- Date:

- 1 Aug 2022

Responsible body’s declaration

In accordance with the Financial Management Act 1994 (Vic), I am pleased to present the Portable Long Service Benefits Authority’s Annual Report for the period ended 30 June 2021.

Note on accessibility

We've provided as much of this annual report in HTML as practicable. Complex financial tables are provided in position in Word documents.

For accessibility assistance understanding this report, contact us via email.

Overview

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

The Portable Long Service Benefits Authority is an independent statutory body established to administer the Long Service Benefits Portability Act 2018 (the Act). The Act, together with the Long Service Benefits Portability Regulations 2020 (the Regulations), provide a scheme for the portability of long service benefits to eligible workers in the community services, contract cleaning and security industries.

The Scheme enables eligible workers to accrue long service benefits based on the length of time employed in their respective industry, rather than the length of time employed by one employer. The Authority maintains registers of covered employers and workers and is responsible for the collection of levies and overseeing the payment of benefits.

Vision

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

Purpose

Administering an effective Portable Long Service Benefits Scheme through prudent, sustainable investment and supporting all stakeholders – including employers and workers alike – as well as educating and enforcing every stakeholder’s role and interest in the Scheme.

Values

The Authority has adopted the Victorian Public Sector values, which underpin the behaviours that the government and community rightly expect of it. Acting consistently with these values strengthens the Authority’s capacity to operate effectively and achieve our objectives.

These values are:

- Responsiveness – We are approachable and provide timely, useful and accurate information.

- Integrity – We have unbiased and honest interactions.

- Impartiality – We are firm and consistent in our application of the law.

- Accountability – We fulfil our objectives in a clear, transparent and responsible manner.

- Respect – We respect our stakeholders, each other and ourselves.

- Leadership – We seek to have a positive influence and to empower others.

- Human rights – We administer the law and deliver decisions, advice and policy that respect and support everyone’s human rights.

Chair and Chief Executive Officer / Registrar’s Report

On behalf of the Governing Board, we are pleased to present the Annual Report of the Portable Long Service Authority (the Authority) for the financial year ended 30 June 2021.

The Portable Long Service Leave Scheme (the Scheme) continues to grow and mature and this is evidenced by the total number of registered workers which has increased to 177,960 across the three covered industries being community services, contract cleaning and security. Total registered employers have also increased to 2,540. Both registration figures are well above the targets of the Authority that were originally determined by the Victorian Government and informed by a detailed independent actuarial study performed at the commencement of the Scheme.

Since the Scheme commenced operations on 1 July 2019, the Authority has made giant steps towards fulfilling its vision of delivering a quality portable long service leave scheme to some of Victoria’s most financially vulnerable workers. The strong foundations that have been laid during the 2020-2021 financial year continue to build on the success of the first year of the Authority’s operations despite the continued background challenges that COVID-19 has had on so many workplaces and more sadly on society in general.

Under the oversight of the Governing Board, the Authority’s leadership team has established the Portable Long Service Authority as an effective regulator and administrator of the Scheme. This has been underlined by continued strong financial growth and the responsible funds management of over $120 million in financial assets since the Scheme’s inception.

The dedication and commitment of our staff is also to be commended. The large number of workers and employers registering with the Authority in the past financial year has generated heavy workloads which have been managed by a dedicated workforce based mainly in regional Victoria. The challenges of providing exceptional customer service to employers and workers, as well as other stakeholders against the uncertainty of necessary lockdowns during the financial year, has been overcome by the resilience and willingness of the Authority’s staff to adapt to changing circumstances.

The Authority continues to be headquartered in Bendigo and this has been fruitful in creating employment and injecting income into the local economy, as supported by the fact that the majority of staff have been recruited from Greater Bendigo and surrounding areas. The Authority remains determined to build lasting relationships with community and business groups in regional Victoria.

Looking forward, our priority for the coming financial year is to ensure more eligible employers in the three covered industries are registered with the Authority. We will also be enforcing the legislation and regulations that establish the Authority to ensure that covered employers comply with their legal and financial obligations.

We look forward to the challenges in the new financial year and to building on the continued achievements made by the Authority in the current financial year.

Julius Roe

Chair, Governing Board

Joseph Yeung

Chief Executive Officer / Registrar

Role and functions

The Authority has several key functions pursuant to the Act:

- Administering the Portable Long Service Benefits Scheme in the covered industries.

- Making payments of benefits.

- Keeping registers of covered employers and workers.

- Resolving disputes as to the timing of taking a period of leave (applicable only to workers in the contract cleaning and security industries).

- Consulting other industries that may be affected by decisions made under the Act in relation to covered industries.

Statement of expectations

The Authority is delivering on the Victorian Government’s Statement of Expectations for the period 1 July 2020 to 30 June 2022, which sets out the Authority’s contribution to the Government’s program to reduce red tape and promote greater efficiency and effectiveness in the administration and enforcement of regulation.

To achieve this, the Authority has identified a range of projects and activities. The key priorities are:

- Continuing to explore ways to ensure all processes are timely, efficient and effective.

- Employing risk-based approaches to regulatory operations.

- Providing easy to understand, effective and accessible compliance information.

- Being accountable and transparent in its operations.

- Ensuring that regulatory activities are clear and consistent.

The Authority will consult with relevant stakeholders as appropriate and will report progress against performance targets in our Corporate Plan and Annual Financial Reports.

The Authority will continue to strive to identify and implement further regulatory burden reduction initiatives where possible.

| Registered workers: 177,960 (114,137 last financial year) |

Community services: 119,288 (77,021 last year) |

| Registered employers: 2,540 (1,914 last financial year) | Community services: 1,619 (1,363 last year) Contract cleaning: 517 (347 last year) Security: 404 (204 last year) |

| Funds invested |

$113,832,748.00 |

| Emails received: 4,968 |

3,447 from employers |

| Inbound calls: 9,819 *227 callback queue from (employers and workers) |

6,129 from employers 15,243 outbound calls 99% of all calls answered within three minutes |

| Worker gender breakdown |

Community services: 80% female | 20% male |

| Website visits | 91,000 hits |

| Social media | Facebook up 134% LinkedIn up 113% |

| Email newsletter subscribers | 3,402 |

Meet Martin Boyle

At 203 centimetres tall, Bendigo resident Martin Boyle is certainly an imposing figure. We talk to Martin about his career as a security guard.

How did you get into the security industry?

Back in 2012, a couple of friends were employed as security guards and suggested I might enjoy the work. I found a casual contract position working at the Thales facility in Bendigo where they manufacture light armoured military vehicles. It was an interesting place to work, with shifts varying from three to seven days a week, any time of the day or night.

Were you only working the one security job?

Besides Thales, I was working on the front desk at State Trustees in Bendigo, meeting customers and assessing their needs. I also had a job as a security guard at a nightclub a couple of nights a week. In total, I had three jobs going. Two were with security contract companies while the third was directly through the nightclub manager.

Have there been other security positions since then?

Plenty. I work at major sporting events including the Melbourne Grand Prix, the Spring Racing Carnival, the Australian Tennis Open and music concerts at Rod Laver Arena. Since that work is spasmodic, I’ve also held casual contract positions in security with the Federal Circuit Court, Bendigo TAFE and more recently, La Trobe University in Bendigo.

How did you hear about the Portable Long Service Scheme?

Initially through a housemate who worked in payroll but I also had two contract employers who told me they had both signed me up to the Scheme. I remember receiving a letter from the Authority informing me that I was now registered with the Scheme. I never thought in my working life that I’d be eligible for portable long service leave. I’m now getting benefits paid into the Scheme from three employers.

Has the Scheme changed your life in anyway?

Not yet, but it will in about five years’ time. I log into the Authority’s worker portal every now and again to check on my hours accrued and think about the money I’ll get after seven years in the Scheme.

What do you plan to do with the money?

Have an overseas holiday for the first time ever.

Meet Gavin Pawsey

For most of Gavin Pawsey’s working life, the days and nights have been filled with rapturous applause. Few people can say their career revolved around the world of theatre production and furthermore be employed by some of Australia’s most significant cultural institutions.

There were signs of Gavin’s impending artistic future while growing up south west of Sydney, with the teenager taking a keen interest in amateur theatre.

Gavin felt he should complete a tertiary course which would give him a reliable, life-long career. An engineering course at Wollongong University beckoned. However, the magnetic draw of the arts saw Gavin become involved in Theatresports, a form of improvisational amateur theatre while in Wollongong. The prospect of a career in engineering faded away when Gavin applied and became one of the first ever theatre technical trainees at the Sydney Opera House in 1990.

