- Date:

- 15 Oct 2019

The Portable Long Service Authority’s 2018–19 Annual Report and accompanying financial statements present a summary of the Authority's performance over the 2018–19 financial year.

Responsible body’s declaration

In accordance with the Financial Management Act 1994 (Vic), I am pleased to present the Portable Long Service Benefits Authority’s Annual Report for the period ended 30 June 2019.

Julius Roe

Chair, Governing Board

Note on accessibility

We've provided as much of this annual report in HTML as practicable. Complex financial tables are provided in position in Word documents.

For accessibility assistance understanding this report, contact us.

Overview

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

About us

The Portable Long Service Benefits Authority (the Authority) is an independent statutory body established to administer the Long Service Benefits Portability Act 2018 (Vic) (the Act). The Act, together with the Long Service Benefits Portability Regulations 2019 (Vic) (Regulations) provides a Scheme for the portability of long service benefits to eligible workers in the community services, contract cleaning and security industries.

The Authority is responsible to a Governing Board appointed by the Victorian Minister for Industrial Relations.

The Authority is responsible for:

- registering employers who employ workers in these sectors

- maintaining a register of workers and employers for the Scheme

- undertaking compliance and enforcement activities

- educating employers and workers of their responsibilities and entitlements under the Scheme

- ensuring employers under the Scheme submit a quarterly activity return and pay the appropriate levy

- paying the appropriate benefit to workers who qualify for it

The new Scheme was created in response to the Victorian Parliament’s Economic, Education, Jobs and Skills Committee inquiry into portability of long service leave entitlements. The Scheme will enable eligible workers in the community services, contract cleaning and security industries to accrue long service benefits based on length of time employed in their respective industry, as opposed to the length of time employed by one employer. The Portable Long Service Benefits Scheme is intended to bring fairness and equity to eligible industry workplaces in Victoria.

The Victorian Government chose Bendigo as the location of the Authority as part of its commitment to invest in regional Victoria.

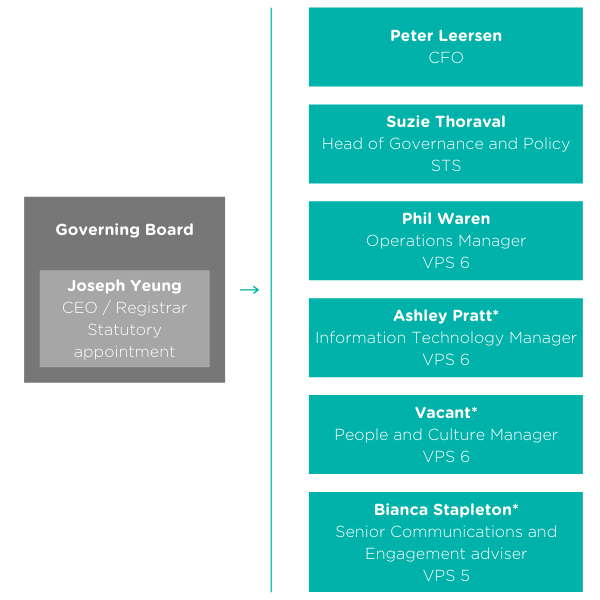

Business Units within the Authority

|

|

The Executive, Governance, Legal and Secretariat Business Unit is responsible for establishing good governance, delivering sound legal advice to the Authority as well as facilitating the efficient and effective running of the Governing Board and Audit and Risk Committee. |

|

|

The Financial Services Business Unit underpins our organisation’s operations and the Chief Financial Officer who leads the Financial Services Business Unit has specific responsibilities under the Financial Management Act 1994 (Vic). |

|

|

The Client Service and Operations Business Unit is the largest business unit within the Authority and delivers our core Registry and Enforcement functions to the public. |

|

|

The Facilities, Information and Technology Business Unit underpins our core operations and manages key vendors which support our network infrastructure and telephony systems. |

|

|

Our people are our greatest asset. Without our people, we have no capability to fulfil our statutory obligations under the Act. The People and Culture Business Unit supports the growth and development of our people and culture. |

|

|

As a new scheme in Victoria, it is vital that we communicate and engage with employers and eligible workers across the covered sectors. It is equally important that as a regulator, we assist eligible employers and workers to understand their obligations under the Portable Long Service Benefits Scheme. The Communications and Engagement Business Unit has responsibilities to deliver these core functions. |

Our vision

Delivering a quality Portable Long Service Benefits Scheme to protect the benefits of those who are entitled to them.

Our purpose

Administering an effective Portable Long Service Benefits Scheme in the sectors we serve by prudent, sustainable investment and supporting all stakeholders, including employers and workers alike, as well as educate and enforce every stakeholder’s role and interest in the Scheme.

Our values

|

|

Responsiveness | We are approachable and provide timely, useful and accurate information. |

|

|

Integrity | We have unbiased and honest interactions. |

|

|

Impartiality | We are fair and consistent in our application of the law. |

|

|

Accountability | We fulfil our objectives in a clear, transparent and responsible manner. |

|

|

Respect | We respect our stakeholders, each other and ourselves. |

|

|

Leadership | We seek to have a positive influence and to empower others. |

|

|

Human rights | We administer the law and deliver decisions, advice and policy that respect and support everyone’s human rights. |

Governing Board

The Governing Board of the Authority.

Governing Board

The Portable Long Service Benefits Authority has a Governing Board comprising a mix of expert skills, qualifications and experience, including individuals from organisations who represent employers and workers for the three covered industries.

Mr Julius Roe, Chair

Julius’s career spans 40 years in industrial relations, including as Fair Work Commissioner from 2010 to 2017. Since July 2017, Julius has been working as a consultant, handling mediation in a diverse range of workplace disputes in the public and private sectors.

Julius has been a leader in vocational education and training policy, including on a number of boards at both state and national level. He was National President of the Australian Manufacturing Workers Union from 2000–2010.

Ms Claire Filson, Deputy Chair

Claire has worked extensively in the financial services sector. She has more than 20 years’ boardroom experience gained in superannuation and infrastructure businesses. Before taking a career break to travel in 2010, she was a director on the board of Emergency Services & State Superannuation, a 150,000-member public sector superannuation fund managing $15 billion.

Claire has a mix of skills spanning law, governance and risk management.

Ms Emma King

Emma King joined the Victorian Council of Social Service (VCOSS) as Chief Executive Officer in 2013, providing a strong voice of leadership and advocacy on social justice issues for the community sector.

Emma was previously Chief Executive Officer of the Early Learning Association Australia (formerly Kindergarten Parents Victoria), the peak organisation representing parents and providers of early learning services in Victoria.

Emma also has an extensive background in the public sector and in workforce and education issues, having worked as a Victorian policy adviser, a teacher, and in a range of industrial and training roles at the Victorian Independent Education Union and the Finance Sector Union. Emma’s qualifications include a Masters in Industrial and Employee Relations, a Graduate Diploma of Education and a Bachelor of Arts.

Emma represents VCOSS on a range of ministerial advisory groups and committees. She is also the Chair of the Future Social Service Institute, President of the Farnham Street Neighbourhood Learning Centre and Board Member of Mental Health Victoria.

Emma is a regular commentator on social affairs and justice issues.

Ms Kate Marshall

Kate is Trustee of the Health Services Union. She joined the union in 2015 as Senior Industrial Officer, leading a team of lawyers and industrial staff to assist members in their enquiries.

Before that, she was a Legal Officer with the Construction, Forestry, Mining and Energy Union, Victoria and Tasmania, heading the legal department to run matters before the Fair Work Commission, the Federal Court of Australia and the Federal Circuit Court of Australia.

Mr Tim Piper

Tim has been Head of the Australian Industry Group’s Victorian Branch since 2002. Ai Group advocates on behalf of more than 12,000 businesses in Victoria and over 60,000 around Australia. Tim has had significant engagement with Government at both Federal and State levels, Chairs the Industry Capability Network, and sits on a number of Government bodies.

