This section sets out the current values of salaries and allowances for MPs, reflecting recompense for their responsibilities and duties, including in relation to [The role of an MP was set out in detail in the Tribunal’s 2019 Determination]:

- the Parliament of Victoria, including parliamentary committees of which they are a member

- their constituents

- management of their electorate office.

Salaries

All MPs are provided with a basic salary as recompense for fulfilling their responsibilities and performing their duties. The current value of the basic salary is $192,115 per annum.

In addition to the roles and duties performed by an MP, many members of the Victorian Parliament assume higher responsibilities by holding additional offices. The Parliamentary Salaries, Allowances and Superannuation Act 1968 (Vic) (PSAS Act) lists ‘specified parliamentary offices’ (Table 4.1).

Collectively, MPs who hold a ‘specified parliamentary office’ are defined as ‘specified parliamentary office holders’ (office holders). The 2019 Determination highlighted key events in the history of remuneration arrangements for office holders in Victoria, and outlined the current role of each office holder [Victorian Independent Remuneration Tribunal (2019), Chapter 4].

Office holders are provided with an additional salary, the value of which varies depending on the office held.

Table 4.1 sets out the current values of the additional salaries.

Table 4.1: Value of additional salaries, as of 1 July 2022

| Specified parliamentary office holder | Value ($ p.a.) |

|---|---|

| Premier | 214,368 |

| Deputy Premier | 181,299 |

| Any other Minister; Leader of the Opposition | 161,480 |

| President; Speaker | 141,053 |

| Deputy Leader of the Opposition in the Assembly; Leader of the Opposition in the Council; Leader of the Third Party; Cabinet Secretary | 77,250 |

| Deputy President; Deputy Speaker; Parliamentary Secretary to the Premier | 54,197 |

| A Parliamentary Secretary (other than the Parliamentary Secretary to the Premier) | 44,591 |

| Chairperson of the Public Accounts and Estimates Committee | 38,423 |

| Government Whip in the Assembly; Deputy Leader of the Opposition in the Council; Deputy Leader of the Third Party | 34,580 |

| Government Whip in the Council; Opposition Whip in the Assembly; Opposition Whip in the Council; Whip of the Third Party in the Assembly; Whip of the Third Party in the Council | 21,132 |

| Deputy Government Whip in the Assembly; Chairperson of a standing committee appointed under standing order of the Assembly or the Council; Chairperson of a Joint Investigatory Committee within the meaning of the Parliamentary Committees Act 2003 (Vic) which is not otherwise provided for in this table | 19,211 |

| Shadow Minister | 16,787 |

| Chairperson of joint select committee when resolution establishing committee so provides that chairperson is entitled | 9,606 |

| Secretary of the Party forming the Government; Secretary of the Opposition Party; Secretary of the Third Party; Deputy chairperson of the Public Accounts and Estimates Committee; Deputy chairperson of the Scrutiny of Acts and Regulations Committee; Deputy chairperson of the Integrity and Oversight Committee | 7,685 |

Source: Victorian Independent Remuneration Tribunal (2022b), pp. 11-12.

Allowances and the EO&C Budget

MPs are eligible to receive a range of work-related parliamentary allowances and an EO&C Budget. These support them in the exercise of their public duties [Members of Parliament (Standards) Act 1978 (Vic), s. 2; PSAS Act, s. 4A], which include [Members of Parliament (Standards) Act 1978 (Vic), s. 2]:

- committee business

- electorate business

- Ministerial business

- parliamentary business.

Some allowances (travel allowance, commercial transport allowance and international travel allowance) and expenditure from the EO&C Budget can be claimed on a reimbursement basis only, up to a maximum claimable amount. The expense allowance, electorate allowance, motor vehicle allowance and PASA are paid to eligible MPs as fixed amounts, regardless of actual expenditure incurred.

Criteria set by the Tribunal in its guidelines for the use of particular allowances and the EO&C Budget (MP Guidelines) are summarised in the MP Guidelines page of this consultation paper.

The PSAS Act includes a Statement of Principles in respect of the use of public resources by MPs (Box 4.1).

Box 4.1: PSAS Act — Statement of Principles

|

Fair and reasonable recompense for public duties

Good faith and integrity

Personal responsibility and accountability

|

Source: PSAS Act, Part 2, Div. 1.

Expense allowance

Certain office holders receive an expense allowance in addition to their additional salary, to cover expenses particular to that office [Victorian Independent Remuneration Tribunal (2019), p. 70].