The course involved working in most departments within the Sydney Opera House including staging and lighting, audio visual and sound. The hours were extremely long but exhilarating. The longest period he worked without a break was 25 days straight! Gavin worked at the Sydney Opera House for 21 years.

Gavin began work in the year 2000 at the Australian National Maritime Museum based at Darling Harbour on audio-visual installations. The positions at the Sydney Opera House and the Maritime Museum were flexible, giving him time to work between the two organisations.

In 2011, Gavin was appointed Head of Sound and Audio Visual at Opera Australia. The following six years was a hectic schedule of operatic productions performed around Australia.

By 2017, it was time for a dramatic change but not involving the drama of the stage. Gavin, his wife and son embarked on a journey from the suburbs of Sydney to country Victoria to be closer to his wife’s parents but with no idea where they would work or live.

“We lived with the ocean at the end of the street. The morning we left Sydney I watched a whale breaching the water. When we arrived in rural Victoria, a kangaroo hopped across the backyard where we were staying,” he said. Gavin wasn’t sure of the significance of the two incidents but felt nature was trying to tell him something.

Now settled in the Macedon Ranges, Gavin looked at his career options. A friend told Gavin his greatest gift was his ability to effectively communicate to all manner of people, often practiced within the inner sanctum of a theatre, opera house or museum.

With that in mind, Gavin applied for a position with a brand new organisation based in Bendigo called the Portable Long Service Authority, which managed a scheme aimed at providing workers in community services, security and contract cleaning with long service leave.

At his interview, Gavin told the panel he was attracted to the position because of its social justice element. “During my career,

I worked alongside contract security guards and cleaners who despite years of dedicated service never received long service leave,” said Gavin. “What I considered an important and rightful benefit,” he added.

Gavin became one of the first Customer Service and Education Officers with the Authority when it began operations in 2019. He now has a demanding role advising workers registered with the Authority of their rights under the Scheme and helping employers understand their role in providing for the financial future of their casual staff.

Take a bow Gavin Pawsey.

Business units

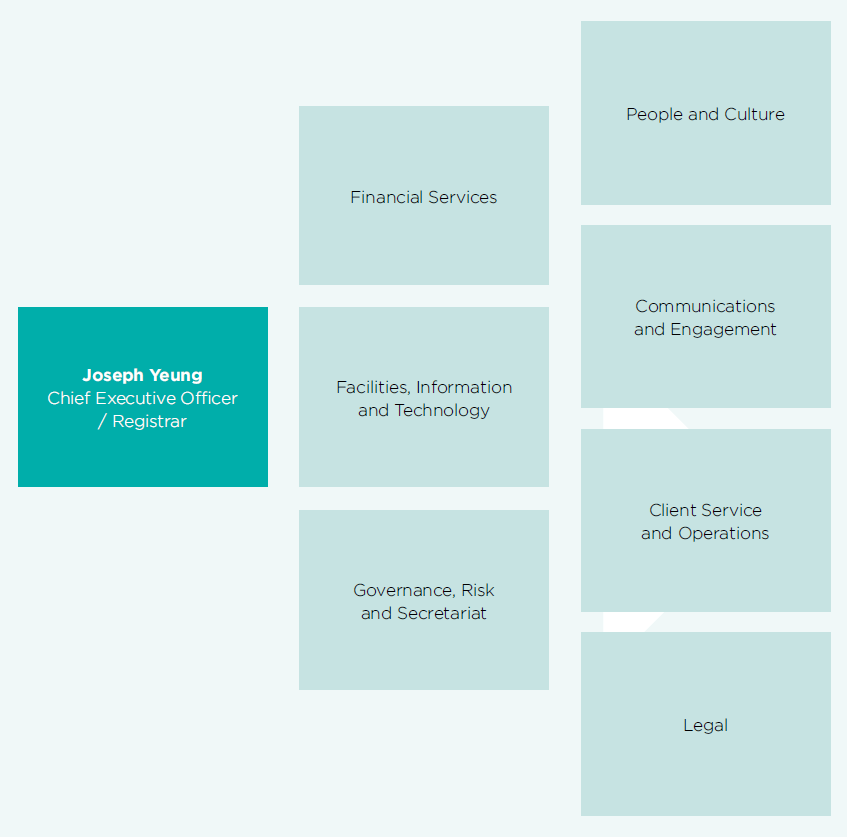

The Governance, Risk, Secretariat and Legal business unit is responsible for establishing good governance, delivering sound legal advice to the Authority as well as facilitating the efficient and effective running of the Governing Board and Audit and Risk Committee.

The Financial Services business unit underpins our operations and the Chief Financial Officer has specific responsibilities under the Financial Management Act 1994. Performance monitoring, responsible budgeting, and a robust investment strategy ensures that the entitlements of registered workers are managed prudently and helps to ensure the sustainability of the Scheme.

The Client Service and Operations business unit is the largest business unit within the Authority and delivers our core registry and enforcement functions through engaging with employers and workers to support them to fulfil their obligations and understand their rights.

The Facilities, Information and Technology business unit underpins our core operations and manages key vendors which support our network infrastructure and telephony systems. Having the best systems in place enables us to be efficient and effective in delivering on our functions.

The People and Culture business unit supports the growth and development of our people and culture. Our people are our greatest asset. Without our people, we have no capability to fulfil our statutory obligations under the Act.

The Communications and Engagement business unit leads communications, identification of and engagement with key stakeholders and internal and external education activities to ensure that employers understand and can meet their obligations and workers know their rights. It is vital that we communicate and engage with employers and eligible workers across the covered sectors.

Objectives

The Authority’s primary objectives

- Fulfil our legislative obligations by effectively administering the Long Service Benefits Portability Act 2018.

- Implement effective responsible budget and investment strategies which grow levy funds and deliver long-term sustainability.

- Be clear, consistent, transparent and responsive in our stakeholder communications to encourage registration and levy payments and ensure that eligible workers and employers are aware of their rights and obligations.

- Maintain a healthy and safe workplace with a culture that encourages engaged, resilient and solution-focused staff.

- Maintain an innovative, secure, resilient and integrated information technology environment that supports effective operations now and into the future.

- Protect the long-term interests of the Authority through effective regulation using governance, strategic risk management and clear policies and procedures.

Our performance

The Authority's financial and output performance for the 2020-21 financial year.

Organisational objectives, indicators and outputs

The Authority had one output associated performance measure with the 2020–21 Victorian Budget as set out in the 2020–21 Budget Paper No. 3 Service Delivery. This is shown below.

| Performance measures | Unit of measure | 2020/21 actual result | 2020/21 target |

|---|---|---|---|

| Workers registered under the Portable Long Service Benefits Scheme |

Number | 177,960* | 75,000 |

* The 2020–21 actual is higher than the 2020–21 target due to increased proactive activity by the Portable Long Service Authority to register employers.

Business Unit reports

Governance, Risk, Secretariat and Legal

In the past year we have achieved our goal of providing strategic, sound and constructive legal and governance advice to the Authority, Registrar and internal business units.

We have supported the Governing Board, along with the Audit and Risk Committee, to make astute and prudent decisions, ensure assurance through our strategic internal audit program and effectively monitor our risks.

The production of a comprehensive risk management framework and a detailed integrity and policies framework underpins the foundations of the Authority’s corporate governance.

We have also managed an effective corporate planning process, performance management framework, along with ensuring measures are in place and monitored to provide public accountability and transparency.

The COVID-19 pandemic has had a significant impact on the Authority. The Authority’s approach to responding to the pandemic was driven by our business unit resulting in the Authority successfully ensuring operations continued unabated.

The Legal team supports the Authority by educating business units on changes to the regulations associated with our Act and assisting with the implementation of operational changes arising from these developments.

It has also reviewed and provided advice on draft amendments to the Act, with changes to come into effect on 1 July 2021 and has continued negotiations with portable long service entities in other states to establish reciprocal agreements.

We developed the Authority’s response to the Ministerial Statement of Expectations while fostering productive working relationships with other regulators and leave authorities across Australia.

The challenge ahead is to develop accessible and consistent messaging internally and externally about the scope of the scheme for employers and workers, to support a strengthened compliance and enforcement approach, along with ensuring management and staff are given effective legal advice in response to issues as they arise.

Financial Services

A key highlight for the Finance business unit this year has been the smooth transition of our business systems.

We are operating more efficiently and have also reduced costs by moving from external system providers to managing payroll and financial systems internally.

We have also enhanced our budgeting and forecasting processes as well as implemented key financial policies and procedures.

On an extremely positive note, the Authority is managing almost $114 million in capital, which will fund the future long service benefits of registered workers.