He was previously Executive Director of the Australian Retailers Association Victoria and practiced as a lawyer in private practice in Australia and the UK.

Ms Rachaell Saunders

In 1988, Rachaell established National Protective Services, a leading professional security company specialising in the provision of quality and tailored protective services. National Protective Services assists people to defend their property and people through the provision of security officers, security patrols, alarm and CCTV installation and consultancy.

She is the company’s Chief Executive Officer, setting the strategic direction for the business with focus on operations, finance, human resources, sales and marketing.

Rachaell is a member of the Board of the Australian Security Industry Association, the peak body for security employers in Australia.

Ms Julie Warren

Until recently, Julie was the Senior Vice President of the Victorian Trades Hall Council, Julie has considerable understanding of the issues and concerns that are relevant to contract industries.

She has worked for more than 20 years with the National Union of Workers, and has been President of the union’s Victoria branch since 2006. In that role, she has been part of a number of valuable changes in strategic direction to adapt the union’s purpose and policies to the contemporary workplace.

Ms Linda White

Linda works with the Australian Services Union (ASU) and is currently the union’s Assistant National Secretary, developing the ASU’s strategy in the private and community sectors and also works on the union’s growth strategy.

She coordinated the ASU’s ground-breaking Equal Pay case in the Fair Work Commission

Before joining the ASU, Linda was a senior associate at Maurice Blackburn & Co for 10 years. Her areas of practice included crime, industrial law, personal injuries and criminal injuries.

Mr Joseph Yeung

Joseph is the inaugural Chief Executive Officer and Registrar of the Portable Long Service Benefits Authority and is a member of the Governing Board.

He is an experienced corporate governance and corporate services professional and was Chief Financial Officer for the Department of Premier and Cabinet from 2017 to 2019.

Prior to working in Victorian Government, Joseph was an Assistant Secretary in Corporate Services Division at the Commonwealth Attorney-General’s Department based in Canberra.

Joseph is a Chartered Accountant, holds an MBA (Executive) and is an Australian Lawyer and Victorian Legal Practitioner.

Objectives and achievements

The Authority's objectives and achievements for the 2018-19 financial year.

Our objectives

The Authority’s primary objectives are to:

- Fulfil our legislative obligations by effectively administering and supporting compliance with the Long Service Portability Act 2018 (Vic).

- Implement effective responsible budget and investment strategies which grow levy funds and deliver long-term sustainability.

- Be clear, consistent, transparent and responsive in our stakeholder communications which encourages registration, levy payments and ensures that eligible workers and employers are aware of their rights and obligations.

- Maintain a healthy and safe workplace with a culture that encourages engaged, resilient and solution-focused staff.

- Implement an innovative, secure, resilient and integrated information technology environment that supports effective operations now and in the future.

- Protect the long-term interests of the Authority through effective regulation using governance, strategic risk management and clear policies and procedures.

The Authority has developed a set of initiatives and activities to support these objectives that will enable it to monitor the progress of key activities within the Authority. Performance measures are published within the Authority’s Corporate Plan 2019–20.

Achievements

Key achievements of the Authority since commencement of operations include:

- The appointment of the Governing Board and Chief Executive Officer of the Authority.

- Staff employed by Industrial Relations Victoria and the completion of extensive training in the legislation and Regulations of the Scheme.

- The setting of the employer levy by the Governing Board for each of the community services, contract cleaning and security industries.

- Putting into place effective systems and processes to support core operations of the Authority including key policies and procedures to enable good governance and strong controls.

- Communicating effectively with stakeholders to ensure that information is available for those affected by the new Scheme.

- Publishing the Authority’s first Corporate Plan for 2019–20 which has set a range of operational performance measures that will allow success to be measured.

- Establishment of the Authority’s head office in Bendigo and the fit-out of the space.

The Authority has supported the initiative to grow jobs in the region by recruiting from the talented pool of staff, and using suppliers that are available from the local area where possible. From 1 July 2019, the Authority had a dedicated workforce comprising well-trained customer service operators based in our Bendigo offices, each of whom are eager to play their part in supporting this important initiative.

Spotlight on information sessions

Early in the new financial year, the Authority hosted over 55 information sessions across Victoria to help inform eligible employers of the new Portable Long Service Benefits Scheme in Victoria. At these sessions, members of the public met the Authority’s Education Officers who provided guidance on the Scheme, the registration process and submission of quarterly returns.

Portland

| Where was the event held? | The newly refurbished Portland Library on 28 August 2019. |

| What was the event designed to achieve? | To inform employers of the new Portable Long Service Benefits Scheme in Victoria and assist eligible employers to register their business with the Authority, as well as guide them through how to submit a quarterly return. It also provided the opportunity to educate employers on determining eligibility of their workers. |

| Who attended the event? | Attendees were from the community services industry who were keen to provide portability of long service leave to their workers. |

| What were the main things people attending the event were interested in? | Topics included usability of the employer portal, the type of information required, when first quarterly returns would be due and what happens to money paid into the fund when a worker leaves the industry for more than 4 years. There was also discussion around eligible workers and staff providing corporate services. |

| What feedback did people give you about the session? | The groups were happy with the information provided and were encouraged to reach out to the Authority for further support moving forward. |

Echuca

| Where was the event held? | A function centre in Echuca’s famous Port precinct, on 5 September 2019. |

| What was the event designed to achieve? | To educate employers about the new Portable Long Service Benefits Scheme and ensure that they have a strong understanding of their responsibilities under it, as well as the benefits applicable to their workers. |

| Who attended the event? | Attendees were from the community services and contract cleaning industries. |

| What were the main things people attending the event were interested in? | Attendees were keen to get a better understanding of the impacts of the Scheme on their organisations. |

| What feedback did people give you about the session? |

Feedback from attendees was generally positive. |

|

What was the highlight of the session? |

Seeing the ‘aha’ moment in the eyes of the community services workers when they realised how the provisions worked. |

| As a Customer Service Officer with the PLSA, how do you feel about being out in the community speaking to people about the new Portable Long Service Benefits Scheme? | It was great to get out in to the community, meet people in the regions who will be part of the Scheme, and share our knowledge with them. |

Long service leave in Australia

Background to portable long service leave schemes in Australia

Long service leave authorities in other jurisdictions

The Authority has developed close working relationships with its counterpart authorities in other Australian jurisdictions such as the Long Service Leave Authority established under the Long Service Leave (Portable Schemes) Act 2009 (ACT), a Scheme similar to Victoria’s Scheme operating in the Australian Capital Territory.

During 2019–20, the Authority will look to formalise arrangements through reciprocal arrangements which will enable workers of the respective Schemes to move eligible benefits more seamlessly between different Australian States and Territories.

Background to portable long service leave schemes in Australia

Paid long service leave is unique to Australia and New Zealand. In Australia, long service leave has been part of the Australian workplace since the 1860s when it was introduced to allow senior public servants to return to their home country once a decade as a reward for a long period of loyal service with one employer. The extension of long service leave to the private sector occurred in the 1940s through inclusion in private sector awards with entitlements created through the processes of conciliation and arbitration.

As this traditional characteristic of long service leave made it available only to certain employees who remained with a single employer for a significant amount of time, portability schemes developed in industries where there were unique employment arrangements. This allowed eligible workers continuity in accruing long service leave despite the fact that they may not have spent the mandated length of time with a single employer.

Portability is seen as particularly important for workers in industries whose nature means that workers do not usually work for a single employer for long periods of time but who may be employed over many years on a project basis, or in some other way routine to that industry.1

Portable long service leave exists in all states and territories in Australia, with the ACT and Victoria including the most industries.

The Portable Long Service Leave Scheme for the construction industry in Victoria is administered by CoINVEST.

