifts, and how it deals with misconduct.

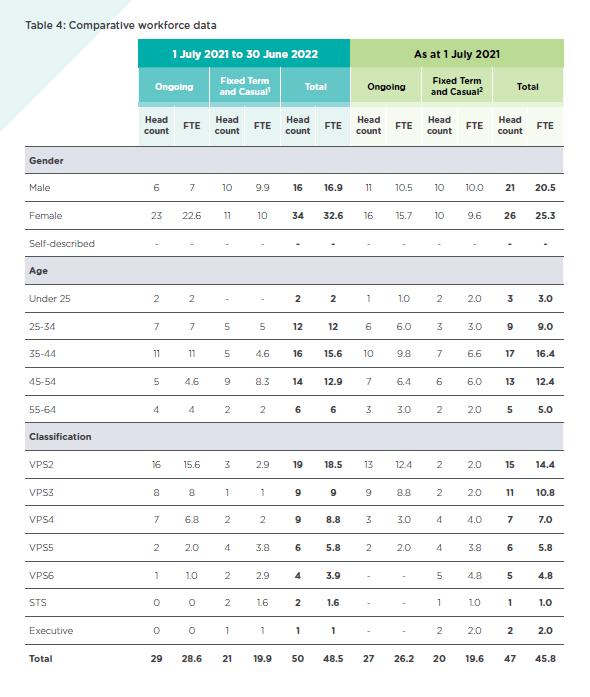

Comparative workforce data

The following table discloses the head count and full-time equivalent (FTE) of all Authority employees employed in the last full pay period in June 2022, and in the last full pay period in June 2021 of the previous reporting period. The Authority is taking steps to convert a number of fixed term positions to ongoing roles in the next financial year.

The following table discloses the annualised total salary for senior employees of the Authority, categorised by classification. the salary amount is reported as the full-time annualised salary.

Table 5: Annualised total salary for executives and other senior-non-executive staff

| Executives | STS** | |||

| Headcount | FTE | Headcount | FTE | |

| $160,000 - $179,999 | - | - | 1 | 0.6 |

| $180,000 - $239,999 | - | - | 1 | 1 |

| $240,000 - $259,999 | 1 | 1 | - | - |

** The data excludes acting arrangements but includes staff on secondments during the financial year.

Other disclosures

Other disclosures for the financial year 2021-22.

Local Jobs First

The Local Jobs First Act 2003, introduced in August 2018, brings together the Victorian Industry Participation Policy and Major Project Skills Guarantee, which were previously administered separately.

The Authority is required to apply the Local Jobs First policy to all metropolitan Melbourne or state-wide projects valued at $3 million or more, or any regional Victoria projects valued at $1 million or more.

The Authority undertook no projects subject to the Act during the 2021-22 reporting period.

Government advertising expenditure

In 2021–22 there were no government advertising campaigns with total media spend of $10,000 or greater (exclusive of GST).

Consultancy expenditure

Details of consultancies (valued at $10,000 or greater)

In 2021–22, there was one consultancy where the total fees payable to the consultants were $10,000 or greater.

The total expenditure incurred during 2021–22 in relation to this consultancy is $52,000 (excl. GST).

Table 6: Details of consultancies (valued at $10,000 or greater) ($ thousand)

| Consultant | Purpose of consultancy |

Start date | End date | Total approved project fee (excl. GST) |

Research and evaluation expenditure (excl. GST) |

Print and collateral expenditure (excl. GST) |

| Deloitte Consulting Pty Ltd |

Advisory Services |

10 June 2022 | 31 August 2022 | 39 | - | 39 |

| Deloitte Consulting Pty Ltd |

Advisory Services |

28 February 2022 | 31 May 2022 | 13 | - | 13 |

| 52 | - | 52 |

Details of consultancies under $10,000

In 2021-22, there were no consultancies engaged during the year, where the total fees payable to the individual consultancies was less than $10,000. The total expenditure incurred during 2021-22 was nil.

Information and Communication Technology expenditure

For the 2021-22 reporting period, the Authority had a total ICT expenditure of $0.566m, with details shown below.

Table 7: ICT expenditure ($ thousand)

| All operational ICT expenditure |

ICT expenditure related to projects to create or enhance ICT capabilities | ||

| Business as usual (BAU) ICT expenditure |

Non-business as usual (non-BAU) ICT expenditure |

Operational expenditure |

Capital expenditure |

| (Total) | (Total = Operational expenditure and capital expenditure) |

||

| 566 | - | - | - |

ICT expenditure refers to the Authority’s costs in providing business enabling ICT services within the current reporting period. It comprises Business as Usual (BAU) ICT expenditure and non-Business as Usual (Non-BAU) ICT expenditure. Non-BAU ICT expenditure relates to extending or enhancing the Authority’s current ICT capabilities. BAU ICT expenditure is all remaining ICT expenditure that primarily relates to ongoing activities to operate and maintain the current ICT capability.

Disclosure of major contracts

The Authority did not award any major contracts valued above $10 million or more during 2021–22.

Freedom of information

The Freedom of Information Act 1982 (the Act) allows the public a right of access to documents held by the Authority.

Information about the type of material produced by the Authority is available on its website under the Part II Information Statement.

During the 2021–22 financial year, the Authority received no applications.

Access to documents may be obtained through a written request to the Freedom of Information Officer, as detailed in section 17 of the Act.

Making a request

Access to documents can be made by a written request to the Authority’s Freedom of Information Officer.

When making a Freedom of Information request, applicants should ensure requests are in writing and clearly identify the documents being sought.

Requests for documents in possession of the Authority can be made via email to foi@plsa.vic.gov.au(opens in a new window) or by mail to:

Attention: Freedom of Information Officer

Portable Long Service Authority

PO Box 443

Bendigo VIC 3552

An application fee of $30.60 applies.

Further information

Access charges may also apply once documents have been processed and a decision on access is made, such as but not limited to photocopying, search and retrieval charges. Further information regarding Freedom of Information can be found at ovic.vic.gov.au/freedom-of-information/(opens in a new window)

Compliance with the Building Act 1993 (Vic)

The Authority does not own or control any government buildings and consequently is exempt from notifying its compliance with the building and maintenance provisions of the Building Act 1993 (Vic) (the Act).

The Authority met all relevant compliance provisions of the Act in our building and maintenance activities during the year.

Competitive neutrality policy

The Authority does not provide services that compete with the private sector and is therefore not subject to the requirements of the Victorian Competitive Neutrality Policy or subsequent reforms.

Compliance with the Public Interest Disclosures Act 2012

The Public Interest Disclosures Act 2012 (the Act) encourages and assists people in making disclosures of improper conduct by public officers and public bodies. The Act provides protection to people who make disclosures in accordance with the Act and establishes a system for the matters disclosed to be investigated.

The Authority encourages its officers and members of the public to report known or suspected incidences of improper conduct and detrimental action.

Disclosures of improper conduct or detrimental action by the Authority or any of its employees and/or officers must be made directly to the Independent Broad-based Anti-corruption Commission:

Level 1, North Tower, 459 Collins Street

Melbourne, VIC 3000

Phone: 1300 735 135(opens in a new window)

Internet: www.ibac.vic.gov.au(opens in a new window)

Table 8: Disclosures under the Public Interest Disclosures Act 2012

| 2021-22 number |

2020-21 number |

2019-20 number |

|