Our investment of funds with the Victorian Funds Management Corporation (VFMC) is returning a healthy 6.54% from February 2020 and is currently sitting at 14.2% for the past financial year.

The challenge ahead for the Finance business unit is to increasingly use live data to validate key assumptions behind actuarial modelling, adapt to changes in regulations and the development of new information technology which will improve the Authority’s business registry system.

As the Authority has flourished, the Finance business unit has met every challenge with aplomb.

Client Service and Operations

The Client Service and Operations business unit is comprised of two teams.

The Customer Service and Education (CSE) team assesses applications for registration from employers and workers and determines whether they should be registered with the Authority. Once registered, the CSE team members are the main point of contact for employers and workers, assisting them with quarterly returns and enquiries.

The Compliance and Enforcement team works with employers to ensure they fulfil their obligations and financial commitments to the Scheme.

The challenge for all teams is to implement a range of strategies to ensure that employers and workers are registered to the full extent of the Scheme’s scope and that there is accessible and consistent messaging about the scope of the scheme.

We will further develop our processes to assist employers to complete accurate and timely returns and to identify where workers have been omitted from returns. In the coming year our compliance and enforcement strategy will be enhanced.

The business unit has once again shown resilience and professionalism by adjusting to remote working, children learning from home and changing travel restrictions.

The amount of calls Client Service and Operations has managed over the past year is staggering for such a developing Authority. We have received nearly 10,000 inbound calls in the past year and are actively engaged with the 177,960 workers and 2,540 employers registered with the Authority.

We have seen the continual development and improvement of processes and business systems employed by the business unit, often through the feedback that we receive from employers and workers.

The impact of COVID-19 has presented many challenges. It has led to staff moving to remote working environments.

There is no doubt there have been challenges in the past year for the business unit, highlighted by the extraordinary increase in the number of workers registrations and the impact of COVID-19 on the workplace. The business unit has once again shown resilience and professionalism.

Facilities, Information and Technology

As the Authority evolves, we have ensured the organisation remains flexible and agile by introducing new technology to improve operations.

A major project for us has been the successful installation of the Genesys phone system for the Client Services and Operations Unit, based in Bendigo.

We have also been involved in the implementation of a new HR/payroll system and risk management software to help streamline operations.

The Facilities team has also overseen the establishment of new office space to cater for the Authority’s growth in Bendigo and Melbourne CBD. The fit-out of both office areas occurred seamlessly.

The construction and design of the Authority’s new intranet has also been an important element of the business unit’s activities during the past 12 months. We have been working closely with all the business units to develop the site.

The aim is to make the Authority’s intranet simple to navigate and with easy access to a wealth of information provided by each business unit.

The transition to staff working remotely due to the COVID-19 pandemic has occurred without incident. We have provided around-the-clock support and technical expertise to the various business units to ensure no interruption to the Authority’s operations.

The challenge for us is to keep investigating and introducing new information technology products to further support the successful operations of the Authority.

People and Culture

The People and Culture business unit has focused on ensuring our workforce has the right skills, capabilities and as an organisation, the Authority has a healthy culture where people feel happy and productive.

We believe people are our greatest asset and it’s our job to support their growth and development within the Authority.

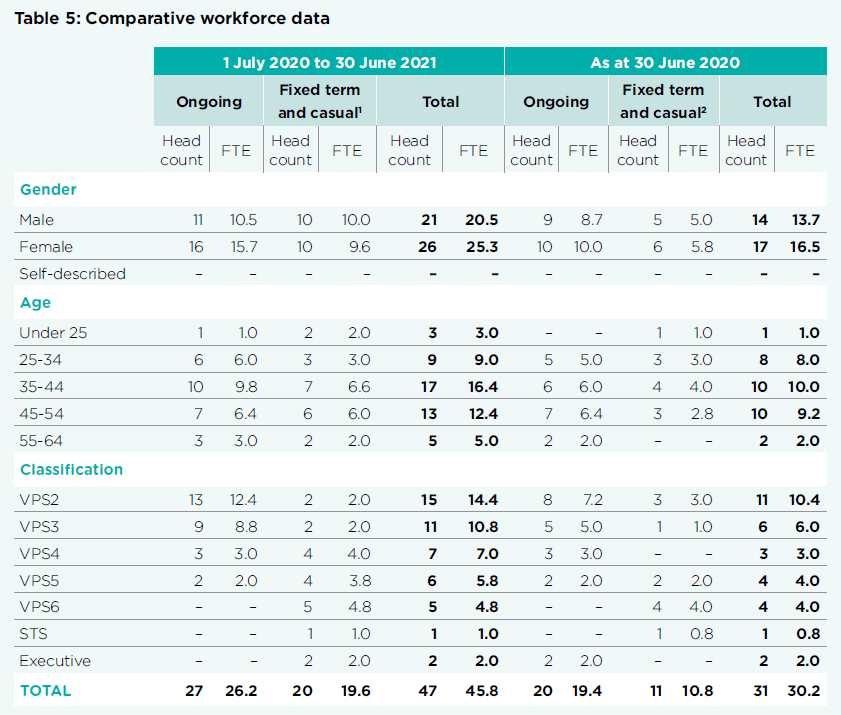

As at 30 June 2021, the Authority has 47 staff with more than 90 per cent from the Greater Bendigo and surrounding areas as part of its commitment to invest in regional Victoria. In the past year, we have been involved in the recruiting process for 21 positions with the Authority.

The COVID-19 pandemic has presented many challenges. We made the swift transition of our staff to remote working. This meant we had to adapt the ways in which we supported staff to make sure everyone felt connected, informed and that everyone’s mental health and well-being were cared for.

We conducted 155 one-on-one check-ins with staff members over the past year to speak with staff about their health, well-being and to ensure they felt supported by the Authority while working remotely.

There were various ways we went about this, including giving staff access to a virtual gym, ‘ergonomics at home’ virtual training sessions and webinars to cope with the onset of loneliness and isolation.

The Victorian Public Service annual survey the ‘People matter survey’ conducted last October found that 96% of staff found the

Authority inspired them to do the best in their job, motivated them to help achieve its objectives and 92% thought it was a good place to work.

Communications and Engagement

This year, the Communications and Education business unit leveraged off the previous year’s comprehensive communications and engagement activities to propel the Authority’s brand and presence among the target audiences and stakeholders.

Following the successful 2019 advertising campaign, the Authority delivered two further campaigns focusing on raising awareness among employers and workers with employers receiving a stronger compliance message. The campaigns were delivered through digital and radio advertising in metropolitan and regional Victoria.

Content on the Authority website was enhanced resulting in an increase of over 10,000 unique visitors from the previous year, while our social media channels including Facebook and LinkedIn grew by 134% and 113% respectively. The fortnightly email newsletter moved to monthly distribution in February 2021 and averaged an open rate of 40 – 50% which is significantly above the industry standard. Our digital presence continues to be our main channel in raising awareness of the Authority and moving forward, will play a key role in driving traffic to our website.

COVID-19 affected our proposed participation in trade shows and events, however online speaking opportunities were made available to the Authority throughout the year. Since October 2020, the Research and Education team within the business unit held ten general online webinars for 300 external stakeholders, as well as sector specific online sessions for 130 employers.

The Communications and Engagement business unit continued to work in concert with the Operations business unit supporting tactical initiatives and developing targeted communication to address issues and needs identified through data and intelligence gathering.

A challenge ahead is to support accessible and consistent messaging about the broad scope of the scheme for employers and workers and to support our strengthened compliance and enforcement approach.

As our scheme matures there are also opportunities to support our stakeholders by providing access to data about our industries and their workforce.

Meet Aimee Sparnenn

The journey to Bendigo and working at the Portable Long Service Authority has taken several interesting twists and turns for Aimee Sparnenn.

It begins with Aimee growing up in Melbourne’s outer eastern suburbs and the lure of the city’s vibrant hospitality industry. An offer from a friend to work in a café kickstarted her working life.

“It was a fun job straight out of high school,” said Aimee. “There’s something very satisfying ensuring customers have a great experience and I also enjoyed working with a wide variety of people in hospitality,” she added.

The next step was more geographically complicated. “After spending time in frontof- house positions I decided to transition into becoming a chef. I had always loved cooking and it seemed a natural progression.”

Uluru is about 2,000 kilometres from Melbourne and is far removed from most peoples’ everyday work experience. The large sandstone formation, which happens to be one of the most recognised natural wonders of the world, is right next door to the Ayers Rock Resort. The resort had eleven restaurants, cafés and bars for a budding chef to ply their passion for food.