1 Source: Report of the inquiry into the feasibility of, and options for, creating a national long service standard, and the portability of long service leave and other entitlements (26 February 2016), Chapter 2.

Chair and Chief Executive Officer / Registrar's Report

Report from the Chair and CEO/Registrar

Chair and Chief Executive Officer / Registrar’s Report

It is with great pleasure that we present the first Annual Report of the Portable Long Service Benefits Authority (the Authority). The Authority was established on 1 November 2018 under the Long Service Benefits Portability Act 2018 (Vic) (the Act). With strong support from the Minister for Industrial Relations and the Department of Premier and Cabinet’s Industrial Relations Victoria Group, the Authority’s Portable Long Service Benefits Scheme commenced on 1 July 2019.

The Portable Long Service Benefits Scheme (the Scheme) allows eligible workers in the community service, contract cleaning and security industries to accumulate long service benefits after working in their industry for seven years, irrespective of the number of employers that they have worked for over that time. This makes it fairer for some of our hardest working Victorians – Victorians who may have worked many years in the same job, in the same place but without being able to accrue any long service benefits.

We have been delighted with the progress of the Authority over the short period of time since establishment, as well as the successful commencement of Scheme operations from 1 July 2019. The Governing Board and staff have worked hard to ensure that the Authority is ready to fulfil its vision of delivering a quality Portable Long Service Benefits Scheme, one that balances the interests of all the different stakeholders of the Authority. The Governing Board, who were appointed in March 2019, held the first Governing Board Meeting in April 2019. Since then, the Governing Board has met regularly to oversee management’s establishment of the operations of the Authority. The Authority’s management team, together with its staff, has worked hard to establish the Authority’s core operations in Bendigo, one of Victoria’s important regional centres.

Amidst the intense establishment activity to ensure that Scheme operations commenced smoothly on 1 July 2019, staff and the Governing Board also took the time out to consider goals for the next 12 months. Through this process, the Authority has developed key objectives that are aligned to activities, outcomes and performance targets that will enable us to measure success as well as establish accountabilities. These are outlined in our Corporate Plan for 2019–20.

Under the Scheme, employers and workers are able to register with the Authority through an online registration system and the Authority is rolling out communications to stakeholders right across Victoria. The Authority continues to build, strengthen and further develop relationships with stakeholders who are affected by, or have an interest in, the Portable Long Service Benefits Scheme.

We would like to acknowledge the work done by Industrial Relations Victoria (IRV) in the Department of Premier and Cabinet not just in leading the drafting of the legislation, but also in initial project management to establish the foundational aspects of the Portable Long Service Benefits Authority. We look forward to building on this success to establish full operations in 2019–20 and achieving our vision of delivering a quality portable long service scheme to protect the benefits of those who are entitled to them.

Julius Roe

Chair, Governing Board

Joseph Yeung

CEO and Registrar

Our performance

The Authority's financial and output performance for the 2018-19 financial year.

Five-year financial summary

The Portable Long Service Benefits Authority (the Authority) commenced operations during the financial year, therefore there is no prior year comparative information.

| Summary |

2018-19 |

|---|---|

| Total revenue | 1,820 |

| Total expenses | 301 |

| Net result for the year | 1,519 |

| Assets | 1,731 |

| Liabilities | 212 |

| Net assets | 1,519 |

Current-year financial performance

The Authority achieved a net profit of $1.5 million for the period ended 30 June 2019, being the first year of the Authority’s operations. As this is the first year of reporting, there is no prior year comparative information.

The net profit of $1.5 million relates to grant funding received from the Department of Health and Human Services to assist with the establishment and introduction of the Scheme, with a focus on the Community Services sector. This grant funding will be used in the 2019–20 financial year.

During the 2018–19 financial year, an additional $0.3 million of grant funding was also received from the Department of Premier and Cabinet to fund the recruitment and salaries of the Governing Board and the Chief Executive Officer, the initial head office occupancy lease in Bendigo and the financial statements audit fee for 2018–19 financial year to the Victorian Auditor-General’s Office.

Financial position – balance sheet

The Authority ended the period with net assets of $1.5 million, which related to the grant funding received from the Department of Health and Human Services, but not expended as at the balance sheet date of 30 June 2019.

As this is the first year of reporting, there is no prior year comparative information.

The Authority’s output performance

Within the Victorian Budget 2018/19 Service Delivery Budget Paper No. 3, a key output initiative was for the Government to establish a portable long service leave scheme for the community services, contract cleaning and security industries.

As at 30 June 2019, this output initiative was achieved with the Authority established and in readiness for operation on 1 July 2019. Specific key achievements of the Authority include the following:

- The appointment of the Governing Board and Chief Executive Officer of the Authority.

- Staff employed by Industrial Relations Victoria and the completion of extensive training in the legislation and Regulations of the Scheme.

- The setting of the employer levy by the Governing Board for each of the community services, contract cleaning and security industries.

- Putting into place effective systems and processes to support core operations of the Authority including key policies and procedures to enable good governance and strong controls.

- Communicating effectively with stakeholders to ensure that information is available for those affected by the new Scheme.

- Publishing the Authority’s first Corporate Plan for 2019–20 which has set a range of operational performance measures that will allow success to be measured.

- Establishment of the Authority’s head office in Bendigo and the fit-out of the space.

The Authority’s objectives, indicators and progress

The Authority had one output associated performance measure within the Victorian Budget 2018/19. This section reports the Authority’s progress on the achievement of these objectives and on the trends of quantifiable results.

| Performance measures | Unit of measure | 2018-19 actual result | 2018-19 target (BP3) |

|---|---|---|---|

| Workers registered under the Portable Long Service Benefits Scheme | Number | 01 | 5,000 |

1 The Authority commenced full operations on 1 July 2019, therefore the 2018/19 target

of 5,000 workers was not achieved.

Financial statements

Financial statements for the financial year ended 30 June 2019.

Statutory Certification

We certify that the attached financial statements for the Portable Long Service Benefits Authority (the Authority) have been prepared in accordance with Direction 5.2 of the Standing Directions of the Minister for Finance under the Financial Management Act 1994, applicable Financial Reporting Directions, Australian Accounting Standards including interpretations, and other mandatory professional reporting requirements.

We further state that, in our opinion, the information set out in the Comprehensive Operating Statement, Balance Sheet, Statement of Changes in Equity, Cash Flow Statement and the accompanying notes, presents fairly the financial transactions during the financial period ended 30 June 2019 and the financial position of the Authority as at 30 June 2019.

At the date of signing, we are not aware of any circumstance which would render any particulars included in the financial statements to be misleading or inaccurate.

We authorise the attached financial statements for issue on 14 August 2019.

Julis Roe,

Chair

Joseph Yeung,

CEO and Registrar

Peter Leersen

CFO

Comprehensive Operating Statement

| For the period ended 30 June 2019 | Notes | 2019 ($'000) |

|---|---|---|

| Revenue | ||

| Government grants | 2.1 | 1,820 |

| Total revenue | 1,820 | |

| Expenses | ||

| Operating and administration expenses | 3.2 | 133 |

| Employee benefits | 3.3.1 | 168 |

| Total expenses | 301 | |

| Net result for the year | 1,519 | |

| Total comprehensive result for the year | 1,519 |

The above Comprehensive Operating Statement should be read in conjunction with the accompanying notes.

Balance Sheet

| As at 30 June 2019 | Notes | 2019 ($'000) |

|---|---|---|

| Assets | ||

| Current assets | ||

| Receivables | 4.1 | 1,731 |

| Total current assets | 1,731 | |

| Total assets | 1,731 | |

| Liabilities | ||

| Current liabilities | ||

| Payables | 4.2 | 160 |

| Employee benefits | 3.3.2 | 52 |

| Total current liabilities | 212 | |

| Total liabilities | 212 | |

| Net assets | 1,519 | |

| Equity | ||

| Accumulated funds | 1,519 | |

| Total equity | 1,519 |

The above Balance Sheet should be read in conjunction with the accompanying notes.