Table 4.2 sets out the current expense allowance values for eligible office holders.

Table 4.2: Value of the expense allowance, as of 1 July 2022

| Specified parliamentary office holder |

Value ($ p.a.) |

|---|---|

| Premier | 58,435 |

| Deputy Premier | 22,343 |

| Any other Minister; Leader of the Opposition | 17,187 |

| Shadow Minister | 12,031 |

| President; Speaker | 6,875 |

|

Deputy President; Deputy Speaker; Deputy Leader of the Opposition in the Assembly; Leader of the Opposition in the Council; Leader of the Third Party; Cabinet Secretary; Parliamentary Secretary |

3,438 |

Source: Victorian Independent Remuneration Tribunal (2022b), pp. 11-12.

The expense allowance is paid fortnightly, is treated as income by the ATO and is subject to the Pay As You Go withholding (PAYG‑W) system.

Electorate allowance

All MPs are paid an electorate allowance, which covers the costs associated with providing services to constituents, including additional costs incurred by MPs in electorates with a larger geographical area [VIRTIPS Act, s. 17(3)(e)].

The value of this allowance varies depending on the geographical size of an MP’s electorate. Table 4.3 sets out the current values of the electorate allowance.

Table 4:3: Value of the electorate allowance as of 1 July 2022

| Size of electorate (sq.km) |

Value ($ p.a.) |

|---|---|

| < 500 | 42,155 |

| 500 – 4,999 | 45,771 |

| ≥ 5000 | 50,499 |

Source: Victorian Independent Remuneration Tribunal (2022b), p. 6.

The electorate allowance is paid fortnightly. While tax is not withheld from the allowance through the PAYG‑W system, MPs must account for the use of the allowance in their personal income tax returns and pay tax on any amount not spent on a deductible expense. The ATO’s Taxation Ruling 1999/10 explains the deductibility of expenses commonly claimed by MPs.

Parliamentary accommodation sitting allowance

This allowance is available to certain MPs in regional electorates who choose to maintain a second residence in metropolitan Melbourne to help them carry out their public duties while in Melbourne [Victorian Independent Remuneration Tribunal (2022c), p. 23].

The value of this allowance varies depending on the specified parliamentary office held by an MP (if any). Table 4.4 sets out the current value of this allowance.

Table 4.4: Value of the PASA, as of 1 July 2022

| Parliamentary office held by MP (if any) |

Value of the PASA |

|---|---|

| Premier | 53,217 |

| Deputy Premier | 46,565 |

| Minister; Presiding Officer or Deputy Presiding Officer; Cabinet Secretary; Leader or Deputy Leader of the Opposition or of the Third Party; Leader or Deputy Leader of the Opposition in the Legislative Council | 39,910 |

| Other MP | 26,609 |

Source: Victorian Independent Remuneration Tribunal (2022b), pp. 6-7.

MPs who claim the PASA are prohibited from claiming the travel allowance for stays within the ‘metropolitan area’ [Victorian Independent Remuneration Tribunal (2022c), p. 25].

Travel allowance

This allowance is available to all MPs to cover the commercial costs of accommodation, meals and incidentals on occasions when they are required to stay overnight within Australia and away from their primary residence, in order to perform their public duties [Victorian Independent Remuneration Tribunal (2022c), p. 24]. The allowance is provided on a reimbursement basis — MPs that meet the travel allowance eligibility criteria may claim up to the ‘travelling allowance rate’ for each overnight stay.

The ‘travelling allowance rate’ is equal to the rate set by the Commonwealth Remuneration Tribunal for Members of the Parliament of Australia. This rate varies depending on the location of the stay.

Table 4.5 sets out the ‘travelling allowance rate’ that currently applies for stays in Victoria. A higher ‘travelling allowance rate’ applies to the Premier, Deputy Premier, Ministers, Presiding Officers and Leader of the Opposition. These office holders may claim up to $464 per overnight stay in Melbourne, and up to $394 for stays in other Victorian localities.

Table 4.5: Standard ‘travelling allowance rate’, as of 28 August 2022

| Location of overnight stay |

Travelling allowance rate ($ per day) |

|---|---|

| Ararat; Bairnsdale; Echuca; Hamilton; Mildura; Portland; Sale; Seymour; Warrnambool; Wodonga | 311 |

| Ballarat | 333 |

| Benalla | 317 |

| Bendigo | 314 |

| Bright | 341 |

| Castlemaine | 320 |

| Colac | 312 |

| Geelong | 323 |

| Horsham; Swan Hill | 328 |

| Melbourne | 402 |

| Shepparton | 324 |

| Wangaratta | 332 |

| Wonthaggi | 334 |

| Other locations | 296 |

Note: The travel allowance can be claimed on a reimbursement basis only.