Aimee accepted a position as an apprentice chef at the resort.

It was hours of gruelling shift work in big kitchens and an even bigger learning curve into the machinations of the hospitality industry on a grand scale. “There wasn’t a great deal of time to explore the desert,” said Aimee. Most down time was spent at the staff bar or pool after a long day “which left you with little energy for anything else,” she added.

After a year in the surreal surrounds of Uluru and the Ayers Rock Resort, Aimee decided to return to Melbourne where she continued her studies at the William Angliss Institute and cooked at a popular Richmond café.

Life took a different turn when Aimee’s partner, who was also a chef, accepted a job in food technology and product development based in Brisbane.

Packing their bags, Aimee decided it was time to try something different after growing tired of long hours and demanding shift work in hospitality.

With good communication skills and an analytical mind, Aimee took up a position with Brisbane City Council as a field-based compliance officer. She investigated everything from serious dog attacks, interference with protected vegetation, illegal dumping, breaches of the Food Act or public health matters relating to hoarding or asbestos.

After five years in Brisbane, Aimee and her partner decided to come back to Victoria, but they wanted to experience living in a regional area rather than the confines of metropolitan Melbourne.

While in Brisbane, Aimee started searching for a job in Victoria and found an advertisement on the Victorian Government jobs website for a Customer Service and Compliance Officer position with the Authority in Bendigo. Her communication skills would once again prove beneficial. She was interviewed and began work with the Authority in May this year.

The role involves making sure employers comply with their obligations under legislation introduced in 2019.

Aimee is adapting from a council with eight-thousand employees to a much smaller government authority.

As Aimee says, “there are plenty of upsides working with a fresh and new organisation like the Portable Long Service Authority that wants to make a positive financial impact on the lives of workers”.

That’s quite a change from investigating dog attacks and hoarders in Brisbane.

Delivering on our objectives

The Authority’s Corporate Plan 2020–23 sets out the Authority’s short and medium-term priorities along with its key measures for success.

Below is an overview of the activities contributing towards these objectives.

Key highlights |

Numbers |

|

During the financial year, 13,951 quarterly returns were issued to registered employers:

The Authority adjusted 5,403 quarterly returns due to incorrect information being submitted by the employer.

|

Key highlights |

Numbers |

|

$83.9 million invoiced. $3.4 million outstanding at 30 June 2021 of which $0.8 million is more than 30 days overdue. $113.8 million invested with Victoria Funds Management Corporation (VFMC) in the Balanced Portfolio. |

Key highlights |

Numbers |

|

|

Key highlights |

Numbers |

|

|

Working from home

|

Key highlights |

Numbers |

|

|

Key highlights |

Numbers |

|

|

COVID-19 response

The COVID-19 global pandemic has for another year had a deep impact on the lives of all Victorians.

Working remotely has created significant challenges for the Portable Long Service Authority. It has been difficult to maintain internal cohesion and consistency of messaging to employers and workers in this environment.

Despite this the Authority has ensured services for registered employers and workers have continued unimpeded in this challenging operating environment.

Our Customer Service and Education Officers have responded to thousands of enquiries while also conducting online training sessions to employers in the three covered industries.

We have been proud of the way our team has risen to the challenges faced as a result of the COVID-19 pandemic, including successfully adapting to working from home.

Every effort has been made to ensure our staff members are comfortable with their rapidly changing work conditions.

The Continuity Leadership Team has been meeting to update planning and the Authority’s response to the challenges presented by the pandemic.

The People and Culture business unit have maintained close contact with staff, monitoring well-being and directing our people to the Employee Assistance Program.

Other measures have been put in place to maintain and monitor the health of all staff. There are regular group video conferences and individual check-ins to provide conversation, comfort and maintain morale.

Our staff members have been encouraged to receive a COVID-19 vaccination if they are eligible.

We have also implemented an electronic desk booking system for our Bendigo and Melbourne offices to manage workplace capacity, in line with social distancing requirements. The system, known as ‘Robin’, allows staff to plan when they can work in the office on any given day.

As part of our response to the rapidly changing situation, staff have been issued with the latest communications and information technology enabling them to successfully continue their important work from any location.

The Authority and its people have undergone a transformation during the pandemic. We are far more agile and adaptive to the many challenges before us.

Those strengths have ensured the thousands of workers and employers registered with the Authority continue to receive the best possible service and advice during these difficult times.

Financial performance

Five-year financial summary

The Authority commenced operations on 18 March 2019, therefore only one year of comparative information is available.

Table 2: Two-year financial summary

| Summary | 2020-21 ($,000) | 2019-20 ($’000) | 2018-19 ($’000) |

|---|---|---|---|

| Total income from transactions | 106,525 | 62,419 | 1,820 |

| Total expenses from transactions | 95,643 | 53,146 | 301 |

| Net result for the period | 10,882 | 9,273 | 1,519 |

| Net cash flow from operating activities | 75,929 | 40,387 | - |

| Total assets | 159,415 | 59,740 | 2,351 |

| Total liabilities | 137,741 | 48,948 | 832 |

| Net assets | 21,674 | 10,792 | 1,519 |

Current-year financial performance

The 2020–21 financial year is the Authority’s second full year having only commenced on 18 March 2019.

The Authority administers three schemes which provide portability of long service leave benefits for registered workers in the community services, contract cleaning and security industries in Victoria.

The Authority levies registered employers for workers in the covered industries in accordance with the Act and the Regulations and makes payments for benefits taken.

In the 2020–21 financial year, the Authority achieved a net result for the year of a $10.9 million surplus compared to $9.3 million surplus in 2019–20.

Levy contributions from employers and contractors based on levy rates set by the Governing Board was the largest source of income from transactions. This was achieved through 177,960 (114,137 2019-20) registered workers with 2,540 (1,914 2019-20) registered employers completing four quarterly returns during the year.

The Authority continued investing with the Victoria Funds Management Corporation (VFMC) Balanced Fund and transferred a total of $81.3 million additional investments during the year, increasing the total investments to $113.8 million. Investment income increased substantially to $5.7 million as the markets recovered from the COVID-19 sell-off the previous year. The Balance Fund also outperformed the benchmark resulting in a net gain of $6.8 million on financial instruments during the year.

A total of $0.7 million in Government grants was received during the year to continue the assistance with the establishment of the Authority, with a final payment of $0.2 million to occur next year.

During the year the Authority appointed Deloitte Consulting Pty Ltd as the new actuary to calculate the valuation of the portable long service benefit expense which increased to $136.3 million as at 30 June 2021.

Administration costs totalled $6.7 million with $4.7 million relating to employee benefits expense and $2.0 million for information technology costs, office expenses, professional services, promotion costs and internal and external audit fees.

Financial position balance sheet

The Authority ended the financial year with net assets of $21.7 million and a solvency ratio of 115.7%.

Cash at bank totalled $9.4 million, which included scheme funds collected and not transferred to VFMC investments and the Administration charge received to fund the Authority but not spent.

The Authority increased the investment funds with VFMC to $113.8 million and accrued $5.2 million of investment income due in July 2021 and $27.2 million for the fourth quarter employer levy contribution payable on 31 July 2021.

The Authority’s actuary calculated the long service leave valuation which totalled $136.3 million for portable long service benefit expense based on 177,960 workers as at 30 June 2021.

Operating cash flows

Net cash flow from operating activities was positive for the year totalling $75.9 million, which included $81.7 million of receipts from employers for their worker levy contributions and $1.2 million from Government to continue the establishment of the Authority.

The Authority transferred $81.3 million to VFMC Balance Fund and received $1.1 million of proceeds from these investments during the year.

Investment performance

The Governing Board approved the Authority’s investment strategy following workshops facilitated by VFMC based on an analysis of desired investment returns against investment risk appetite. Investment manager performance is actively monitored by management of the Authority.

The investment objectives of the Authority at 30 June 2020 are:

- Return: To achieve an average return objective of at least CPI + 3.0% p.a. with greater than 60% probability over a rolling 10‑year period; and

- Risk: To limit the likelihood of a negative annual return to no more than one year in every five years and when negative returns occur, for this not to exceed a 10% loss of capital on average.

Current-year investment performance

Under the Long Service Benefits Portability Act 2018, the Authority is permitted to invest Scheme assets for the benefit of the Schemes.