Statement of Changes in Equity

| For the period ended 30 June 2019 | Accumulated funds ($'000) |

Total ($'000) |

|---|---|---|

| Balance at 1 July 2018 | - | - |

| Net result for the year | 1,519 | 1,519 |

| Balance at 30 June 2019 | 1,519 | 1,519 |

The above Statement of Changes in Equity should be read in conjunction with the accompanying notes.

Cash Flow Statement

| For the period ended 30 June 2019 | Notes | 2019 ($'000) |

|---|---|---|

| Cash Flows from Operating Activities | ||

| Receipts | ||

| Receipts from Government | 100 | |

| GST received from the ATO1 | 4 | |

| 104 | ||

| Payments | ||

| Payments to suppliers and employees | (104) | |

| (104) | ||

| Net cash inflows from operating activities | 5.1.1 | - |

| Net increase in cash and cash equivalents | - | |

| Cash and cash equivalents at the beginning of the financial year | - | |

| Cash and cash equivalents at the end of the financial year | - |

The above Cash Flow Statement should be read in conjunction with the accompanying notes.

1 Goods and Services Tax paid to the ATO is presented on a net basis.

Understanding the financial statements

Understanding the financial statements for the financial year ended 30 June 2019.

Understanding the financial statements

Comprehensive Operating Statement

- The Comprehensive Operating Statement measures our performance over the period and shows if a surplus or deficit has been made in delivering products and services. This statement includes all sources of income, less all expenses incurred in earning that income.

- For the period ending 30 June 2019, the Authority made a net profit for the year of $1.5 million.

Balance Sheet

- The Balance Sheet sets out our net accumulated financial worth at the end of the financial period. It shows the assets we own as well as liabilities or claims against those assets.

- Both assets and liabilities are expressed as current or non current. Current assets or current liabilities are expected to be converted to cash receipts or outlays within the next twelve months. Non current assets or liabilities are longer-term.

- Equity is total capital, and reserves and accumulated profits that have been reinvested in the business over the period.

Statement of Changes in Equity

- The Statement of Changes in Equity shows the changes in equity from last year

- to this year.

- As this is the inaugural year, the total overall change in equity during the financial

- period comprises the net result for the period.

Cash Flow Statement

- The Cash Flow Statement summarises our cash receipts and payments for the financial period and the net cash position at the end of the period. It differs from the Comprehensive Operating Statement in that it excludes non-cash expenses such as the accruals taken into account in the Comprehensive Operating Statement.

- For the period ending 30 June 2019, the Authority’s net cash flow related to funding from Government, that covered all outgoing expenditure.

Notes to the financial statements

- The Notes to the financial statements provide further information about how the financial statements are prepared as well as additional information and detail about specific items within them.

- The Notes also describe any changes to accounting standards, policy or legislation that may affect the way the statements are prepared. Information in the Notes is particularly helpful if there has been a significant change from the previous year’s comparative figures.

Statutory Certificate and Auditor General’s Report

- These provide the reader with a written undertaking that the financial statements fairly represent the Authority’s financial position and performance for the financial period ended 30 June 2019. The Report from the Auditor General provides an independent view and outlines any issues of concern.

Note 1: About this report

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note outlines the basis of preparation and compliance information relating to the financial statements

Structure

- 1.1 Basis of Preparation

1.1 Basis of Preparation

General

This financial report of the Portable Long Service Benefits Authority (the Authority) is a general purpose financial report that consists of a Comprehensive Operating Statement, Balance Sheet, Statement of Changes in Equity, Cash Flow Statement and notes accompanying these statements. The general purpose financial report has been prepared in accordance with Australian Accounting Standards (AASs), Interpretations and other authoritative pronouncements of the Australian Accounting Standards Board, and the requirements of the Financial Management Act 1994 and applicable Ministerial Directions.

The Authority is a not-for-profit entity for the purpose of preparing the financial statements. Where appropriate, those AASs paragraphs applicable to not-for-profit entities have been applied.

The accrual basis of accounting has been applied in the preparation of these financial statements whereby assets, liabilities, equity, revenue and expenses are recognised in the reporting period to which they relate, regardless of when cash is received or paid. This financial report has been prepared on a going concern basis.

These financial statements were authorised for issue by the Governing Board of the Authority on 14 August 2019. The Authority’s reporting period is from 18 March 2019 to 30 June 2019.

Accounting policies

Accounting policies are selected and applied in a manner which ensures that the resulting financial information satisfies the concepts of relevance and reliability, thereby ensuring that the substance of the underlying transactions or other events is reported.

Functional and presentation currency

Items included in this financial report are measured using the currency of the primary economic environment in which the Authority operates (“the functional currency”). The financial statements are presented in Australian dollars, which is the Authority’s functional and presentation currency.

Classification between current and non-current

In the determination of whether an asset or liability is current or non-current, consideration is given to the time when each asset or liability is expected to be realised or paid. The asset or liability is classified as current if it is expected to be turned over within the next twelve months, being the Authority’s operational cycle.

Rounding

Unless otherwise stated, amounts in the report have been rounded to the nearest thousand dollar.

Historical cost convention

These financial statements have been prepared under the historical cost convention.

Accounting estimates

Judgements, estimates and assumptions are required to be made about financial information being presented. The significant judgements made in the preparation of these financial statements are disclosed in the notes. Estimates and associated assumptions are based on professional judgements derived from historical experience and various other factors that are believed to be reasonable under the circumstances. Actual results may differ from these estimates.

Revisions to accounting estimates are made in the period in which the estimate is revised and also in future periods that are affected by the revision.

Judgements and assumptions made by management in applying AASs that have significant effects on the financial statements and estimates relate to:

- employee benefits provisions (Note 3.3)

- accrued expenses (Note 4.2)

- contingent assets and contingent liabilities (Note 6.2)

Note 2: Funding delivery of our services

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note presents the sources and amounts of income to the Authority, and the accounting policies that are relevant for an understanding of the items reported in the financial statements.

Income is recognised to the extent it is probable the economic benefits will flow to the Authority and the income can be reliably measured at fair value.

Structure

- 2.1 Summary of income that funds the delivery of our services

- 2.2 Income from transactions

- 2.2.1 Grants

| Notes | 2019 ($'000) |

|

|---|---|---|

2.1 Summary of income that funds the delivery of our services |

||

| Government grants | 1,820 | |

| 1,820 |

Income is recognised net of goods and services tax (GST) to the extent it is probable the economic benefits will flow to the Authority and the income can be reliably measured at fair value. Where applicable, amounts disclosed as income are net of returns, allowances, duties and taxes.

| Notes | 2019 ($'000) |

|

|---|---|---|

2.2 Income from transactions |

||

2.2.1 Grants |

||

| Department of Health and Human Services | 1,519 | |

| Department of Premier and Cabinet | 301 | |

| 1,820 |

Grant income arises from transactions in which a party provides goods or assets (or extinguishes a liability) to the Authority without receiving approximately equal value in return. While grants may result in the provision of some goods or services to the transferring party, they do not provide a claim to receive benefits directly of approximately equal value (and are termed ‘nonreciprocal’ transfers). Receipt and sacrifice of approximately equal value may occur, but only by coincidence.

Note 3: The cost of delivering our services

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note provides information about how the Authority’s funding is applied in delivering services and outputs, and the accounting policies that are relevant for an understanding of the items reported in the financial statements.