Source: Remuneration Tribunal (Cth) (2022), pp. 12-15.

Motor vehicle allowance

MPs are entitled under legislation to request that a motor vehicle be provided for their use while they serve as an MP [PSAS Act, s. 6(6)].

Since 2013, MPs who choose not to request a motor vehicle instead receive the motor vehicle allowance (formerly known as the ‘allowance in lieu of a motor vehicle’) to cover the transportation costs associated with carrying out their public duties [Victorian Independent Remuneration Tribunal (2019), p. 138; PSAS Act, s. 6(1)(c)]. For example, an MP may use the allowance to cover the cost of travel by taxi or similar services. The value of the motor vehicle allowance provided to an MP varies depending on the geographical size of their electorate (Table 4.6).

Table 4.6: Value of the motor vehicle allowance, as of 1 July 2022

| Size of electorate (sq.km) |

Value ($ p.a.) |

|---|---|

| < 5,000 | 22,353 |

| ≥ 5,000 | 33,680 |

Source: Victorian Independent Remuneration Tribunal (2022b), pp. 6-7.

Commercial transport allowance

This allowance covers the cost of transport undertaken by an MP within Australia to perform their public duties [Victorian Independent Remuneration Tribunal (2022c), p. 26]. This allowance is available to all MPs on a reimbursement basis.

The maximum value of the allowance that can be claimed depends on the geographical size of the MP’s electorate (Table 4.7). However, an MP is only entitled to that part of the commercial transport allowance which is equal to their claimable costs under the MP Guidelines [Victorian Independent Remuneration Tribunal (2019), p. 7].

Table 4.7: Maximum value of the commercial transport allowance, as of 1 July 2022

| Size of electorate (sq,km) |

Value ($ p.a.) |

|---|---|

| < 10,000 | 5,000 |

| 10,000 – 19,999 | 10,971 |

| ≥ 20,000 | 17,226 |

Note: Allowance can be claimed on a reimbursement basis only.

Source: Victorian Independent Remuneration Tribunal (2022b), p. 7.

International travel allowance

This allowance covers the cost of international travel undertaken by an MP to perform their public duties and is available to all MPs on a reimbursement basis.

The maximum amount that each MP may claim is currently $10,080 per annum [Victorian Independent Remuneration Tribunal (2022b), p. 8].

Electorate Office and Communications Budget

The EO&C Budget is available to all MPs to [PSAS Act, s. 7F(2)]:

- fund the operating costs and maintenance of their electorate office

- communicate with their electorate in relation to the performance of their public duties.

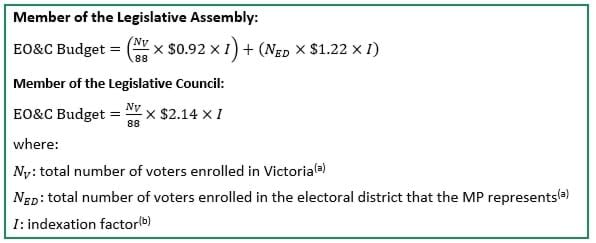

The value of the EO&C Budget provided to an MP is based on the total number of voters enrolled in Victoria and, for members of the Legislative Assembly, the total number in the electoral district they represent [Victorian Independent Remuneration Tribunal (2022b), p. 8].

Box 4.2 sets out the current formulas used to determine the value of an MP’s EO&C Budget in a non-election year. Special rules apply for calculating the value of the EO&C Budget for a financial year in which a general election is held, or where an MP enters the Parliament other than as a result of a general election (e.g. a by‑election) [Victorian Independent Remuneration Tribunal (2022b), pp. 9-10].

Box 4.2: Formulas for determining value of EO&C Budget in a non-election year

Source: Victorian Independent Remuneration Tribunal (2022b), p. 8.

Notes: (a) As published by the Victorian Electoral Commission as at the last day of February in the previous financial year. (b) Equal to 1.008 for the 2021-22 financial year and 1.044 for the 2022-23 financial year.

For the 2021-22 financial year, each member of the Legislative Assembly had a total EO&C Budget allocation of between $93,458 and $130,759 (average of $105,373), while each member of the Legislative Council had a total allocation of $105,373 [Tribunal calculations using VEC enrolment data as at the end of February 2021].

Updated