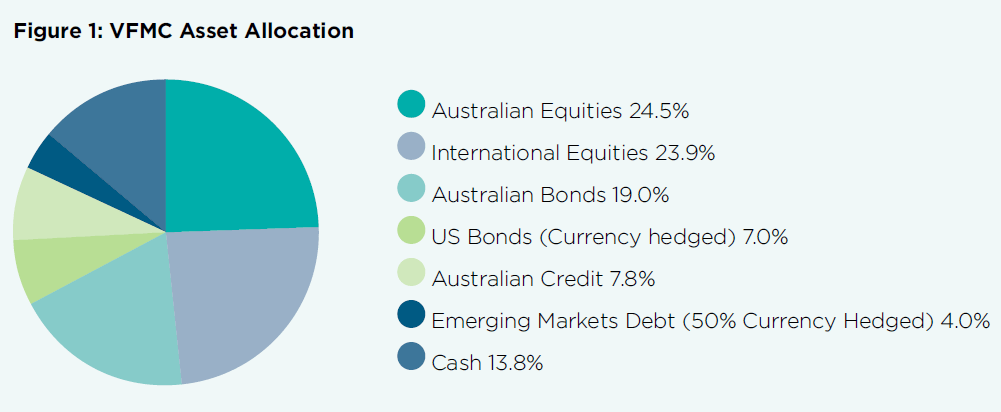

The Authority has appointed VFMC as its investment manager and VFMC has determined the following balanced asset allocation of investments for the Authority’s portfolio:

VFMC asset allocation

Australian Equities 24.5%

International Equities 23.9%

Australian Bonds 19.0%

US Bonds (Currency hedged) 7.0%

Australian Credit 7.8%

Emerging Markets Debt (50% Currency Hedged) 4.0%

Cash 13.8%

For the 12 months from 1 July 2020 to 30 June 2021, the Authority realised investment gains of $6.8 million against total scheme funds of $113.8 million as at 30 June 2021. In addition to the $6.8 million investment gain, the Authority also received $5.7 million of investment income during the year. As a result, the net investment gain for the financial year was $12.6 million (or 14.2% return for the financial year) compared to a 12.6% benchmark for the VFMC Balanced Fund which outperformed over the year with stock selection adding value in all asset classes.

Outlook

The Authority is working with its investment manager to adjust portfolio positioning in response to market movements and changes to economic conditions and policy outlook of governments, which may affect key investment asset classes.

Governance and organisational structure

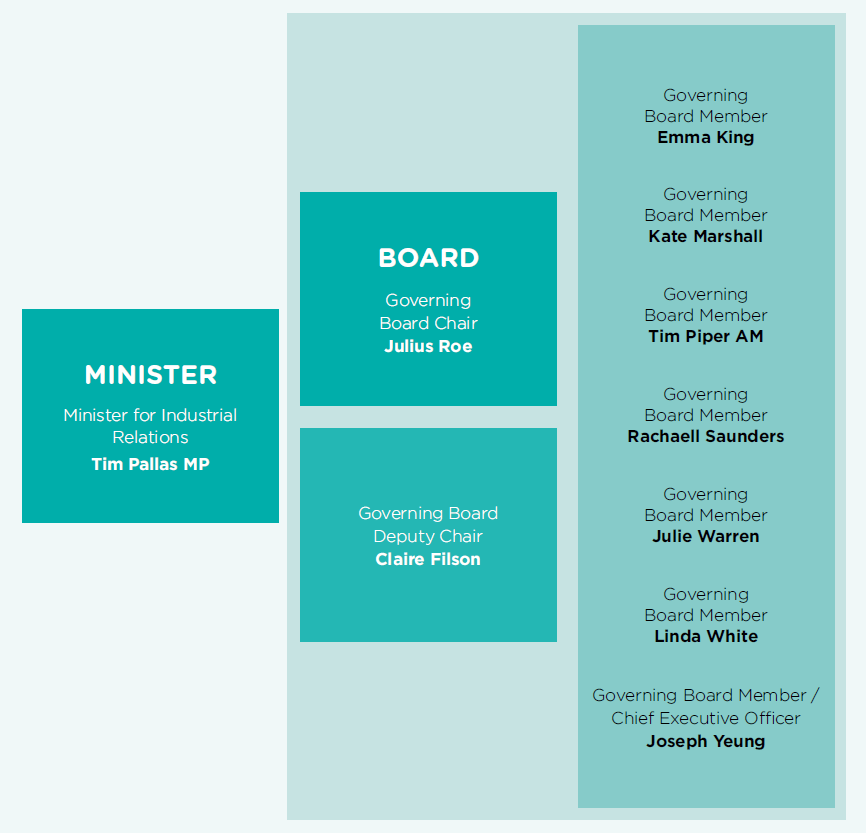

The Governing Board of the Authority.

The Authority is responsible to a Governing Board appointed by the Victorian Minister for Industrial Relations. The Governing Board comprises a mix of expert skills, qualifications and experience, including individuals from organisations who represent employers and workers for the three covered industries.

The directors of the Governing Board perform their duties consistent with the standards set in the Code of Conduct for Directors of Victorian Public Entities and the duties and values contained in the Public Administration Act 2004.

In accordance with the Long Service Benefits Portability Act 2018, the Governing Board:

- sets the levy to be paid by employers and contract workers

- is responsible for the governance, strategic planning and risk management of the Authority

- advises the Minister on agreements for corresponding schemes across Australia

- may perform functions and exercise the powers of the Authority that it deems appropriate.

Governing Board

Julius Roe, Chair

Julius’s career spans 40 years in industrial relations, including as Fair Work Commissioner from 2010 to 2017. He is currently a member of the Police Registration and Services Board and since 2017, Julius has been working as a consultant, handling mediation in a diverse range of workplace disputes in the public and private sectors. Julius has been a leader in vocational education and training policy, including on a number of boards at both state and national level. He was National President of the Australian Manufacturing Workers Union from 2000–2010.

Claire Filson, Deputy Chair

Claire Filson has worked extensively in the financial services sector, with more than 20 years’ boardroom experience in superannuation and infrastructure businesses. Before taking a break to travel in 2010, she was a Director on the Board of Emergency Services and State Superannuation, a 150,000-member public sector superannuation fund managing $15 billion. Claire has a mix of skills spanning law, governance and risk management.

Emma King

Emma King is currently CEO and Company Secretary of the Victorian Council of Social Service.

Emma is a strong voice on social justice, has a Masters in Industrial and Employee Relations and has worked as a policy adviser, teacher and in a range of industrial and training roles.

Emma is also Chair of the Farnham Street Neighbourhood House Learning Centre.

Kate Marshall

Kate Marshall is the Assistant State Secretary of the Health and Community Services Union (HSU, Vic No. 2 Branch), having joined in 2015.

She is currently the National Junior Vice President of the Health Services Union.

Before that, Kate was a legal officer with the Construction, Forestry, Mining and Energy Union in Victoria and Tasmania, heading the legal department to run matters before the Fair Work Commission, the Federal Court and the Federal Circuit Court. Kate was an associate in the Federal Court in Queensland and completed her articles at Maurice Blackburn Lawyers.

Tim Piper AM

Tim Piper has been Head of the Australian Industry Group’s Victorian branch since 2002, advocating for more than 12,000 businesses in Victoria and over 60,000 across Australia. He has had significant engagement with government at all levels. He chairs the Industry Capability Network and sits on a number of Ministerial Committees and government bodies.

A lawyer in private practice in Australia and the UK, Tim was previously Executive Director of the Australian Retailers Association in Victoria.

Tim was appointed a Member of the Order of Australia (AM) in the Queen’s Birthday 2020 Honours List for significant service to industry and manufacturing, to skills training, and to multicultural youth.

Rachaell Saunders

Rachaell Saunders is founder and CEO of National Protective Services a leading national security organisation that specialises in both protective services and electronic security. Having founded the organisation in 1988 Rachaell has an extensive career within the security industry. Rachaell has various qualifications in marketing, international business, risk management, security and business. As CEO of National Protective Services, she sets the strategic direction for the business with focus on operations, finance, human resources, sales and marketing.

Rachaell has been on the board of the Australian Security Industry Association Limited (ASIAL) the peak body for security employers for several years and is currently Vice President.

Julie Warren

In addition to her work with the Authority, Julie is also on the Board of Victorian WorkCover Authority (WorkSafe Victoria) and the Migrant Workers Centre Inc.

She has worked for more than 20 years with the National Union of Workers and was president of the union’s Victoria branch for 13 years. In that role, she has been part of a number of valuable changes in strategic direction. Previously Julie Warren was

the Senior Vice President of the Victorian Trades Hall Council and has considerable understanding of the issues and concerns that are relevant to contract industries.