Structure

- 3.1 Summary of expenses incurred in the delivery of our services

- 3.2 Operating and administration expenses

- 3.3 Employee benefits

- 3.3.1 Employee benefits – comprehensive operating statement

- 3.3.2 Employee benefits – balance sheet

| Notes | 2019 ($'000) |

|

|---|---|---|

3.1 Summary of expenses incurred in the delivery of our services |

||

| Operating and administration expenses | 3.2 | 133 |

| Employee benefits | 3.3.1 | 168 |

| 301 |

Expenses are recognised net of goods and services tax (GST), except where the amount of GST is not recoverable from the ATO. In these circumstances, the GST is recognised as part of an item of expense.

| Notes | 2019 ($'000) |

|

|---|---|---|

3.2 Operating and administration expenses |

||

| Recruitment costs | 80 | |

| Other operating and administration expenses | 53 | |

| 133 |

Recruitment costs includes costs incurred to recruit the Governing Board of the Authority and the Chief Executive Officer.

Other operating and administration expenses include costs relating to the occupancy agreement with the Department of Jobs, Precincts and Regions for the Authority’s office premises in Bendigo, and the external audit fee with the Victorian Auditor-General’s Office that are expensed as incurred.

3.3 Employee benefits

3.3.1 Employee benefits – comprehensive operating statement

Employee benefits in the Comprehensive Operating Statement are a major component of operational expenses and include all costs related to employment, including wages and salaries, superannuation and leave entitlements. The majority of employee expenses in the Comprehensive Operating Statement are salaries and wages.

| Salaries and wages | 109 |

| Annual leave | 22 |

| Long service leave | 29 |

| Superannuation | 8 |

| 168 |

The amount recognised in the Comprehensive Operating Statement in respect of superannuation represents contributions made or due by the Authority to the relevant superannuation plans in respect to the services of the Authority’s staff. Superannuation contributions are made to the plans based on the relevant rules of each plan and any relevant compulsory superannuation requirements that the Authority is required to comply with.

3.3.2 Employee benefits – balance sheet

As part of operations, the Authority provides for benefits accruing to employees but payable in future periods in respect of annual leave, long service leave and related on-costs for services rendered to the reporting date.

| Notes | 2019 ($'000) |

|

|---|---|---|

| Current provisions | ||

| Employee benefits – annual leave: | ||

| Unconditional and expected to be wholly settled within 12 months | 17 | |

| Unconditional and expected to be paid after 12 months | 2 | |

| Employee benefits – long service leave: | ||

| Unconditional and expected to be wholly settled after 12 months | 27 | |

| 46 | ||

| On-costs relating to employee benefits: | ||

| Unconditional and expected to be wholly settled within 12 months | 3 | |

| Unconditional and expected to be wholly settled after 12 months | 3 | |

| 6 | ||

| Total current provisions for employee benefits | 52 | |

| Total provision for employee benefits | 52 | |

Employee numbers at the end of financial year |

|

9 |

Wages and salaries, annual leave and accrued days off

Liabilities for wages, salaries, annual leave and accrued days off to be wholly settled within 12 months of the reporting date are measured at their nominal values. Employee benefits which are not expected to be wholly settled within 12 months are measured at the present value. Regardless of the expected timing of settlements, provisions made in respect of employee benefits are classified as a current liability, unless there is an unconditional right to defer the settlement of the liability for at least 12 months after the reporting date, in which case it would be classified as a non‑current liability.

Long service leave

Current liability – unconditional Long Service Leave (LSL) (representing 7 or more years of continuous service) is disclosed as a current liability even where the Authority does not expect to wholly settle the liability within 12 months because it does not have the unconditional right to defer the settlement of the entitlement should an employee take leave within 12 months.

The components of this current liability for LSL are measured at:

- present value – component that the Authority does not expect to wholly settle within 12 months

- nominal value – component that the Authority expects to wholly settle within 12 months

Non-current liability – conditional LSL (representing less than 7 years of continuous service) is disclosed as a non-current liability. There is an unconditional right to defer the settlement of the entitlement until the employee has completed the required years of service. Conditional LSL is required to be measured at present value.

In calculating present value, consideration is given to expected future wage and salary levels, experience of employee departures and periods of service. Expected future payments are discounted using market yields at the reporting date based on national government bonds with terms to maturity and currency that match, as closely as possible, the estimated future cash outflows.

Employee benefit on-costs

Employee benefit on-costs, including superannuation, payroll tax and workers compensation are recognised and included in employee benefit liabilities and costs when the employee benefits to which they relate are recognised as liabilities.

Note 4: Other assets and liabilities

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note sets out other assets and liabilities that arise from the Authority’s operations.

Structure

- 4.1 Receivables

- 4.1.1 Movement in provision for impaired receivables

- 4.2 Payables

- 4.2.1 Ageing analysis of contractual payables

4.1 Receivables

Receivables are stated inclusive of GST. The net amount of GST recoverable from, or payable to, the ATO is included as a current asset or liability in the Balance Sheet.

| 2019 ($'000) |

|

|---|---|

| Current receivables | |

| Statutory: | |

| Amount owing from the Victorian Government | 1,720 |

| GST receivables | 11 |

| Total receivables | 1,731 |

Receivables consist of:

- Statutory receivables, such as amounts owing from the Victorian Government and GST input tax credits recoverable.

Statutory receivables are recognised and measured similarly to contractual receivables (except for impairment), but are not classified as financial instruments because they do not arise from a contract.

4.1.1 Movement in provision for impaired receivables

As at 30 June 2019, there were no impaired receivables and no provision made as recoverability of the grant invoices to the Victorian Government is high.

4.2 Payables

Payables are stated inclusive of GST. The net amount of GST recoverable from, or payable to, the ATO is included as a current asset or liability in the Balance Sheet.

| 2019 ($'000) |

|

|---|---|

| Current payables | |

| Contractual: | |

| Accrued expenses | 160 |

| Total payables | 160 |

Payables consists of:

- Contractual payables include items such as accrued expenses.

The contractual payables are unsecured and are usually paid within 30 days of recognition.

Accrued expenses are recognised when the Authority, as a result of a past event, has a present obligation that can be estimated reliably, and it is probable that a payment will be required to settle the obligation.

The amount recognised as accrued expenses is the best estimate of the consideration required to settle the present obligation at the end of the reporting period, taking into account the risks and uncertainties surrounding the obligation.

4.2.1 Ageing analysis of contractual payables

The ageing at 30 June 2019 includes accrued expenses. Statutory payables are excluded.

| Maturity Dates | ||||||

|---|---|---|---|---|---|---|

| Carrying Amount | Nominal Amount | Less than 1 month | 1 to 3 months | 3 months to 1 year | 1 to 5 years | |

| 2018-19 | ||||||

| Supplies and services | 160 | 160 | 160 | - | - | - |

| 160 | 160 | 160 | - | - | - |

Note 5: Financing our operations

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note provides information on the balances related to the financing of the Authority, including financial commitments at year-end. The Authority’s recurrent operations are generally financed from cash flows from operating activities (see Cash Flow Statement).

Structure

- 5.1 Cash and cash equivalents

- 5.1.1 Reconciliation of net result to cash flow from operating activities

- 5.2 Commitments for expenditure

- 5.2.1 Operating commitments

- 5.2.2 Other commitments

| 2019 ($'000) |

|

|---|---|

5.1 Cash and cash equivalents |

|

5.1.1 Reconciliation of net result to cash flow from operating activities |

|

| Net result for the year | 1,519 |

| Movements in assets and liabilities | |

| Decrease/(increase) in receivables | (1,731) |

| (Decrease)/increase in payables | 160 |

| (Decrease)/increase in employee benefits | 52 |

| Net cash inflows from operating activities | - |

Cash flows arising from operating activities are disclosed inclusive of GST.

5.2 Commitments for expenditure

5.2.1 Operating commitments

Commitments for future expenditure include operating commitments arising from contracts which are disclosed at their nominal value and inclusive of the GST payable. These future expenditures cease to be disclosed as commitments once the related liabilities are recognised in the Balance Sheet.