Linda White

Linda White is an experienced industrial relations and legal professional with extensive board director experience. Ms White currently sits on a number of boards including the Melbourne Cricket Ground Trust and Greater Western Water. Ms White is also currently Chair of the Chifley Research Centre and on the board of Statewide Super. She was previously an executive member of the Australian Council of Trade Unions and Assistant National Secretary of the Australian Services Union where she was responsible for the union’s strategy in the community sector.

Joseph Yeung

Joseph Yeung is an experienced corporate governance executive and was previously the Chief Financial Officer at the Department of Premier and Cabinet from 2017 to 2019.

Before working in State Government, Joseph was an Assistant Secretary in the Civil Justice and Legal Services Division at the Commonwealth Attorney-General’s Department in Canberra. A chartered accountant and lawyer, Joseph also holds an MBA (Executive).

As Registrar, Joseph is a non-voting member of the Governing Board.

As Chief Executive Officer, Joseph is responsible for the day-to-day management of the Authority and its operations.

| Director | Eligible to attend | Attended |

|---|---|---|

| Julius Roe | 6 | 6 |

| Claire Filson | 6 | 6 |

| Emma King | 6 | 6 |

| Kate Marshall | 6 | 6 |

| Tim Piper AM | 6 | 6 |

| Rachaell Saunders | 6 | 6 |

| Julie Warren | 6 | 6 |

| Linda White | 6 | 6 |

| Joseph Yeung | 6 | 6 |

Audit and Risk Committee

The Audit and Risk Committee is established by the Governing Board and in accordance with the Standing Directions for the Minister for Finance (2018) under the Financial Management Act 1994 (the Standing Directions).

It provides independent assurance and advice to the Governing Board and Chief Executive Officer / Registrar on the effectiveness of the Authority’s financial management systems and controls, performance and stability, compliance with laws and regulations and risk management.

The Audit and Risk Committee comprises four members, at least one of which must be independent from the Governing Board and the Authority. The Committee is governed by a charter detailing its role and responsibilities consistent with the Standing Directions and best practice corporate governance principles.

Audit and Risk Committee members

The Audit and Risk Committee consists of the following members:

- Claire Filson

- Rachaell Saunders

- Julie Warren

- Peter Wyatt (independent member)

Peter Wyatt

Independent Member – Audit and Risk Committee

The Audit and Risk Committee’s independent member, Peter Wyatt, is the Chief Financial Officer of Treasury Corporation Victoria (TCV) and has responsibility for TCV’s finance and reporting and settlements functions. Prior to joining TCV in 2006, Peter was the Chief Financial Officer of the State Superannuation Fund, having formerly held senior management roles in life insurance and financial services organisations.

Peter has a Bachelor of Business and a Graduate Diploma of Applied Finance, is a Certified Practicing Accountant, a member of the Australian Institute of Company Directors (GAICD) and of the Australian Corporate Treasury Association.

| Member | Eligible to attend | Attended |

|---|---|---|

| Claire Filson | 5 | 5 |

| Rachaell Saunders | 5 | 5 |

| Julie Warren | 5 | 5 |

| Peter Wyatt | 5 | 5 |

Conflicts of interest

The Authority has a Conflict of Interest Policy for the Governing Board and for employees. These policies set out obligations in relation to managing conflicts of interest.

The policies ensure that there is a clear, transparent and accountable process in place to manage actual and perceived conflicts of interest which facilitates the Authority’s compliance with section 81 of the Public Administration Act 2004 and section 45 of the Long Service Benefits Portability Act 2018 in relation to pecuniary interests.

Occupational health and safety

The Authority is committed to providing and maintaining a healthy, safe working environment for staff and visitors in accordance with the Occupational Health and Safety Act 2004 and associated regulations.

In 2020–21, we recorded:

- Zero worker injury claims

- Zero days of lost time due to injury

- No equal opportunity, bullying or harassment complaints.

OH&S Committee

The Authority’s OH&S Committee meets bi-monthly to discuss the health, safety and wellbeing of staff and visitors in the workplace. The Committee consists of management, employees and health and safety representatives from both our Bendigo and Melbourne offices.

During the COVID-19 pandemic the Committee continued to meet via Microsoft Teams.

Workforce data

Employment and conduct principles

The Authority is committed to applying merit and equity principles when appointing staff.

The selection processes ensure that applicants are assessed and evaluated fairly and equitably on the basis of the key selection criteria and other accountabilities, without discrimination. Employees have been correctly classifed in workforce data collections.

Public sector values and employment principles

The Authority maintains policies and practices that are consistent with the Victorian Public Sector Commission’s employment standards and provide for fair treatment, career opportunities and the early resolution of workplace issues. The Authority has advised its employees on how to avoid conficts of interest, how to respond to offers of gifts, and how it deals with misconduct.

Comparative workforce data

The following table discloses the head count and full-time equivalent (FTE) of all Authority employees employed in the last full pay period in June 2021, and in the last full pay period in June 2020 of the previous reporting period.

The following table discloses the annualised total salary for senior employees of the Authority, categorised by classification. The salary amount is reported as the full-time annualised salary.

| Executives | STS | |||

|---|---|---|---|---|

| Income band (salary) | Headcount | FTE | Headcount | FTE |

|

$160,000 - $179,999 |

- | - | - | - |

|

$180,000 - $239,999 |

1 | 1 | 1 | 1 |

|

$240,000 - $259,999 |

1 | 1 | - | - |

Executive officer data

An executive officer (EO) is defined as a person employed as an executive under Part 3 of the Public Administration Act 2004 or a person to whom the Victorian Government’s Policy on Executive Remuneration in Public entities applies.

The table below reflects employment levels at the last full pay period in June of the current reporting year.

|

1 July 2020 to 30 June 2021 |

||||||||

|---|---|---|---|---|---|---|---|---|

| Female | Male | Self-described | Total | |||||

| Headcount | FTE | Headcount | FTE | Headcount | FTE | Headcount | FTE | |

| Executive | - | - | 1 | 1 | - | - | 1 | 1 |

| Total | - | - | 1 | 1 | - | - | 1 | 1 |

The definition of an EO does not include a statutory office holder or an accountable officer; thus, the Authority’s Chief Executive Officer / Registrar, who is a statutory office holder, was excluded from this data.

Other disclosures

Other disclosures for the financial year 2020-21.

Local Jobs First

The Local Jobs First Act 2003, introduced in August 2018, brings together the Victorian Industry Participation Policy and Major Project Skills Guarantee, which were previously administered separately.

The Authority is required to apply the Local Jobs First policy to all metropolitan Melbourne or state-wide projects valued at $3 million or more, or any regional Victoria projects valued at $1 million or more.

The Authority undertook no projects subject to the Act during the 2020–21 reporting period.

Government advertising expenditure

In 2020–21 there were no government advertising campaigns with total media spend of $100,000 or greater (exclusive of GST). There were however two advertising campaigns during the year with total expenditure less than $100,000. These related to the Portable Long Service is the Law at a cost of $89,939 and a Worker Campaign costing $28,410.

| Name of campaign | Campaign summary | Start / end date | Advertising expenditure (excl. GST) | Creative campaign development expenditure (excl. GST) | Research and evaluation expenditure (excl. GST) | Print and collateral expenditure (excl. GST) | Other campaign expenditure (excl. GST) | Total |

|---|---|---|---|---|---|---|---|---|

| Nil | Nil | Nil | - | - | - | - | - | - |

Consultancy expenditure

Details of consultancies (valued at $10,000 or greater)

In 2020–21, there was one consultancy where the total fees payable to the consultants were $10,000 or greater.

The total expenditure incurred during 2020–21 in relation to these consultancies is $261,000 (excl. GST). Details of individual consultancies are outlined below.

| Consultant | Purpose | Start date | End date | Total approved project fee (excl. GST) | Expenditure 2020-2021 (excl. GST) | Future expenditure (excl. GST) |

|---|---|---|---|---|---|---|

|

Deloitte Consulting Pty Ltd |

Advisory services | 16 December 2020 | 31 August 2021 | 261 | 261 | - |

| Total | 261 | 261 | - |

Details of consultancies under $10,000

In 2020–21 there were no consultancies engaged during the year where the total fees payable to the individual consultancies was less than $10,000.

The total expenditure incurred during 2020–21 in relation to these consultancies was nil.