Operating commitments in nominal values including GST as at 30 June 2019 totalled $1.3 million. This amount is represented by one contract for the provision of licensed software, maintenance, support and cloud hosting managed services for a period of three years from 1 July 2019. Operating expenditure commitments under this contract are due and payable as follows:

| 2019 ($'000) |

|

|---|---|

| Operating expenditure commitments | |

| Not later than one year | 479 |

| Later than one year and not later than five years | 957 |

| Total operating expenditure commitments | 1,436 |

| Less GST recoverable | 131 |

| Total operating expenditure commitments (excluding GST) | 1,305 |

5.2.2 Other commitments

The Authority has an operating lease in place for the Head Office building in Bendigo that expires in 2022.

Lease payments over the remaining periods of the lease including GST, are expected to be as follows:

| 2019 ($'000) |

|

|---|---|

| Operating lease on head office building | |

| Not later than one year | 259 |

| Later than one year and not later than five years | 439 |

| Total other commitments | 728 |

| Less GST recoverable | 66 |

| Total other commitments (excluding GST) | 662 |

Note 6: Risks, contingencies and valuation judgements

Notes to the financial statements for the period ended 30 June 2019.

Introduction

The Authority is exposed to risks from both its activities and external factors. In addition, it is often necessary to make judgements and estimates associated with recognition and measurement of items in the financial statements.

This section presents information on the Authority’s financial instruments, contingent assets and liabilities.

Structure

- 6.1 Financial instruments specific disclosures

- 6.1.1 Financial instruments: categorisation

- 6.1.2 Financial risk management objectives and policies

- 6.2 Contingent assets and contingent liabilities

6.1 Financial instruments specific disclosures

Introduction

Financial instruments arise out of contractual agreements that give rise to a financial asset of one entity and a financial liability or equity instrument of another entity.

Categories of financial instruments

The principal financial instruments comprise of payables (excluding statutory payables).

Financial liabilities are initially recognised on the date they are originated. They are initially measured at fair value plus any directly attributable transaction costs. Subsequent to initial recognition, these financial instruments are measured at amortised cost with any difference between the initial recognised amount and the redemption value being recognised in profit and loss over the period of the interest bearing liability, using the effective interest rate method. The Authority recognises the following liabilities in this category:

- Payables (excluding statutory payables).

Impairment of financial assets

The Authority assesses at the end of each reporting period whether there is objective evidence that a financial asset or group of financial assets is impaired. All financial assets, except those measured at fair value through profit and loss, are subject to annual review for impairment.

In assessing impairment of statutory (non-contractual) financial assets which are not financial instruments, the Authority applies professional judgement in assessing materiality using estimates, averages and other computational methods in accordance with AASB 136 Impairment of Assets.

6.1.1 Financial instruments: categorisation

The carrying amounts of the contractual financial assets and financial liabilities by category are disclosed below:

| 2018-2019 | Contractual financial assets – receivables and cash ($’000) |

Contractual financial liabilities – at amortised cost ($’000) |

Total ($’000) |

|---|---|---|---|

| Contractual financial liabilities | |||

| Payables | |||

| Trade payables(i) | - | 160 | 160 |

| Total contractual financial liabilities | - | 160 | 160 |

(i) The total amounts disclosed exclude statutory payables.

6.1.2 Financial risk management objectives and policies

The activities of the Authority expose it to a variety of financial risks, market risk, credit risk and liquidity risk. This note presents information about the Authority’s exposure to each of these risks, and the objectives, policies and processes for measuring and managing risk.

The Governing Board of the Authority has the overall responsibility for the establishment and oversight of the risk management framework. The overall risk management program seeks to minimise potential adverse effects on the financial performance of the Authority. The Authority uses different methods to measure different types of risk to which it is exposed. These methods include sensitivity analysis in the case of interest rate, other price risks and ageing analysis for credit.

Risk management is carried out by the Authority’s management under policies approved by the Governing Board of the Authority. The Governing Board provides written principles for overall risk management, as well as policies covering specific areas, such as foreign exchange risk, interest rate risks, credit risk and non-derivative financial instruments, and investment of excess liquidity.

The main risks that the Authority is exposed to through its financial instruments are as follows:

(a) Market risk

Market risk is the risk that changes in market prices will affect the fair value or future cash flows of the Authority’s financial instruments. Market risk comprises of foreign exchange risk, interest rate risk and other price risk. The Authority’s exposure to market risk is primarily through interest rate risk. There is insignificant exposure to foreign exchange risk and other price risk.

Objectives, policies and processes used to manage these risks are disclosed in the paragraphs below:

(i) Interest rate risk

The Authority has minimal exposure to interest rate risk through its holding of other financial assets.

(ii) Other price risk

The Authority has no significant exposure to other price risk.

(b) Credit risk

Credit risk is the risk of financial loss to the Authority as a result of a customer or counterparty to a financial instrument failing to meet its contractual obligations. Credit risk arises principally from receivables.

The Portable Long Service Benefits Scheme commenced on 1 July 2019, therefore currently has no exposure to credit risk from receivables. From 1 July 2019, the Authority will minimise concentrations of credit risk by undertaking transactions with a large number of customers who must pay a levy for eligible workers for long service leave in the contract cleaning, security and community services industries. The Authority will therefore not be materially exposed to any individual customer.

(c) Liquidity risk

Liquidity Risk is the risk that the Authority will not be able to meet its financial obligations as they fall due. The Authority’s policy is to settle financial obligations within 30 days and in the event of a dispute make payments within 30 days from the date of resolution.

The Authority manages liquidity risk by maintaining adequate reserves of cash and by continuously monitoring actual cash flows against forecast cash flows of the Authority.

Interest rate exposure of financial instruments

Fair value interest rate risk is the risk that the fair value of a financial instrument will fluctuate because of changes in market interest rates. The Authority does not hold any interest bearing financial instruments that are measured at fair value, and therefore has no exposure to fair value interest rate risk.

6.2 Contingent assets and contingent liabilities

Contingent assets and contingent liabilities are not recognised in the Balance Sheet, but are disclosed by way of this note and, if quantifiable, are measured at nominal value. Contingent assets and liabilities are presented inclusive of GST receivable or payable respectively.

There were no material contingent assets or liabilities at 30 June 2019.

Note 7: Other disclosures

Notes to the financial statements for the period ended 30 June 2019.

Introduction

This note provides information on other disclosures that impact the Authority.

Structure

- 7.1 Responsible persons

- 7.2 Remuneration of executives

- 7.3 Related parties

- 7.4 Events occurring after the balance date

- 7.5 Auditors remuneration

- 7.6 Australian Accounting Standards issued that are not yet effective

7.1 Responsible persons

In accordance with the Ministerial Directions issued by the Minister for Finance under the Financial Management Act 1994, the following disclosures are made regarding responsible persons for the reporting period.

The Minister’s remuneration and allowances is set by the Parliamentary Salaries and Superannuation Act 1968 and is reported within the Department of Parliamentary Services’ Financial Report.

The following lists the responsible persons for the Authority during the year:

| Name | Title | Period of appointment from | Period of appointment to |

|---|---|---|---|

| The Hon. Tim Pallas MP | Minister for Industrial Relations | 8 April 2019 | 30 June 2019 |

| Julius Roe | Director (Chair) | 8 April 2019 | 30 June 2019 |

| Claire Filson | Director (Deputy Chair) | 8 April 2019 | 30 June 2019 |

| Emma King | Director | 8 April 2019 | 30 June 2019 |

| Kate Marshall | Director | 8 April 2019 | 30 June 2019 |

| Timothy Piper | Director | 8 April 2019 | 30 June 2019 |

| Rachaell Saunders | Director | 8 April 2019 | 30 June 2019 |

| Julie Warren | Director | 8 April 2019 | 30 June 2019 |

| Linda White | Director | 8 April 2019 | 30 June 2019 |

| Joseph Yeung | Director and Chief Executive Officer | 8 April 2019 | 30 June 2019 |

Remuneration

The number of Responsible Persons whose remuneration from the Authority was within the specified bands were as follows:

| 2019 | |

|---|---|

| Income band ($): | No |

| 0 – 9,999 | 7 |

| 10,000 – 19,999 | 1 |

| 70,000 – 79,999 | 1 |

| Total Numbers | 9 |

Remuneration received, or due and receivable, during 2018/19 by Responsible Persons including the Chief Executive Officer from the Authority in connection with the management of the Authority was $122,593.

7.2 Remuneration of executives

Being a new Authority that commenced full operations on 1 July 2019, there is no total remuneration payable to executives, other than the Chief Executive Officer listed under responsible persons in Note 7.1.

7.3 Related Parties

The Authority is a wholly owned and controlled entity of the State of Victoria.

Related parties of the Authority include:

- all key management personnel and their close family members and personal business interests (controlled entities, joint ventures and entities they have significant influence over);

- all cabinet ministers and their close family members

- all departments and public sector entities that are controlled and consolidated into the whole of state consolidated financial statements.

All related party transactions have been entered into on an arm’s length basis.

Significant transactions with government-related entities

During the year, the Authority had the following government-related entity transactions (exclusive of GST):

| 2019 ($'000) |

|

|---|---|

| Amounts recognised as revenue in the Comprehensive Operating Statement | |

| Entity and nature of transaction | |

| Department of Premier and Cabinet | 301 |

| Department of Health and Human Services | 1,519 |

| 1,820 | |

| Amounts recognised as an expense in the Comprehensive Operating Statement | |

| Entity and nature of transaction | |

| Department of Jobs, Precincts and Regions | 49 |

| 49 |

Key management personnel

Key management personnel (as defined in AASB 124 Related Party Disclosures) are those persons having authority and responsibility for planning, directing and controlling the activities of the Authority, directly or indirectly. Key management personnel of the Authority includes the Portfolio Minister, all Directors and the Chief Executive Officer as listed under responsible persons in Note 7.1.

| Compensation of key management personnel(i)(ii) | |

|---|---|

| Short-term employee benefits | 113 |

| Post-employment benefits | 9 |

| Other long-term benefits | 1 |

| Total | 123 |

(i) The Authority did not employ any KMPs as a contractor through an external service provider during the reporting period.

(ii) The compensation detailed above excludes the salaries and benefits the Portfolio Minister receives.

Transactions with key management personnel and other related parties

Outside of normal citizen type transactions with the Authority, there were no related party transactions that involved key management personnel and their close family members.

No provision has been required, nor any expense recognised, for impairment of receivables from related parties.

7.4 Events occurring after the balance date

There have been no matters and/or circumstances that have arisen since the end of the reporting period which significantly affect or may significantly affect the operations of the Authority, the results of those operations, or the state of affairs of the Authority in future financial years.

7.5 Auditors Remuneration

Remuneration for auditing the financial statements of the Authority excluding GST has been set at $8,000 by the Victorian Auditor-General’s Office. No other benefits were received, or are receivable, by the Victorian Auditor-General’s Office.

7.6 Australian Accounting Standards issued that are not yet effective

As at 30 June 2019, the following applicable standards and interpretations had been issued but were not mandatory for the financial period ending 30 June 2019. The Authority has not and does not intend to adopt these standards early.

| Standard/ Interpretation(1) |

Summary | Effective date | Effective date for the entity |

Estimated impact |

|---|---|---|---|---|

| AASB 1059 Service Concession Arrangements: Grantor |

This standard prescribes the accounting treatment of public private partnership (PPP) arrangements involving a private sector operator providing public services related to a service concession asset on behalf of the State, for a specified period of time. For social infrastructure PPP arrangements, this would result in an earlier recognition of financial liabilities progressively over the construction period rather than at completion date. For economic infrastructure PPP arrangements that were previously not on balance sheet, the standard will require recognition of these arrangements on balance sheet. | 1/1/20 | 1/7/19 | Based on a preliminary assessment by the Authority, there will be no impact as the Authority has not entered into any PPP arrangements. |

| AASB 16 Leases | The key changes introduced by AASB 16 include the recognition of most operating leases (which are currently not recognised) on the Balance Sheet, which has an impact on net debt. | 1/1/19 | 1/7/19 | Based on a preliminary assessment by the Authority, there will be an estimated $0.6 million increase to both assets and liabilities on the balance sheet (net impact of $nil). This represents an operating lease that is currently in place for the office building. |

| AASB 15 Revenue from Contracts with Customers | The core principle of AASB 15 requires an entity to recognise revenue when the entity satisfies a performance obligation by transferring a promised good or service to a customer. | 1/1/19 | 1/7/19 |

Based on a preliminary assessment by the Authority, the changes in revenue recognition under AASB 15 will have no impact on the timing and amount of revenue recorded in the financial statements. The full impact of the additional disclosures on service revenue and contract modification will also have no impact. |

| AASB 1058 Income of Not-for-Profit Entities | AASB 1058 standard will replace AASB 1004 Contributions and establishes principles for transactions that are not within the scope of AASB 15, where the consideration to acquire an asset is significantly less than fair value to enable not-for-profit entities to further their objective. The restructure of administrative arrangement will remain under AASB 1004. | 1/1/19 | 1/7/19 |

Based on a preliminary assessment by the Authority, Grants funds received over the next 3 years to partially offset the operational costs of the Authority are not based on an enforceable agreement that have specific |

| AASB 2016–8 Amendments to Australian Accounting Standards – Australian Implementation Guidance for Not-for-Profit Entities |

This standard amends AASB 9 and AASB 15 to include requirements and implementation guidance to assist not-for-profit entities in applying the respective standards to particular transactions and events. The amendments require non-contractual receivable arising from statutory requirements (i.e. taxes, rates and fines) to be initially measured and recognised in accordance with AASB 9 as if those receivables are financial instruments; and clarifies circumstances when a contract with a customer is within the scope of AASB 15. |

1/1/19 | 1/7/19 | Based on a preliminary assessment by the Authority, there will be no significant impact. |

| AASB 2018–8 Amendments to Australian Accounting Standards – Right of use asset |

This standard amends various AASB standards to provide an option for not-for-profit entities to not apply the fair value initial measurement requirements to a class or classes of right of use assets arising under leases with significantly below-market terms and conditions principally to enable the entity to further its objectives. This standard also adds additional disclosure requirements to AASB |

1/1/19 | 1/7/19 | Based on a preliminary assessment by the Authority, there will be no significant impact. |

| AASB 2018–7 Amendments to Australian Accounting Standards – Definition of Material |

This standard amends AASB 101 Presentation of Financial Statements and AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors. The amendments refine the definition of material in AASB 10 Events after the Reporting Period, include some supporting requirements in AASB 101 in the definition to give it more prominence and clarify the explanation accompanying the definition of material. The amendments also clarify the definition of material and its application by improving the wording and aligning the definition across AASB standards and other publications. |

1/1/20 | 1/7/20 |

Based on a preliminary assessment by the Authority, there will be no significant impact. |

Notes:

(1) For the current year, given the number of consequential amendments to AASB 9 Financial Instruments and AASB 15 Revenue from Contracts with Customers, the standards/interpretations have been grouped together to provide a more relevant view of the upcoming changes.

The following accounting pronouncements are also issued but not effective for the 2018–19 reporting period. At this stage, the preliminary assessment suggests they may have insignificant impacts on public sector reporting.