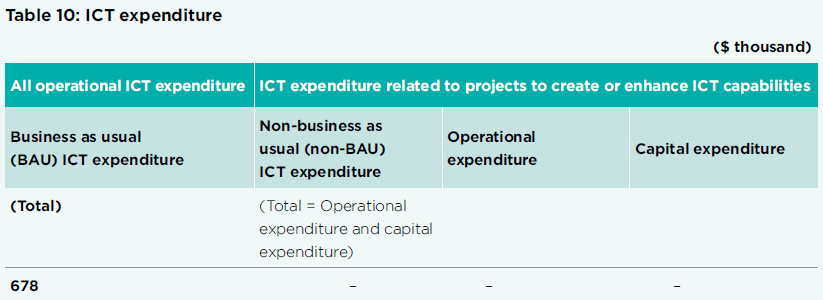

Information and communication technology expenditure

Information and communication technology (ICT) expenditure refers to the Authority’s costs in providing business enabling ICT services within the current reporting period.

For the 2020–21 reporting period, the Authority had a total ICT expenditure of $678,000, with the details shown below.

It comprises of business as usual (BAU) ICT expenditure and non-business as usual (non-BAU) ICT expenditure. Non-BAU ICT expenditure relates to extending or enhancing the Authority’s current ICT capabilities. BAU ICT expenditure is all remaining ICT expenditure that primarily relates to ongoing activities to operate and maintain the current ICT capability.

Disclosure of major contracts

The Authority did not award any major contracts valued above $10 million or more during 2020–21.

Freedom of information

The Freedom of Information Act 1982 (the Act) allows the public a right of access to documents held by the Authority.

Information about the type of material produced by the Authority is available on its website under the Part II Information Statement.

During the 2020–21 financial year, the Authority received no applications.

Access to documents may be obtained through written request to the Freedom of Information Officer, as detailed in subsection 17 of the Act.

Making a request

Freedom of Information (FOI) requests can be lodged online at www.foi.vic.gov.au. An application fee of $29.60 applies. Access charges may also be payable if the document pool is large, and the search for material time consuming.

Access to documents can also be obtained through a written request to the Authority’s Freedom of Information Officer, as detailed in subsection 17 of the Act.

When making an FOI request, applicants should ensure requests are in writing, and clearly identify what types of material/documents are being sought.

Requests for documents in the possession of the Authority should be addressed to:

Attn: Freedom of Information Officer

Portable Long Service Benefits Authority

Level 1, 56-60 King Street

Bendigo VIC 3550

Requests can also be lodged online on the Freedom of Information Request website.

Further information

Access charges may also apply once documents have been processed and a decision on access is made, such as but not limited to photocopying, search and retrieval charges. Further information regarding Freedom of Information can be found online.

Compliance with the Building Act 1993 (Vic)

The Authority does not own or control any government buildings and consequently is exempt from notifying its compliance with the building and maintenance provisions of the Building Act 1993.

The Authority met all relevant compliance provisions of the Building Act 1993 (Vic) in our building and maintenance activities during the year.

Competitive neutrality policy

The Authority does not provide services that compete with the private sector and is therefore not subject to the requirements of the Victorian Competitive Neutrality Policy or subsequent reforms.

Compliance with the Public Interest Disclosure Act 2012

The Public Interest Disclosure Act 2012 (previously known as the Protected Disclosure Act 2012) was amended by the Integrity and Accountability Legislation Amendment (Public Interest Disclosures, Oversight and Independence) Act 2019 which came into operation on 1 January 2020. The Act encourages and assists people in making disclosures of improper conduct by public officers and public bodies. The Act provides protection to people who make disclosures in accordance with the Act and establishes a system for the matters disclosed to be investigated and rectifying action to be taken.

The Authority encourages its officers and members of the public to report known or suspected incidences of improper conduct and detrimental action.

Disclosures of improper conduct or detrimental action by the Authority or any of its employees and/or officers must be made directly to the Independent Broad-based Anti-corruption Commission:

Level 1, North Tower, 459 Collins Street

Melbourne, VIC 3000

Phone: 1300 735 135

Website: www.ibac.vic.gov.au

| 2020–21 number | 2019–20 number | |

|

The number of disclosures made by an individual to the Authority and notified to the Independent Broad-based Anti-corruption Commission |

||

| Assessable disclosures | - | - |

Compliance with the Carers Recognition Act 2012

To the extent applicable, the Authority has taken all practical measures to comply with obligations under the Carers Recognition Act 2012. These include:

- ensuring our staff have an awareness and understanding of the care relationship principles set out in the Act.

- considering the care relationships principles set out in the Act when setting policies and providing services.

- promoting the availability of flexible work arrangements and providing resources to effectively support this.

- providing support to all staff through the Employee Assistance Program.

- increasing awareness of the flexible work arrangements and special leave arrangements available to staff during the COVID-19 pandemic to support home schooling and caring responsibilities.

Compliance with the Disability Act 2006

The Authority acknowledges the importance of strengthening the rights of people with a disability. We are committed to creating and maintaining an accessible and inclusive environment for all people with a disability who come into contact with the Authority, whether as employees, stakeholders or members of the public more generally.

The Department of Premier and Cabinet developed a comprehensive Disability Action Plan 2017–20 which informs the Authority’s policies ensuring we remain responsive to the needs of people with a disability.

Office-based environmental impacts

The Authority’s three offices maximise natural light, with electronics, lighting, heating and cooling turned off each evening.

Staff are encouraged to avoid printing where possible and senior staff members have been provided with devices to assist with this initiative.

In addition, the implementation of “Follow Me” printing allows us to undertake usage reporting, apply print policies organisation-wide and solve mobile printing issues while also reducing waste, saving on average, 30% of wasted print jobs sent by mistake.

All office waste systems across our locations are segregated, reducing the amount of recyclable material directed to landfill.

Authority staff are strongly encouraged to adopt “green commuting” through active or public transport when undertaking business activities, particularly when travelling between our Bendigo and Melbourne locations.

Subsequent events

There are no post balance date events that materially affect the Authority’s 2020–21 financial statements.

Additional information

The Authority’s published reports and documents are available on our website.

Any relevant information in relation to the financial year is retained by the Accountable Officer and is available on request subject to the provisions of the Freedom of Information Act 1982.

Attestation for financial management compliance with Standing Direction 5.1.4

Portable Long Service Authority Financial Management Compliance Attestation Statement

I Julius Roe, on behalf of the Responsible Body, certify that the Portable Long Service Authority has no Material Compliance Deficiency with respect to the applicable Standing Directions under the Financial Management Act 1994 and Instructions.

_______________________________________________

Julius Roe

Chair, Governing Board

Portable Long Service Benefits Authority

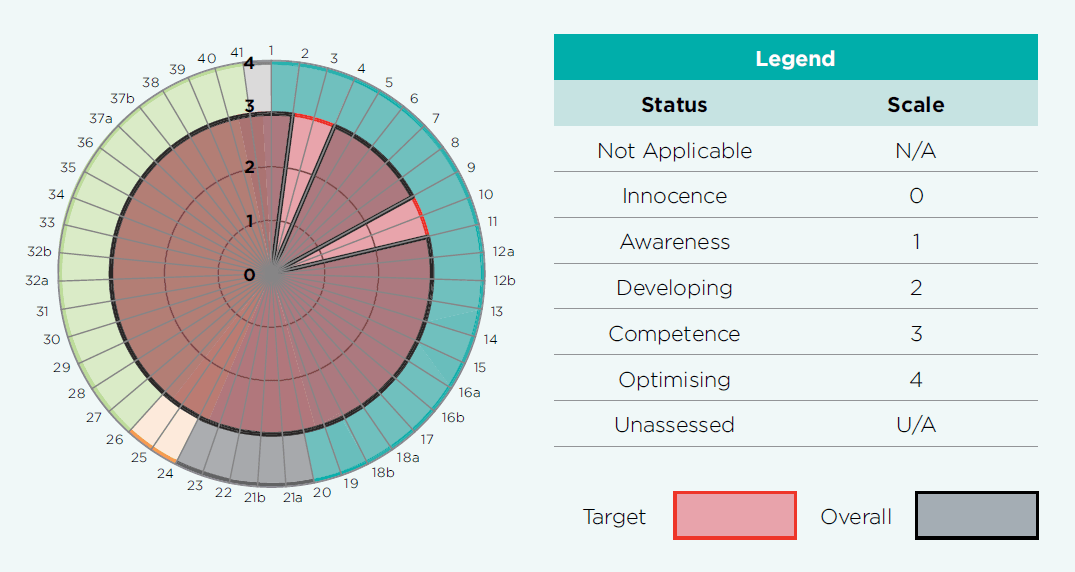

Asset Management Accountability Framework (AMAF) maturity assessment

The following sections summarise the Authority’s assessment of maturity against the requirements of the Asset Management Accountability Framework (AMAF). The AMAF is a non-prescriptive, devolved accountability model of asset management that requires compliance with 41 mandatory requirements. These requirements can be found on the Department of Treasury and Finance (DTF) website.

The Authority’s target maturity rating is ‘competence’, meaning systems and processes are fully in place, consistently applied and systematically meet the AMAF requirement, including a continuous improvement process to expand system performance above AMAF minimum requirements.

The Authority has assessed requirements 3 and 10 as not applicable.

Leadership and Accountability (requirements 1–19)

The Authority has met its target maturity level in this category.

Planning (requirements 20–23)

The Authority has met its target maturity level in this category.

Acquisition (requirements 24 and 25)

The Authority has met its target maturity level in this category.

Operation (requirements 26–40)

The Authority has met its target maturity level in this category.

Disposal (requirement 41)

The Authority has met its target maturity level in this category.

Financial statements

Financial statements for the financial year ended 30 June 2021.

Understanding the financial statements

Comprehensive operating statement

This measures our performance over the year and shows if a surplus or deficit has been made in delivering our services. The statement includes all sources of income less all expenses incurred in earning that income.

For the financial year ending 30 June 2021, the net result of the Authority was $10.9 million.

Balance sheet

This sets out our net accumulated financial worth at the end of the financial year. It shows the assets we own as well as liabilities or claims against those assets.

Both assets and liabilities are expressed as current or non-current. Current assets or current liabilities are expected to be converted to cash receipts or outlays within the next twelve months. Non-current assets or liabilities are longer-term.

Equity is our reserves and accumulated surplus that have been reinvested in the Authority over the year.

Cash flow statement

This summarises our cash receipts and payments for the financial year and the net cash position at the end of the year. It differs from the Comprehensive Operating Statement in that it excludes non-cash expenses such as the accruals taken into account in the Comprehensive Operating Statement.

For the year ending 30 June 2021, the Authority had net cash flow from operating activities of $75.9 million.

Statement of changes in equity

This shows the changes in equity from last year to this year.

The total overall change in equity during a financial year comprises the net result for the year.

Notes to the accounts

This provide further information about how the financial statements are prepared as well as additional information and detail about specific items within them.

The Notes to the Accounts also describe any changes to accounting standards, policy or legislation that may affect the way the statements are prepared. Information in the Notes is particularly helpful if there has been a significant change from the previous year’s comparative figures.

Statutory Certificate and Auditor General’s Report

These provide the reader with a written undertaking that the financial statements fairly represent the Authority’s financial position and performance for 2020-21. The Report from the Independent Auditor provides an independent view and outlines any issues of concern.

Statutory certification

We certify that the attached financial statements for the Portable Long Service Benefits Authority have been prepared in accordance with Direction 5.2 of the Standing Directions of the Assistant Treasurer under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting Standards including interpretations, and other mandatory professional reporting requirements.

We further state that, in our opinion, the information set out in the Comprehensive Operating Statement, Balance Sheet, Cash Flow Statement, Statement of Changes in Equity and the accompanying notes, presents fairly the financial transactions during the financial year ended 30 June 2021 and the financial position of the Authority as at 30 June 2021.

At the date of signing, we are not aware of any circumstance which would render any particulars included in the financial statements to be misleading or inaccurate.

We authorise the attached financial statements for issue on 24 August 2021.

Julius Roe

Chair

Portable Long Service Benefits Authority

Joseph Yeung

Chief Executive Officer and Regulator

Portable Long Service Benefits Authority

Peter Leersen

Chief Financial Officer

Portable Long Service Benefits Authority

Comprehensive operating statement

| Notes | 2021 ($'000) |

2020 ($'000) |

|

|---|---|---|---|

| Income from transactions | |||

| Government grants | 2.2.2 | 692 | 6,236 |

| Contributions from employers and contractors | 2.2.1 | 93,250 | 55,997 |

| Investment income | 2.2.3 | 5,748 | 571 |

| Interest | 26 | 33 | |

| Net gain/(loss) on financial instruments | 4.2.1 | 6,809 | (418) |

| Total income from transactions | 106,525 | 62,419 | |

| Expenses from transactions | |||

| Employee benefits expense | 3.3.1 | 4,711 | 3,740 |

| Portable long service benefits expense | 3.4.1 | 88,658 | 47,684 |

| Administration expense | 3.2 | 1,990 | 1,444 |

| Interest expense | 6.2.2 | 10 | 15 |

| Depreciation | 4.1.2, 6.2.2 | 274 | 263 |

| Total expenses from transactions | 95,643 | 53,146 | |

| Net result from transactions (net operating balance) | 10,882 | 9,273 | |

| Net result | 10,882 | 9,273 | |

| Comprehensive result | 10,882 | 9,273 |

The accompanying notes form part of these financial statements.

Balance sheet

| Notes | 2021 ($'000) |

2020 ($'000) |

|

|---|---|---|---|

| ASSETS | |||

| Current assets | |||

| Cash and deposits | 6.3 | 9,444 | 13,959 |

| Receivables | 5.1 | 35,864 | 19,487 |

| Investments and other financial assets | 4.2 | 15,709 | 11,225 |

| Prepayments | 12 | 21 | |

| Total current assets | 61,029 | 44,692 | |

| Non-current assets | |||

| Property, plant and equipment | 4.1 | 262 | 529 |

| Investments and other financial assets | 4.2 | 98,124 | 14,519 |

| Total non-current assets | 98,386 | 15,048 | |

| TOTAL ASSETS | 159,415 | 59,740 | |

| LIABILITIES | |||

| Current liabilities | |||

| Trade and other payables | 5.2 | 309 | 272 |

| Employee benefits | 3.3.2 | 812 | 424 |

| Accrued portable long service benefits | 3.4.2 | 15,984 | 3,123 |

| Borrowings | 6.1 | 191 | 249 |

| Total current liabilities | 17,296 | 4,068 | |

| Non-current liabilities | |||

| Employee benefits | 3.3.2 | 57 | 109 |

| Accrued portable long service benefits | 3.4.2 | 120,358 | 44,561 |

| Borrowings | 6.1 | 30 | 210 |

| Total non-current liabilities | 120,445 | 44,880 | |

| TOTAL LIABILITIES | 137,741 | 48,948 | |

| NET ASSETS | 21,674 | 10,792 | |

| EQUITY | |||

| Reserves | 6.5 | 6,818 | 1,782 |

| Accumulated surplus | 14,856 | 9,010 | |

|

NET WORTH |

21,674 | 10,792 |

The accompanying notes form part of these financial statements.

Cash flow statement

| Notes | 2021 ($’000) |

2020 ($’000) |

|

|---|---|---|---|

| Cash flows from operating activities | |||

| Receipts | |||

| Receipts from Government | 1,191 | 7,379 | |

| Receipts from employers | 81,664 | 37,661 | |

| Goods and services tax received from the ATO (i) | 68 | 126 | |

| Total receipts | 82,923 | 45,166 | |

| Payments | |||

| Payments to suppliers and employees | (6,379) | (4,750) | |

| Payments to scheme employers and workers | (615) | (29) | |

| Total payments | (6,994) | (4,779) | |

| Net cash flows from / (used in) operating activities | 6.3.1 | 75,929 | 40,387 |

| Cash flows from investing activities | |||

| Payments for investments | (81,281) | (26,162) | |

| Proceeds from sale of investments | 1,081 | 67 | |

| Payments for property, plant and equipment | (6) | (100) | |

| Net cash flows from / (used in) investing activities | (80,206) | (26,195) | |

| Cash flows from financing activities | |||

| Repayment of finance lease liabilities | 6.2.3 | (238) | (233) |

| Net cash flows from / (used in) financing activities | (238) | (233) | |

| Net increase in cash and cash equivalents | (4,515) | 13,959 | |

| Cash and cash equivalents at the beginning of the financial year | 13,959 | - | |

| Cash and cash equivalents at end of financial year | 6.3 | 9,444 | 13,959 |

The accompanying notes form part of these financial statements.

(i) Goods and Services Tax paid to the Australian Taxation Office is presented on a net basis.

Statement of changes in equity

| Reserves ($’000) |

Accumulated surplus ($’000) |

Total ($’000) |

|

|---|---|---|---|

| Balance at 1 July 2019 | - | 1,519 | 1,519 |

| Net result for the year | - | 9,273 | 9,273 |

| Transfer to reserves | 1,782 | (1,782) | - |

| Balance at 30 June 2020 | 1,782 | 9,010 | 10,792 |

| Net result for the year | - | 10,882 | 10,882 |

| Transfer to reserves | 5,036 | (5,036) | - |

| Balance at 30 June 2021 | 6,818 | 14,856 | 21,674 |

The accompanying notes form part of these financial statements.