- AASB 2017-4 Amendments to Australian Accounting Standards – Uncertainty over Income Tax Treatments

- AASB 2017-6 Amendments to Australian Accounting Standards – Prepayment Features with Negative Compensation

- AASB 2017-7 Amendments to Australian Accounting Standards – Long-term Interests in Associates and Joint Ventures

- AASB 2018-1 Amendments to Australian Accounting Standards – Annual Improvements 2015 – 2017 Cycle

- AASB 2018-2 Amendments to Australian Accounting Standards – Plan Amendments, Curtailment or Settlement

- AASB 2018-3 Amendments to Australian Accounting Standards – Reduced Disclosure Requirements

Appendix 1: Disclosure index

Details of the Authority's compliance with statutory disclosure requirements.

| Legislation | Requirement | Page |

|---|---|---|

| Report of operations | ||

| Charter and purpose | ||

| FRD 22H | Manner of establishment and the relevant ministers | 3 |

| FRD 22H | Purpose, functions, powers and duties | 3, 7, 11 |

| FRD 8D | Objectives, indicators and outputs | 8, 16–17 |

| FRD 22H | Key initiatives and projects | 8–9, 16 |

| FRD 22H | Nature and range of services provided | 3, 51 |

| Management and structure | ||

| FRD 22H | Organisational structure | 51 |

| Financial and other information | ||

| FRD 8D | Performance against output performance measures | 16-17 |

| FRD 8D | Budget portfolio outcomes | 17 |

| FRD 10A | Disclosure index | 48 |

| FRD 12B | Disclosure of major contracts | 57 |

| FRD 15D | Executive officer disclosures | 41 |

| FRD 22H | Employment and conduct principles | 54 |

| FRD 22H | Occupational Health and Safety Policy | 54 |

| FRD 22H | Summary of the financial results for the year | 15 |

| FRD 22H | Significant changes in financial position during the year | 15 |

| FRD 22H | Major changes or factors affecting performance | 15 |

| FRD 22H | Subsequent events | 60 |

| FRD 22H | Application and operation of Freedom of Information Act 1982 | 58 |

| FRD 22H | Compliance with building and maintenance provisions of Building Act 1993 | 57 |

| FRD 22H | Statement on Competitive Neutrality Policy | 57 |

| FRD 22H | Application and operation of the Protected Disclosure Act 2012 | 59 |

| FRD 22H | Application and operation of the Carers Recognition Act 2012 | 59 |

| FRD 22H | Details of consultancies over $10,000 | 57 |

| FRD 22H | Details of consultancies under $10,000 | 57 |

| FRD 22H | Disclosure of government advertising expenditure | 58 |

| FRD 22H | Disclosure of ICT expenditure | 58 |

| FRD 22H | Statement of availability of other information | 56 |

| FRD 24D | Reporting of office-based environmental impacts | 57 |

| FRD 25C | Victorian Industry Participation Policy disclosures | 58 |

| FRD 29C | Workforce data disclosures | 55-56 |

| SD 5.2 | Specific requirements under Standing Direction 5.2 | 53 |

| Compliance attestation and declaration | ||

| SD 5.2.3 | Declaration in report of operations | 53 |

| Financial statements | ||

| Declaration | ||

| SD 5.1.4 | Attestation for compliance of Ministerial Standing Direction | 53 |

| SD 5.2.3 | Declaration in financial statements | 20 |

| Other requirements under Standing Directions 5.2 | ||

| SD 5.2.1(a) | Compliance with Australian accounting standards and other authoritative pronouncements | 26 |

| SD 5.2.1(a) | Compliance with Ministerial Directions | 20 |

| SD 5.2.1(b) | Compliance with Model Financial Report | 20-47 |

| Other disclosures as required by FRDs in notes to the financial statements | ||

| FRD 9B | Departmental disclosure of administered assets and liabilities by activity | na |

| FRD 11A | Disclosure of ex gratia expenses | na |

| FRD 13 | Disclosure of parliamentary appropriations | na |

| FRD 21C | Disclosures of responsible persons, executive officers and other personnel (contractors with significant management responsibilities) in the financial report | 40–41, 55–56 |

| FRD 103G | Non-financial physical assets | na |

| FRD 110A | Cash flow statements | 25, 35 |

| FRD 112D | Defined benefit superannuation obligations | na |

| Legislation | ||

| Building Act 1993 | 57 | |

| Carers Recognition Act 2012 | 59 | |

| Financial Management Act 1994 | 20, 26 | |

| Freedom of Information Act 1982 | 58 | |

| Protected Disclosure Act 2012 | 59 | |

| Victorian Industry Participation Policy Act 2003 | 58 |

Appendix 2: Functions and Services

Functions and services of the Authority.

* These staff commenced employment with the Portable Long Services Benefits Authority after 30 June 2019.

Appendix 3: Governance

Governance arrangements for the Authority.

Governing Board

The Portable Long Service Benefits Authority (the Authority) has a Governing Board that is accountable to the Minister for Industrial Relations.

In accordance with the Long Service Benefits Portability Act 2018 (Vic), the Governing Board:

- sets the levy to be paid by employers and contract workers

- is responsible for the governance, strategic planning and risk management of the Authority

- advises the Minister on agreements for corresponding schemes across Australia

- may perform functions and exercise the powers of the Authority that it deems appropriate

The following table indicates Director attendance at governing board meetings for the Authority.

| Director | Eligible to attend | Attended |

|---|---|---|

| Julius Roe | 3 | 3 |

| Claire Filson | 3 | 3 |

| Emma King | 3 | 2 |

| Kate Marshall | 3 | 3 |

| Timothy Piper | 3 | 3 |

| Rachaell Saunders | 3 | 3 |

| Julie Warren | 3 | 2 |

| Linda White | 3 | 3 |

| Joseph Yeung | 3 | 3 |

Note: The number of meetings includes ordinary meetings, special meetings and resolutions outside of meetings.

Audit and Risk Management Committee

The Audit and Risk Committee is established by the Governing Board and in accordance with the Standing Directions for the Minister for Finance (2018) under the Financial Management Act 1994 (Vic) (the Standing Directions). It provides independent assurance and advice to the Governing Board and Chief Executive Officer/Registrar on the effectiveness of the Authority’s financial management systems and controls, performance and stability, compliance with laws and regulations and risk management.

The Audit and Risk Committee comprises four members, at least one of which must be independent from the Governing Board and the Authority. The Committee is governed by a charter detailing its role and responsibilities consistent with the Standing Directions and best practice corporate governance principles.

At its May 2019 Governing Board meeting, the Governing Board appointed the following Audit and Risk Committee members:

- Claire Filson (Chair)

- Rachaell Saunders

- Julie Warren

The first Audit and Risk Committee meeting was held on 17 July 2019. Subsequent to the 2018–19 financial year, the Committee will appoint the fourth independent member during the 2019/20 financial year.

Internal audit

The Financial Management Act 1994 (Vic) and the associated Standing Directions for the Minister for Finance (2018) specify standards for governance, including oversight and assurance responsibilities for audit committees and internal audit. To ensure compliance with these obligations and to assure strategic and risk aligned internal controls, in 2019/20, the Authority will establish its internal audit function in accordance with the three lines of defence model, integrating and aligning assurance processes from multiple sources, which is widely considered to be the better practice model for an assurance environment.

The Authority will appoint an internal auditor to undertake the Authority’s internal audit program. Working closely with management, the Governing Board and the Audit and Risk Committee, the first task of the appointed Internal Auditor will be to create a risk-aligned strategic internal audit plan.

The internal audit service provider will report directly to the Authority’s Audit and Risk Committee with the results of audits and monitoring of management actions to address audit findings and recommendations undertaken by the Committee.

Financial management compliance

In accordance with section 8(3)(d) of the Financial Management Act 1994 (Vic) and Standing Directions 1.5, the Assistant Treasurer has granted the Authority an exemption for the 2018/19 financial year.

Conflicts of interest